Group life insurance should be repriced to take into consideration the financial needs of members instead of being based on default sums, according to industry consultant group Rice Warner.

In a blog post on its website, Rice Warner stated that while group life has been a success in providing insurance to many people there were concerns around the over-insurance of young members, and the erosion of retirement balances of older members due to the increasing costs of cover.

The group stated that it believed it was possible within the current model to design insurance cover that was matched to financial needs of members and that grew according to the number of dependants in the family of an insured member.

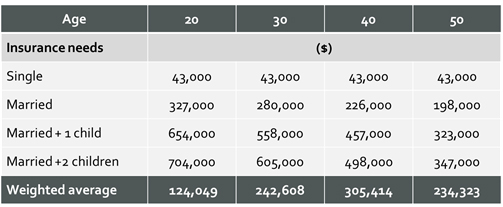

Rice Warner presented statistics that showed while the insurance needs for a single person remained static from age 20 to 50, they were much higher for married people, particularly if they had children (Table 1).

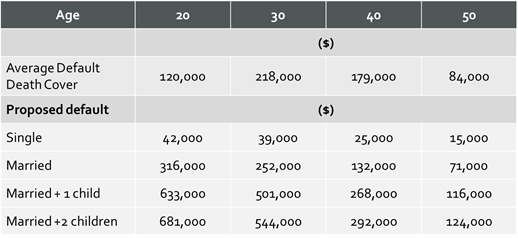

“Using the above statistics, we could shift the default sum insured to one based on needs – all without changing the premium or getting any additional information from members. We would simply assess the amount of the claim based on the dependants at the time of death,” Rice Warner stated.

The group also proposed death cover amounts by age and family type (Table 2) and noted that while some super funds had made changes to address the concerns raised widespread changes would take some time.

“Progress is unlikely to be quick on this front as typical insurance contracts are for three years. Funds will likely have to wait until they can renegotiate,” Rice Warner stated.

“By then, we expect that any further pressure applied either via government or the media will already have prompted change without the need for further legislation.”

That’s great but at what point is this personal advice? Will super funds be issuing SOA’s and then finally having to take responsibility for flippant but potentially dangerous remarks from call center staff or will advisers just have to suffer through the slog of doing this properly while funds skate past them with simple answers. I’d rather something in the middle where advisers and funds can both put forward commonsense solutions without drowning in compliance.

Here’s a thought how about encouraging personal advice instead of this non sense best guess formula

Comments are closed.