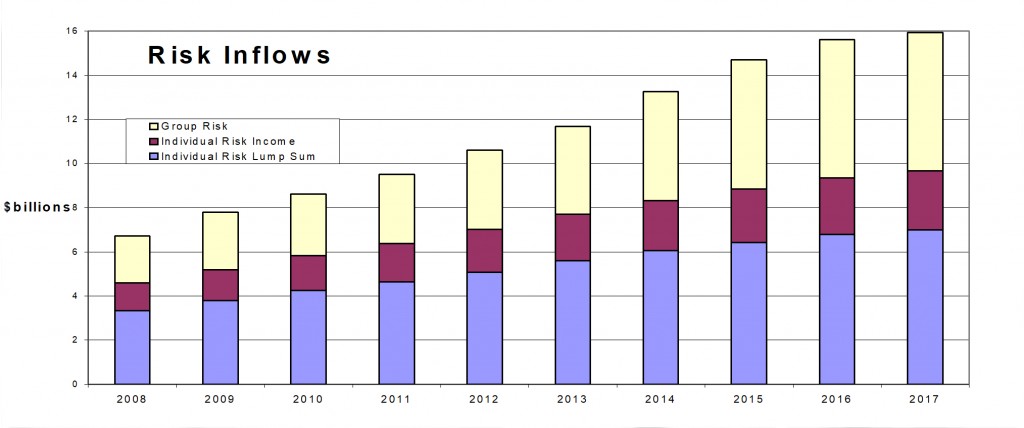

Overall life insurance risk premium inflows have continued to grow modestly at just over 2% for the year to the end of March but overall risk sales have declined after a heavy fall in group risk business, according to according to data released by Strategic Insight.

In its quarterly update of premium inflows and sales, Strategic Insight reported that total Annual Risk Premium Inflows increased slightly by 2.1% to $15.9 billion led by Zurich which posted inflow growth of 60.5% due to the ongoing amalgamation of old Macquarie Life business.

MetLife (9.3%), BT / Westpac (7.4%), AIA (6.4%) and MLC (3.7%) all recorded increases in total premium inflows while AMP (0.0%) and OnePath (0.8%) both posted flat results while CommInsure (-5.2%) was down.

In its market overview of inflows and sales for the 12 months to the end of March 2017 Strategic Insight also reported that Total Risk Premium Sales fell 12.2% over the calendar year due to the decline in new group risk sales of 32.5%.

Insurers most impacted by this included TAL and AIA which recorded falls of 54.1% and 31.1% respectively as MetLife recorded an increase of 165.5%

In the Individual Risk Lump Sum market premium inflows grew at 3.1% led by Zurich (65.6%), ClearView (22%) and AIA Australia (14.1%) while OnePath and CommInsure recorded falls of -2.3% and -3.7%, respectively.

Individual Risk Lump Sum sales fell by 3.9% year on year but Zurich, ClearView, BT/Westpac moved in the other direction with 17.1%, 16% and 5.6% growth respectively. At the opposite end, Suncorp (-18.3%) and OnePath (-11.8%) reported decreases in their annual sales.

Individual Risk Income Market inflows were up 4.6% over the past year while overall Individual Risk Income Sales increased only 0.7% over the last twelve months. Zurich (97.1%), ClearView (56.1%), AIA (15%) all led the market for inflows as well as for sales with recording an increase of 28.9%, 33% and 18.2%, respectively.

Group Risk Inflows were static overall despite increases for AIA (3.9%), MetLife (10.3%), MLC Life (7.6%) and BT / Westpac (6.0%) which all came off a low base and were offset by a decline for TAL (-5.6%).

This decline in flows was echoed in sales with fell by 32.5% bringing the total fall in Group Risk sales over the past two years to 43.8%. While MetLife (205.5%), MLC (53.4%) and CommInsure (26.6%) recorded significant increases in their sales these were offset by larger falls for TAL (-98.2%), AIA (-53.7%), OnePath (-38.0%) and AMP (-23.0%).

Strategic Insight stated the volatility in this part of the market was driven by trends in the stand-alone Corporate Superannuation market as well as Master Funds and Other Investment Platforms extending their services by providing risk insurance services.