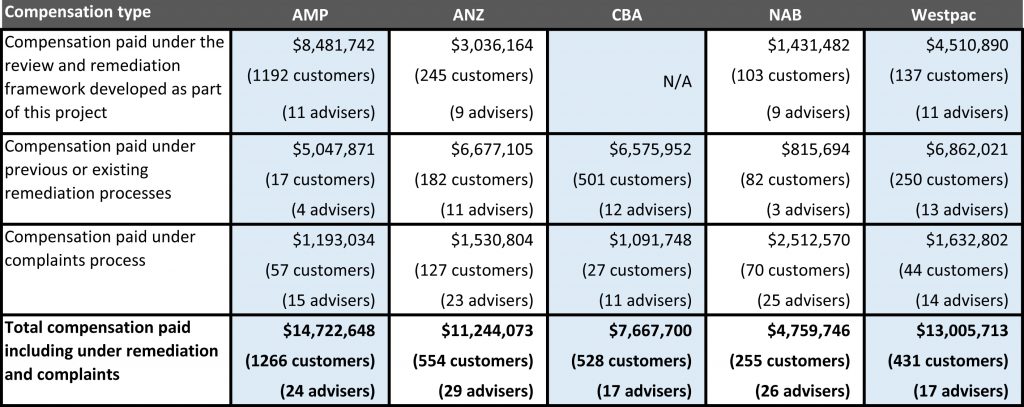

Financial advice groups aligned to the four major banks and AMP have paid more than $51 million in compensation as a result of non-compliant advice, according to ASIC, which is continuing to review the work of 50 advisers.

The regulator released updated figures regarding compensation stemming from its Advice Compliance Project which examined non-compliant advice provided between 1 January 2009 and 30 June 2015, which it reported on in March 2017 (see: Institutions Lagging in Reporting Advice Breaches).

ASIC stated that while $51.4 million had been paid to more than 3,000 consumers as at 31 December, 2017, the Advice Compliance Project was ongoing and it expected further compensation would be paid.

The regulator noted that each of the five institutions were undertaking reviews of the advice of high risk individuals and “…are also undertaking, and seeking expert assurance of, work to identify any high-risk advisers not identified by their previous monitoring and supervision processes.”

ASIC was also engaged in “…ongoing investigation or surveillance activities in relation to more than 50 individual advisers…”

Additionally, ASIC was also engaged in “…ongoing investigation or surveillance activities in relation to more than 50 individual advisers within the scope of the work in Report 515”.

At the time of the release of that report, $30 million had been offered or paid by the five institutions to 1,347 customers who had suffered loss as a result of poor advice by 97 high risk advisers identified by ASIC.

In the most recent update, released this week, ASIC revealed that a further $21.4 million had been paid in the 12 months from 31 December 2016 to 1,687 customers for a total of $51.4 million in compensation.

These figures, however, do not include compensation paid by CBA related to advice provided by former authorised representatives of Commonwealth Financial Planning and Financial Wisdom, which is nearly $32 million, and the $29 million offered under CBA’s Open Advice Review Program.

ASIC also noted the figures did not include $11.6 million paid in compensation to NAB customers as the non-compliant advice conduct related to the compensation took place before the period covered by the Advice Compliance Project (see table below).

The regulator also pointed out these figures are unrelated to compensation amounts paid in relation to fees-for-no-service issues which currently total more than $180 million (see: Aligned Advice Groups Close Gap on Non-Existent Advice Compensation).

Note: An adviser or a customer can appear under more than one compensation type. Source: ASIC