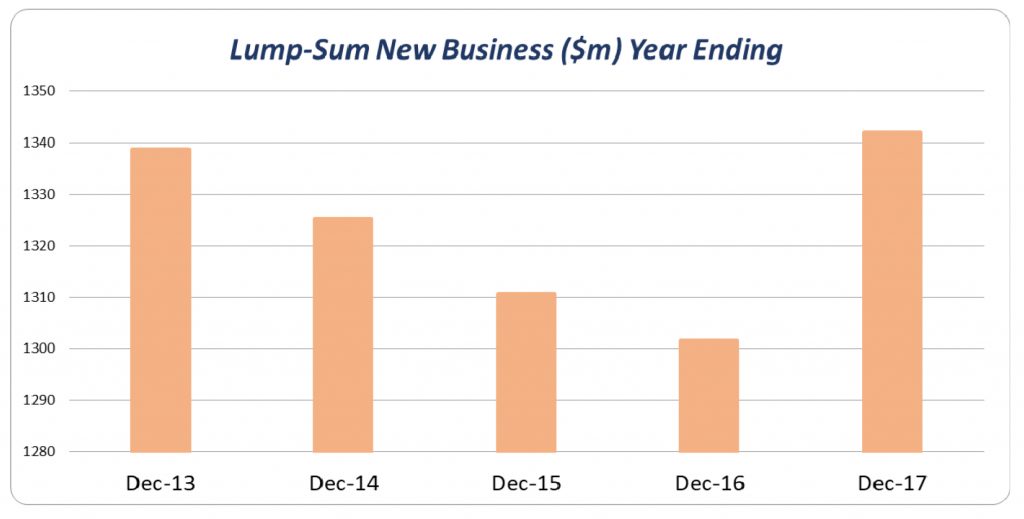

Sales of individual Death, TPD and Trauma insurance reached a five year high for the year to the end of December 2017 as four of the top ten life insurers recorded an increase in lump sum new business, according to the latest Life Analysis Report released by DEXX&R.

The report stated the life insurance sector wrote $1.34 billion of lump sum new business in the 12 months to the end of December 2017, up 3.0 per cent from the $1.30 billion recorded for the year to the end of December 2016.

Four of the top ten life insurance companies recorded an increase in lump sum new business with Zurich posting growth of 84.9 per cent to $190 million, followed by ClearView (3.1 per cent to $39 million), TAL (2.6 per cent to $167 million) and AMP (0.7 per cent to $192 million) for the year to the end of December 2017.

Despite the strong year on year performance, the December quarter was the lowest recorded in any of the past five quarters for individual lump sum new business and was down 16.7 per cent, to $280 million, on the $336 million recorded in the December 2016 quarter.

Individual lump sum discontinuances also continued to fall away for the December quarter after peaking in 2012 at 15.9 per cent, dropping to 12.6 per cent at the end of the December 2017 quarter.

Disability Income new business decreased by 1.6 per cent to $513 million over the year to December 2017 compared to the $521 million recorded in the twelve months to December 2016. There was a larger decline in the December 2017 quarter with Disability Income new business declining by 13 per cent with sales of $125 million compared to $144 million in the September 2017 quarter.

Five of the top ten insurers, however, recorded an increase in Disability Income new business over the twelve months to December 2017. AMP led the way with an increase of 37.8 per cent to $72.7 million, followed by Zurich with an increase of 27.4 per cent and then ClearView (17.2 per cent), CommInsure (7.1 per cent) and TAL (3.9 per cent).

Disability income discontinuances also dropped off from its 2013 peak of 16.2 per cent continuing a four trend and moving from 13.6 per cent at December 2016 to 12.8 per cent at December 2017 and reaching their lowest level in 10 years.

TAL currently remains the largest life insurer based on market share for in-force risk annual premiums, followed by AIA Australia, MLC Life, AMP and OnePath.

This would change following the completion of the acquisition of CommInsure by AIA and OnePath by Zurich and DEXX&R stated that, based on December 2017 figures, TAL and AIA would swap places, Zurich would move into third position, followed by MLC Life and AMP.

Look at that graph. Pretty obvious commissions were about to take a dive in January’18 I’d say. Big push for Dec sales at the old commission rate. I wonder how many of those were written in the client’s best interest? Unless I’m missing some other factor that cause advisers to write a shed-load in a hurry?! Why are people surprised about this ‘temporary’ uptick in sales?

Comments are closed.