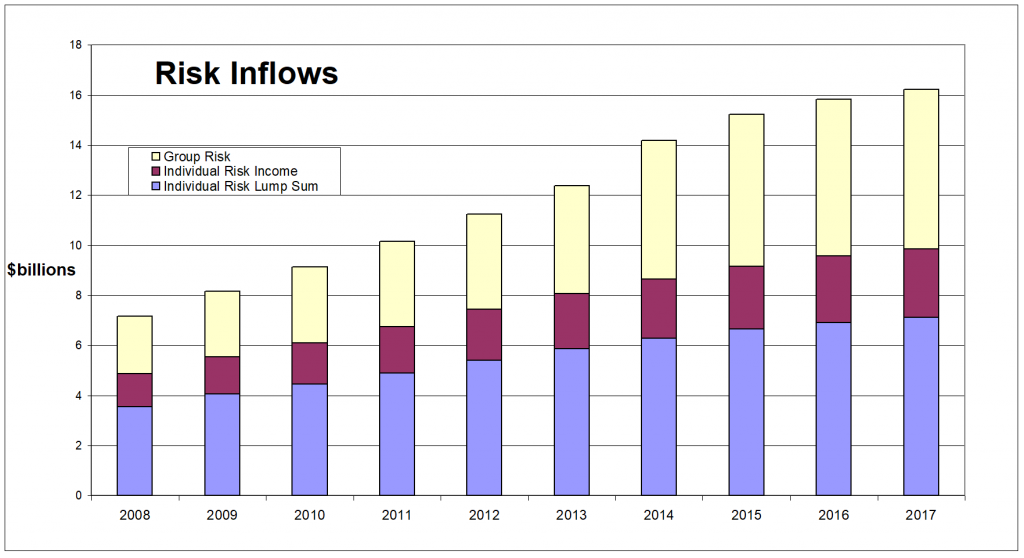

Overall life insurance risk premium inflows have grown at an annual rate of 2.5 per cent but overall risk sales declined by 10.1 per cent due to ongoing volatility in the group risk sector, according to data released by Strategic Insight.

In its quarterly update of premium inflows and sales, Strategic Insight reported that total Annual Risk Premium Inflows increased slightly by 2.5 per cent to $16.2 billion led by Zurich which posted inflow growth of 68.8 per cent, followed by MetLife (12.8 per cent), TAL (10 per cent) and AIA Australia (8.2 per cent) for the 12 months to September 2017.

OnePath (0.5 per cent) and MLC Life (0.5 per cent) both posted flat results while CommInsure (-10.5 per cent) and AMP (-3.4 per cent) were down on total risk premium inflows.

In its market overview of inflows and sales for the 12 months to the end of September 2017, Strategic Insight also reported that Total Risk Premium Sales fell 10.1 per cent over the calendar year but MetLife and Zurich both recorded increases in sales of 204.8 per cent and 43.6 per cent respectively.

Most other insurers reported declines in sales for the period led by MLC Life (-28.7 per cent) and then TAL (-25.7 per cent), CommInsure (-15.3 per cent) and OnePath (-13.6 per cent).

In the Individual Risk Lump Sum market premium inflows grew at 2.9 per cent led by Zurich (63.7 per cent), ClearView (17.1 per cent) and AIA Australia (12.2 per cent) while Suncorp (1.3 per cent), AMP (0.2 per cent) and OnePath (-0.5 per cent) were flat by comparison.

Individual Risk Lump Sum sales fell by 1.7 per cent year on year but Zurich, BT and ClearView recorded increases of 48.3 per cent, 9 per cent and 5.8 per cent growth, respectively, as Suncorp (-15.8 per cent) and CommInsure (-8.4 per cent) reported decreases in their annual sales.

Individual Risk Income Market inflows were up 2.6 per cent over the past year while overall Individual Risk Income Sales decreased by 4.2 per cent over the last twelve months. Zurich (87.5 per cent), ClearView (46.8 per cent) and TAL (13.2 per cent) all led the market for inflows while ClearView, Zurich and AMP led sales with increases of 44.9 per cent, 32.1 per cent and 14.4 per cent, respectively.

Group Risk Inflows were flat, up only 1.9 per cent for the year, led by MetLife with a 14.1 per cent increase in flows ahead of TAL (10.6 per cent) and AIA Australia (7.1 per cent) while Suncorp, CommInsure and AMP posted a decline in inflows of -22.5 per cent, -20.9 per cent and -15.7 per cent, respectively.

Group Risk sales fell by 25.6 per cent, driven by the cyclical nature of marketing that takes place in the group risk sector, according to Strategic Insight.

“Due to its inherent cyclical remarketing nature, Group Risk is a volatile segment of the overall Risk market, for example over the past four years Group Risk Sales have been up 83.1 per cent, down 51.3 per cent, up 31.5 per cent and now once again down,” the group stated.

“Naturally, that sometimes means individual companies might “win” big time but equally there is the distinct possibility that the opposite might occur with ‘losing’ companies having to wait until the next remarketing round for the opportunity to sell their services/products to potential Group Risk clients.”

As a result of these activities, only MetLife and AMP saw an increase in group risk sales by 220.1 per cent and 10.4 per cent respectively, while MLC Life (-69.3 per cent) and TAL (-49.3 per cent) posted the highest decrease in sales.

Daaa !!!! Increased premiums { 30%] reduced sales 10% = less affordability to many people taking out cover due to cost !!! Next step more lapses due to unaffordable costs as life insurance has increased up to 30% Wages and CPI growth is pretty much “stagnet”

Can anyone else see the issue here ? No wonder what premiums are being paid are being done more and more from Super for cash flow purposes Now watch the Super Funds have a” winge” to ASIC and APRA that clients retirement benefits { and what they have to play with} is dwindling.

there IS ALWAYS TWO SIDES OF A COIN !

Comments are closed.