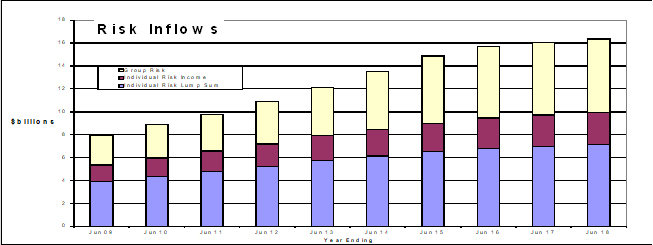

Overall life insurance risk premium inflows have grown at an annual rate of 1.8 per cent while overall risk sales were up around 5.5 per cent due group risk policies continued to be recycle between life insurers via ongoing remarketing strategies, according to data for the year to the end of June 2018 released by Strategic Insight.

As part of its quarterly update of premium inflows and sales, Strategic Insight reported that total Annual Risk Premium Inflows increased by 1.8 per cent to $16.4 billion led by BT/Westpac which posted inflow growth of 20.4 per cent, followed by AIA Australia (8.4 per cent) and Zurich (3.4 per cent) for the 12 months to June 2018.

TAL (2.8 per cent), OnePath (1.7 per cent) and Suncorp (1.4 per cent) all recorded minimal growth rates results while AMP (-3.3 per cent) and CommInsure (-17.2 per cent) were down on total risk premium inflows.

In its market overview of inflows and sales for the 12 months to the end of June 2018, Strategic Insight reported that Total Risk Premium Sales had increased by 5.5 per cent over the calendar year and AIA Australia, BT/Westpac and Zurich recorded double digit increases in sales of 125.8 per cent, 66.9 per cent and 11.1 per cent respectively.

Many other insurers reported declines in sales for the period led by MetLife (-52.6 per cent) followed by TAL (-34.5 per cent), MLC (-23.4 per cent) and OnePatha (-15.2 per cent).

In the Individual Risk Lump Sum market, premium inflows were slow but steady, up another 2.0 per cent over the past twelve months. ClearView (14.1 per cent) and AIA Australia (11.7 per cent) recorded double digit increases TAL (5.5 per cent), Zurich (3.4 per cent), and Suncorp (2.2 per cent) also recorded positive growth.

The top three market leaders, AMP, MLC Life and OnePath posted mixed growth rates of -0.4 per cent, 1.9 per cent and 0.8 per cent, respectively while CommInsure posted -2.9 per cent growth.

Individual Risk Lump Sum sales fell by 5.8 per cent year on year but Zurich recorded an increase of 12.5 per cent, following a 18.5 per cent increase in the March 2018 quarter as well.

A number of insurers posted marginal growth in this area for the year to the end of March 2018, led by AIA Australia (6.1 per cent), followed by ClearView (3.7 per cent) and AMP (3.5 per cent), compared with negative sales for BT/Westpac (-19.4 per cent) and OnePath (-10.2 per cent) and MLC Life (-10.1 per cent).

Individual Risk Income Market inflows were up 3.3 per cent over the past year while overall Individual Risk Income Sales decreased by 2.7 per cent over the last twelve months to June 2018. ClearView (30.7 per cent), TAL (11.6 per cent) and AIA Australia (8.5 per cent) all led the market for inflows while AMP (39.1 per cent), CommInsure (20.8 per cent) and ClearView (9.2 per cent) led the market for risk income sales.

Group Risk Inflows increased by only 1.0 per cent for the year and were led by BT/Westpac which posted growth of 337.9 per cent as a result of taking its superannuation platform insurance mandate in-house. Other groups to post positive growth included AIA Australia (7.6 per cent) which captured the HESTA Industry Fund Group Life mandate, and OnePath (6.4 per cent).

Meanwhile the second to fourth ranked participants in the Group Risk market recorded slight negative sales: TAL (-0.2 per cent), MetLife (0.1 per cent) and MLC (-0.8 per cent), while CommInsure (-40.5 per cent), Suncorp (-21.8 per cent) and AMP (-15.5 per cent) all recorded significantly lower Group Risk Inflows.

Group Risk sales grew by 32.6 per cent year on year, after falling 21.1 per cent in 2017/17, and continued to reflect the latest round of remarketing exercises common within the group risk sub-market.

Some winners in the current cycle include BT / Westpac with high growth of 2413.4 per cent, and AIA Australia (307.6 per cent) while TAL (-86.9 per cent), MetLife (-52.4 per cent) and MLC (-46.4 per cent) dealt with the downside of remarketing.

Pls explain the jargon. What is the difference between Individual Risk Lump Sum PREMIUMS(up 2%) and Individual Risk Lump Sum SALES (down 5.8%)

Either way, LIF has had a severe impact when you consider every life office has increased trauma & TPD premiums this year by a minimum of 7% to 8% on new business.

Standby for Stage 2. If there are any risk specialists left!

Incidentally it is obvious Clearview, with similar products, has benefited from the demise of Comminsure

Individual Risk Lump Sum PREMIUMS are the funds that are paid by current policy holders for active policies while Individual Risk Lump Sum SALES are the funds being paid for the purchase of new life insurance policies.

wait until 2019 when the 2 year responsibility period and maximum commission entitlement of 70% starts to bite. Advisers will look after the renewal base and avoid sales that have any potential to not run the 2 year course.

Insurers will again increase premiums on existing clients to cover claims not being fully covered by new business aquasition. Then clients will bail out { like the heath insurance industry} as they cannot afford it. What an unravelling this is becoming

Comments are closed.