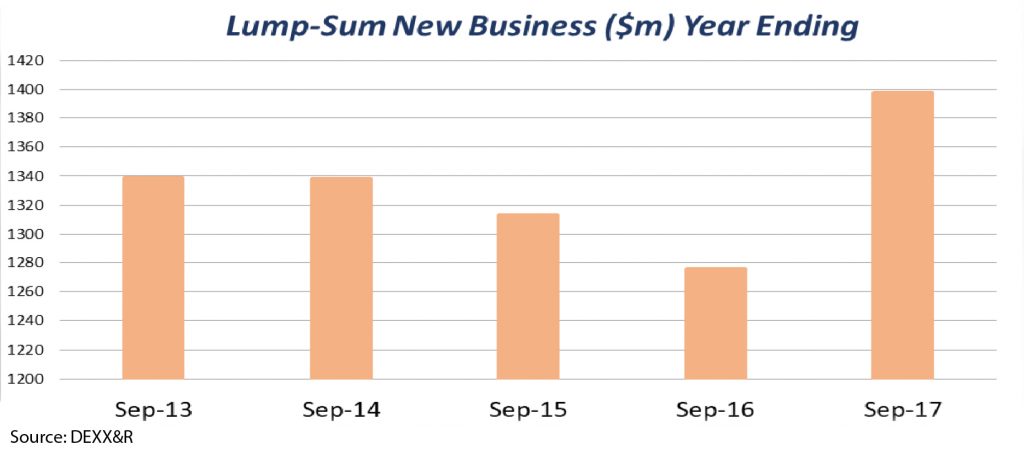

Sales of individual Death, TPD and Trauma insurance were up nearly ten per cent for the year to the end of September 2017 as seven of the top ten life insurers recorded an increase in lump sum new business, according to the latest Life Analysis Report released by DEXX&R.

The report stated the life insurance sector wrote $1.40 billion of lump sum new business in the 12 months to the end of September 2017, up 9.6 per cent from the $1.28 billion recorded for the year to the end of September 2016.

Five of the top ten life insurance companies recorded an increase in lump sum new business of more than 10 per cent with Zurich posting growth of 16.22 per cent, followed by MLC (14.41 per cent), AMP (13.92 per cent), OnePath (12.30 per cent) and TAL (11.97 per cent) for the year to the end of September 2017.

The September quarter was also strong with new business totalling $432 million, up 21 per cent of $72 million, on the $342 million of new business during the June 2017 quarter.

Individual lump sum discontinuances also continued to fall away for the September quarters after peaking in 2013 at 15.6 per cent, dropping to 13.1 per cent at the end of the September 2017 quarter.

Disability Income new business also increased, but only marginally, up 1.9 per cent to $512 million over the year to September 2017 compared to the $502 million recorded in the twelve months to September 2016. There was little movement in the September 2017 quarter with sales of $131 million slightly lower than the $132 million recorded in the June 2017 quarter.

Despite this, six of the top ten insurers recorded an increase in Disability Income new business over the twelve months to September 2017. Zurich led the way with an increase of 71.3 per cent to $61 million, driven by the acquisition of the Macquarie Life business, followed by ClearView with an increase of 22.4 per cent and then AMP (14.4 per cent), TAL (8.8 per cent), Asteron (8.4 per cent), and CommInsure (3.5 per cent).

Disability income discontinuances also dropped off from its 2013 peak of 16 per cent continuing a four and a half year trend and moving from 13.9 per cent at September 2016 to 12.8 per cent at September 2017.

Lets look at these figures in 12 months before jumping in. Could it just have been that the last quarter increase was spurred on by the 1 Jan LIF changes. Just a teensy bit ?

Spot on! Last minute rush by advisers to get the last of the fair rules before the industry starts nailing us to the wall with UNfair responsibility periods, onerous compliance and payment caps is my initial thought.

Comments are closed.