FASEA released the final version of its Education Pathways Policy, in which it has broadened the range of relevant degree subjects it will accept and extended the opportunities for advisers to access credits in recognition of prior learning.

In a statement from the Authority accompanying the release of the final version of its Education Pathways Policy, FASEA notes the amount of education an adviser will be required to undertake will depend on the amount of education they already have.

As in earlier drafts, FASEA says recognition of prior learning will be available for:

- An advanced diploma of financial planning (including the historical 8 course Diploma of Financial Planning)

- Completion of approved coursework to attain a designation

In this final version, however, the Authority has added a third avenue for recognition of prior learning, which is:

- Completion of relevant degree subjects

For this additional avenue, FASEA notes: “Advisers holding a non-relevant degree who have completed between 4 and 7 of the relevant degree knowledge areas will be awarded 2 credits as recognition of prior learning.”

Following industry feedback, the term ‘relevant degree’ has also been expanded to include financial planning and investments studies. FASEA states: “Financial planning (including financial advice areas of superannuation, retirement, insurance and estate planning) and investments (including investments such as shares, derivatives, foreign exchange and options) have been added as relevant degree subjects.

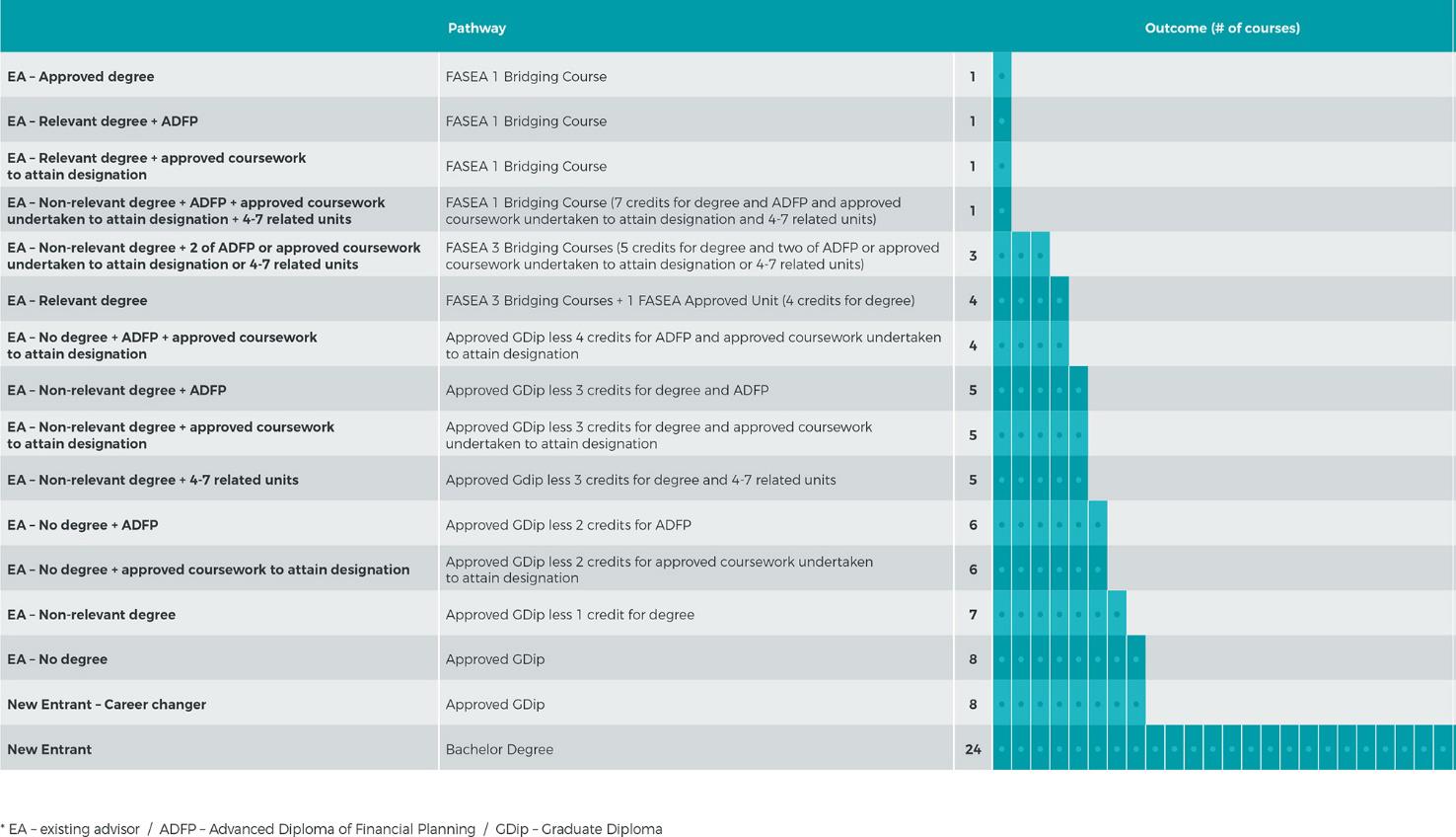

The following table details the recognition of prior learning and the consequent number of subjects that will be required of advisers for each of the different pathways defining existing advisers:

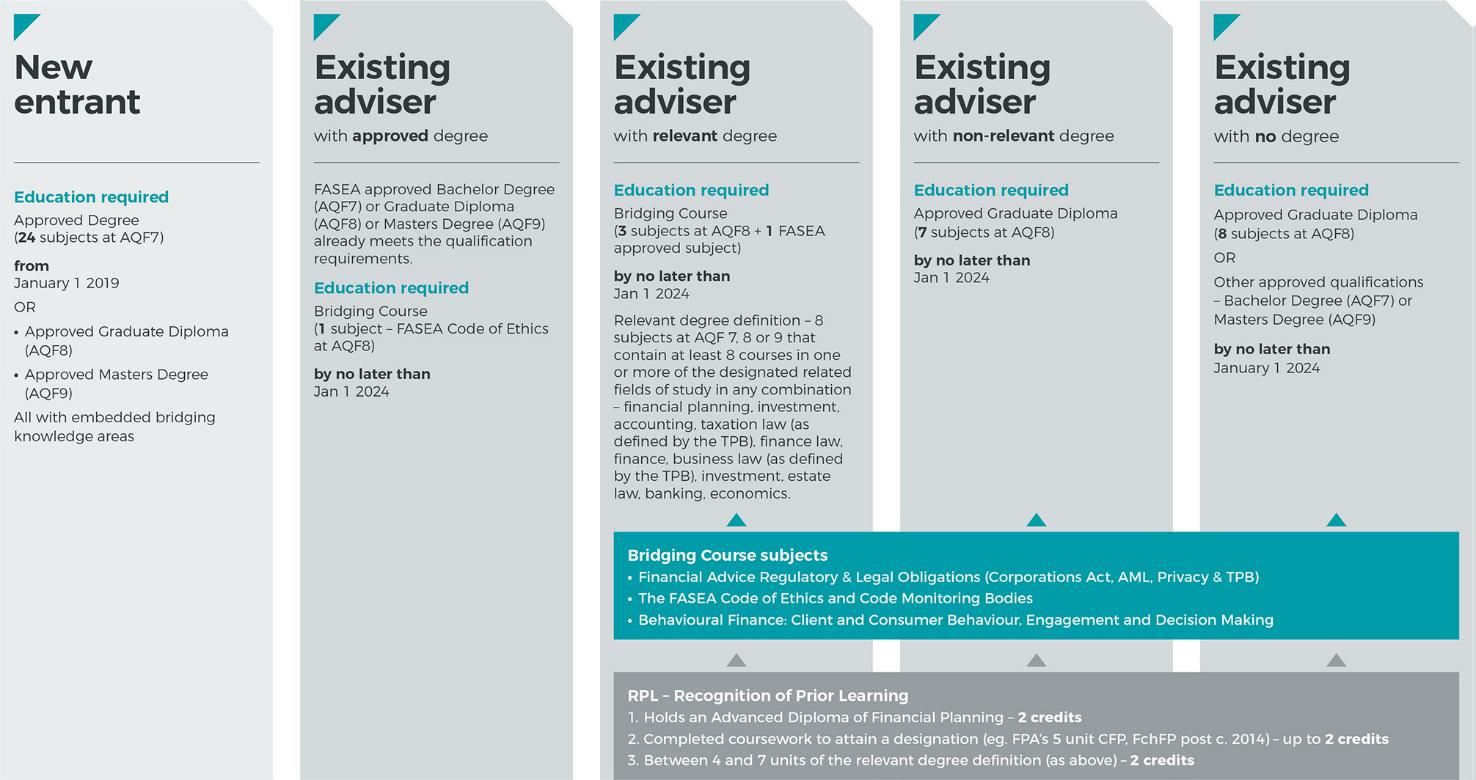

This second table, also taken from the Authority’s final FPS001 Education Pathways Policy, provides a summary of FASEA education pathways for both new entrants and existing advisers:

This second table, also taken from the Authority’s final FPS001 Education Pathways Policy, provides a summary of FASEA education pathways for both new entrants and existing advisers:

Advisers can click here to access the final version of the Financial Adviser Standards and Ethics Authority’s Education Pathways Policy.

Advisers can click here to access the final version of the Financial Adviser Standards and Ethics Authority’s Education Pathways Policy.

As usual, FASEA has not recognised experience, the advisers history around the advice provided, or whether the adviser employs staff.

Getting advice from education providers and people who never left the education system, is a waste of time, as these people are Institutionalised and have never lived in the real world.

As an Industry, the Life Insurance Companies have shot themselves in the foot by not standing up to the FASEA charade right from the start and demanding that only people with a grasp of reality and commercial sense should be involved in the future direction of adviser education.

Like with everything, once a public servant or a self serving lobbyist leech gets involved,

the end result will always be the same, convoluted mumbo jumbo that makes little sense and only creates confusion and losses for the Tax payer and small Businesses who are trying to survive.

Having started my financial career as an investment banker in 1985, then as a stock broker from 1998 and a financial planner since 2001, that all my experience is only worth 2 Credits. It amazes me that I have met the requirements as requested all the way along and have gained invaluable experience for my clients only to be told, the rules are changing and you are out of a job unless you spend a huge amount of hours studying and doing exams that have been written by educators who have little or no real world experience…

So on 31 December 2023 I’ll be fine to talk to someone about their life insurance. It will be a similar conversation to those I will have had countless times over the preceding 44 years. But if I continue the conversation the next day I’ll be (I presume) breaking the law and liable to pay a substantial fine or perhaps even serve jail time? But the 23 year old who’s never actually spoken to a client (but has lots of book learning about unrelated subjects) is ok to go ahead and give advice?

I’ll raise you one year of experience Guy so I feel exactly as you do. A great tragedy that advisers such as you & I will be forced to leave advice to those, many of which have been to university but don’t understand that the key reason people buy life insurance is for love of their family, nothing financial and also the value of disability insurances go far beyond financial compensation.

It should read “historical 8 subject Diploma of Financial Planning”…

Comments are closed.