- Yes (72%)

- No (19%)

- Not sure (9%)

Advisers clearly support the prospect that insurers should be required to notify ASIC of known churning activity.

This is the strong message stemming from our latest poll, where almost three quarters of those taking partl (72%) agree that product manufacturers should report churning activity to ASIC. One in five advisers (19%) don’t think this is a good idea, while 9% are undecided (see: Should Insurers Notify ASIC on Churning?).

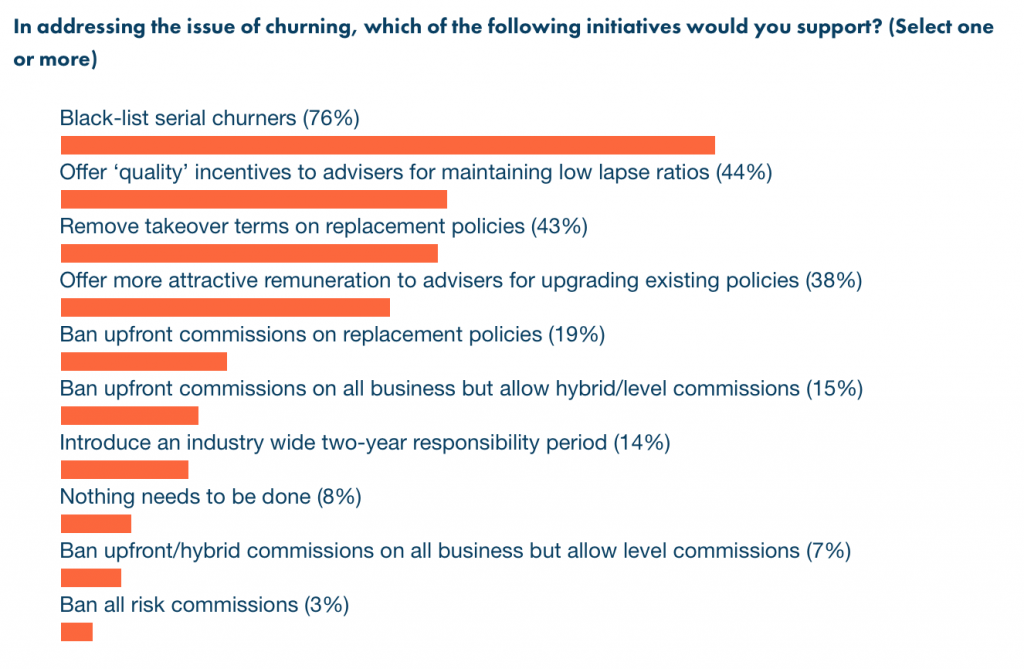

This result should come as no surprise to Riskinfo readers as it serves to reinforce the consistent sentiment indicated by advisers in previous polls where they have always supported the sanctioning of known churners as a key action designed to address and resolve the issue. For example, this is the result from a poll we ran in 2012:

The vast majority of advisers have always supported the identification and sanctioning of known churners and both these poll results reinforce that sentiment.

The vast majority of advisers have always supported the identification and sanctioning of known churners and both these poll results reinforce that sentiment.

So, where to from here? Do those who support the contention that insurers should notify ASIC about known churners think that it’s time for ASIC to hold a serious conversation with the Financial Services Council about putting this into action? Or, because of the implementation of the Life Insurance Framework remuneration reforms, does such an initiative become a moot action if the new, restricted upfront commission regime has its intended impact (amongst others) of severly curtailing churning activity?

At this stage, one can only speculate about the extent to which the LIF remuneration reforms will curb churning …and any post LIF data on churning levels may prove to be problematic at best because the current extent of this practise doesn’t appear ever to have been established with any meaningful level of consensus.

Our poll remains open for another week as we encourage you to have your say…

The serious conversation ASIC should have with the FSC, is how did they come to their conclusions around churn.

What verifiable proof is there, that churn was or is an issue to the extent that required regulatory intervention, that clearly is discriminatory against the vast majority of decent hard working advisers.

What is the process and how is data collated to prove what is a churned policy, or a lapsed policy due to a multiple array of reasons that have nothing to do with advisers.

ASIC’s ongoing surveillance, to determine if churn has increased, or decreased, will need clarity, with a requirement for the Life Companies to tell the full story and not allow the rubbish that was taken as gospel previously, to be passed on for simplicity sake and was found to be blatantly inaccurate.

Is how an adviser defines “churn” the same way as an insurer defines “churn”? If an insurer puts up premiums 20-40% year on year with “repricing” (yes including some level policies here) and customers cancel as they can’t afford it – does that mean that it should affect the advisers lapse rate? Or is this issue an insurer responsibility? Insurance companies do not and will not tell the whole story – only the part that serves to reduce their outgoings (i.e.commission) – a clear conflict of interest at its best.

Comments are closed.