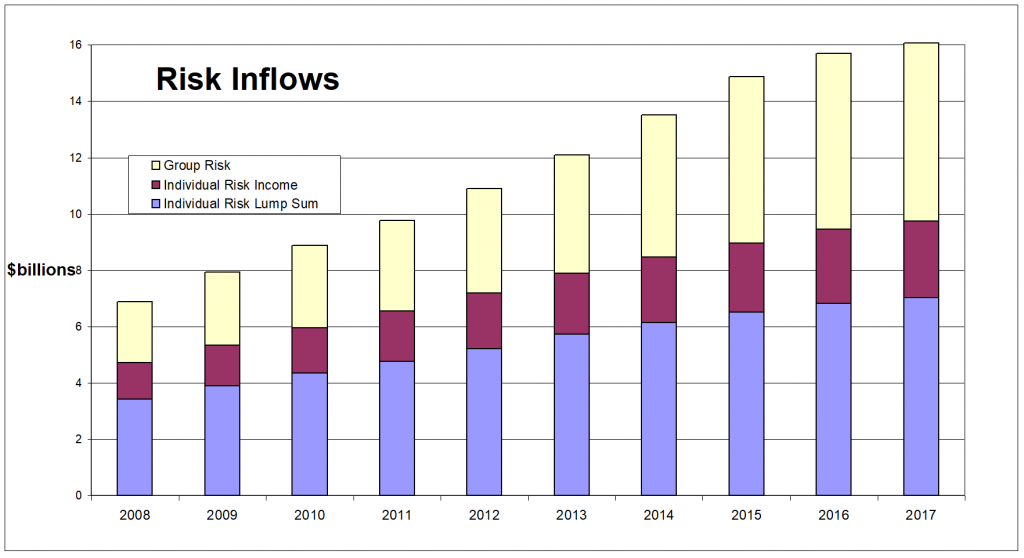

Overall life insurance risk premium inflows have grown at a rate of 2.3% for the year to the end of June but overall risk sales declined by 9.2% due to shifting mandates in the group risk sector, according to data released by Strategic Insight.

In its quarterly update of premium inflows and sales, Strategic Insight reported that total Annual Risk Premium Inflows increased slightly by 2.3% to $16.07 billion led by Zurich which posted inflow growth of 58.5% due to the ongoing amalgamation of old Macquarie Life business.

MetLife (15.1%), TAL (6.6%), BT / Westpac (5.4%), AIA (5.0%) and MLC (3.7%) all recorded increases in total premium inflows while OnePath (0.8%) and AMP (0.2%) both posted flat results while CommInsure (-11.4%) was down. These results were consistent with previously released data for the year to end of the March 2017 (see: Inflows Remain Steady But Sales Flatten).

In its market overview of inflows and sales for the 12 months to the end of June 2017 Strategic Insight also reported that Total Risk Premium Sales fell 9.2% over the calendar year.

While MetLife and Zurich both recorded increases in sales of 111.1% and 30.3% respectively, market leader TAL recorded a decline of 24.6% and AIA Australia recorded a decline in sales of 31.9%.

In the Individual Risk Lump Sum market premium inflows grew at 2.9% led by Zurich (64.2%), ClearView (18.8%) and AIA Australia (13%) while AMP (0.8%) MLC Life (2.8%) and OnePath (-1.4%) were flat by comparison.

Individual Risk Lump Sum sales fell by 4.0% year on year but Zurich, TAL and AIA Australia recorded increases of 31.4%, 5.1% and 4.9% growth respectively as OnePath (-10.4%) and AMP (-9.2%) reported decreases in their annual sales. Once again, these figures were in keeping with those released for the year to the end of March 2017.

Individual Risk Income Market inflows were up 3.8% over the past year while overall Individual Risk Income Sales decreased by 2.1% over the last twelve months. Zurich (91.0%), ClearView (48.7%) and TAL (13.2%) all led the market for inflows while ClearView, Zurich and TAL led sales with increases of 42.0%, 27.4% and 9.6%, respectively.

Group Risk Inflows were flat, up only 1.2% for the year, but MetLife recorded a 10.3% increase in flows ahead of MLC Life (8.4%), TAL (5.4%) and AIA Australia (2.4%) while CommInsure posted a decline in inflows of 21.6%.

Group Risk sales fell by 21.4% with Strategic Insight describing the volatile nature of sales figures tied to the success of insurers acquiring mandates in the latest round of remarketing exercises that are an ongoing feature of sector.

As a result of these activities, only MetLife and MLC Life saw an increase in group risk sales by 127.1% and 19.7% respectively, while AIA Australia (-55.2%) and TAL (-47.6%) posted the highest decrease in sales.

Maybe just maybe people can no lo her afford the outrageous increases and have taken the health insurance route of “let’s tske the risk” You cannot I crease premiums by 30% in less than 12 months and expect people to just bend over and cop

It

No wonder MetLife is in the lead people are looking for options and cheaper premiums a new player in the retail life space must seem like a breath of fresh air that’s the real reason for the decline

Comments are closed.