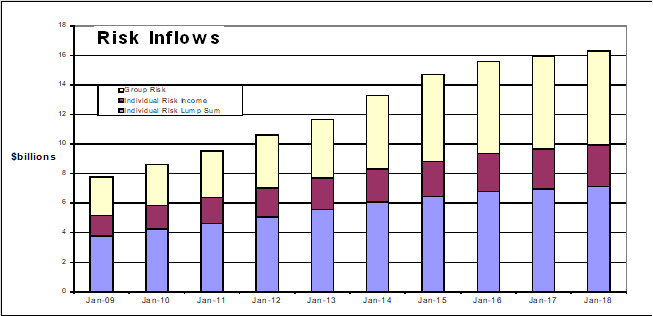

Overall life insurance risk premium inflows have grown at an annual rate of 2.3 per cent while overall risk sales were up around 15 per cent due to a large increase in group risk sales for the year to the end of March 2018, according to data released by Strategic Insight.

In its quarterly update of premium inflows and sales, Strategic Insight reported that total Annual Risk Premium Inflows increased by 2.3 per cent to $16.3 billion led by BT/Westpac which posted inflow growth of 21 per cent, followed by TAL (8 per cent) and AIA Australia (7.2 per cent) for the 12 months to March 2018.

MetLife (3.3 per cent) and Zurich (3 per cent) both posted marginal growth rates results while AMP (-2.7 per cent) and CommInsure (-22.4 per cent) were down on total risk premium inflows.

In its market overview of inflows and sales for the 12 months to the end of March 2018, Strategic Insight reported that Total Risk Premium Sales had increased by 14.6 per cent over the calendar year and AIA Australia, BT/Westpac and TAL recorded sizeable increases in sales of 113.7 per cent, 77 per cent and 62.3 per cent respectively.

Many other insurers reported declines in sales for the period led by MLC Life (-26.8 per cent) followed by OnePath (-15.2 per cent), CommInsure (-14.1 per cent) and AIA Australia (-9.5 per cent).

In the Individual Risk Lump Sum market, premium inflows grew at 2.3 per cent led by ClearView (15.5 per cent), AIA Australia (12.5 per cent) and TAL (5.9 per cent). The top three market leaders, AMP, MLC Life and OnePath posted modest growth rates of 0.1 per cent, 2.7 per cent and 1.4 per cent, respectively while CommInsure posted -2.3 per cent growth.

Individual Risk Lump Sum sales fell by 4.9 per cent year on year but Zurich recorded an increase of 18.5 per cent, following a 26.7 per cent increase in the December 2017 quarter as well. A number of insurers posted negative growth in this area for the year to the end of March 2018, led by CommInsure (-10.3 per cent), followed by Suncorp (-10.2 per cent), BT/Westpac (-9.5 per cent). OnePath (-8.7 per cent) and MLC Life (-7.6 per cent).

Individual Risk Income Market inflows were up 3.8 per cent over the past year while overall Individual Risk Income Sales decreased by 3.2 per cent over the last twelve months to March 2018. ClearView (35.8 per cent), TAL (12.2 per cent) and AIA Australia (8.9 per cent) all led the market for inflows while AMP (49.1 per cent), ClearView (18.6 per cent) and CommInsure (12.4 per cent) led the market for risk income sales.

Group Risk Inflows were up slightly by 1.6 per cent for the year and were led by BT/Westpac which posted growth of 334.7 per cent as a result of taking its superannuation platform insurance mandate in-house. Other groups to post positive growth included TAL (8.1 per cent), OnePath (7.1 per cent) and AIA Australia (5.8 per cent) which were offset by falls recorded by CommInsure (-50.2 per cent), AMP (-15.1 per cent) and Suncorp (-11.6 per cent).

Group Risk sales grew markedly by 73 per cent after two years of large decreases with Strategic Insight stating the turnaround signalled a return to increased turnover and volatility in the Group Risk market. BT / Westpac (2838.4 per cent), TAL (2775.0 per cent) and AIA Australia (262.7 per cent) all recorded very large increases in their sales while by contrast those of MetLife (-60.5 per cent), MLC (-56.9 per cent), CommInsure (-27.6 per cent), Suncorp (-27.3 per cent) and OnePath (-16.8 per cent) all fell.