Detailed individual life company claims records have been released to the Australian public for the first time.

In what is claimed to be a world-first, regulators APRA and ASIC have combined to deliver an immensely comprehensive analysis of life insurance claims and disputes statistics.

A series of publications on the claims data includes an online tool available on ASIC’s MoneySmart website (click here). This package offers advisers and consumers the opportunity – for the first time – to compare and contrast each life insurer across a range of claims metrics for four distribution channels, namely:

- Individual Advised

- Individual Non-Advised

- Group Super

- Group Ordinary

The comparable metrics available within this online consumer tool include:

- Percentage of claims accepted

- Length of time taken to pay claims

- Number of disputes

- Policy cancellation rates

Advisers and consumers can access this claims information for cover types including: Death, TPD, Trauma, Disability Income, Consumer Credit Insurance, Funeral and Accident Cover.

Within the more comprehensive data released by APRA (click here), the same four distribution channels and cover types are the subject of various claims performance metrics including:

- Claims outcomes

- Claims admittance rates

- Claims decline reasons

- Claims withdrawn rates and reasons

- Claims frequency

- Claims paid ratios as a proportion of annual premiums receivable

92 percent of overall claims …were paid in the first instance

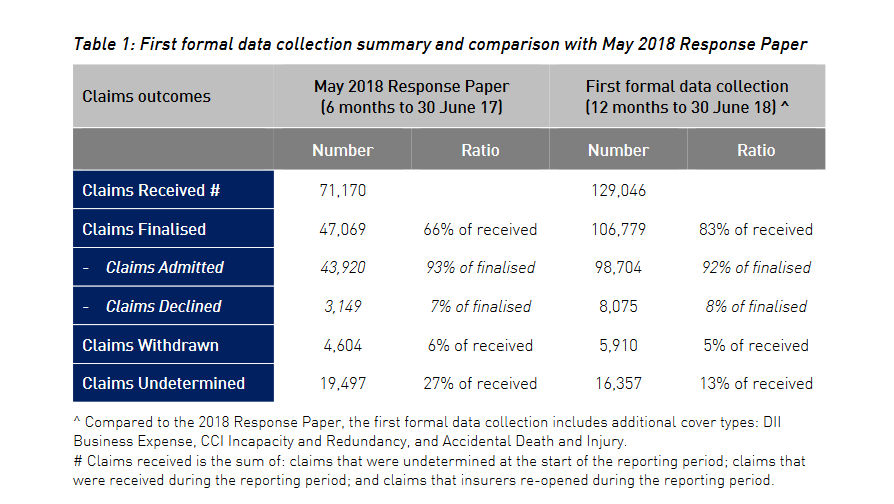

One of the headline statistics referenced in a statement from ASIC accompanying the release of the data is that 92 percent of overall claims across all distribution channels finalised in the 12 months to June 2018 were paid in the first instance. This statistic was also highlighted – ahead of the release of the data – at the recent 2019 FSC Life Insurance Conference in Sydney. Riskinfo notes, however, that this statistic relates to a percentage of finalised claims; not to the percentage of claims received. See below for data taken from APRA’s report comparing ‘claims admitted’ data and other outcomes for the six months to June 2017 with the outcomes for the 12 months to June 2018:

For 2018, the data reports 83 percent of claims received were finalised, and of that 83 percent which could be finalised, 92 percent were accepted, or ‘paid in the first instance’.

For 2018, the data reports 83 percent of claims received were finalised, and of that 83 percent which could be finalised, 92 percent were accepted, or ‘paid in the first instance’.

Interestingly, this table also highlights a stark contrast in the the proportion of undetermined claims for the two periods, showing a significantly reduced rate of undetermined claims for the period ended June 2018 – only 13 percent undetermined in 2018 data, compared with 27 percent undetermined in 2017 data.

APRA Executive Board Member, Geoff Summerhayes, said the release of such broad and granular data on life insurance claims and disputes was world-leading practice among global insurance regulators:

This project represents a joint commitment to …holding life insurers to account for how they treat policyholders

“This project represents a joint commitment to enhancing industry transparency and holding life insurers to account for how they treat policyholders,” said Summerhayes.

Meanwhile, ASIC Commissioner, Sean Hughes, noted: “APRA’s data publication is complemented by ASIC’s MoneySmart life insurance claims comparison tool, which helps consumers make informed decisions when buying these complex life insurance products.”

ASIC advises data will be collected on an ongoing basis, and the resources will be updated twice yearly, with the next round of data set for release on 27 June 2019.

At first glance, this is a fantastic initiative. Do others agree?

Absolutely Aaron, fully agree. Sadly though it won’t change the blinkered views of the Labor party. Nor will it help specialist risk advisers – many like me who spend countless hours helping our clients at claim time for no additional remuneration – get the realistic ‘carve-out’ from the heavy handed FASEA impost.

Industry average 94.2% IP claims accepted when advised by an AR. 82.5% via direct. Death claims – 97.5% advised, with a disturbing 88.1% direct!

TPD advised or through super was pretty much the same. This would likely relate to the more restrictive policy wordings available from life offices & under SIS, out of the direct control of the adviser.

As yet, I have not seen a comprehensive explanation from TAL on the manner in which they were criticised by Mr. Hayne for their poor TPD claims results. Disturbingly, advised TPD claims accepted with TAL were a very poor 67.1% compared to 91.4% through super? I would like to know why TAL was the poorest performer with advised business, yet the best performer under super TPD claims?

The lack of data for claims accepted [more likely ‘not accepted’] by Noble Oak, Hallmark and MetLife is damning in itself, across the 3 direct offered products – IP, Life & TPD.

It is a very good start and finally allows a glimpse into the Life Insurance Industry to gauge what is occurring, though there is missing data and what appears to be unusual data mixed up with all the other information.

What does seem to be a regular theme, is a rise in cancellations which have nothing to do with Advisers, yet advisers have been the ones to be held responsible as per the current fiasco we are in today.

Let us hope that there are people in positions of authority within the Life Insurance Companies, that will digest the data, based on REAL world reasoning and finally make the necessary changes to how Life Insurance is sold and administered, which is blindingly obvious, before it is too late.

There are also some figures relating to super funds v advisers which really surprise me. TPD through a super fund 86.3% accepted with an assessment time of 5.5 months, TPD through an adviser 85.3% accepted with an assessment time of 8.9 months. IP through a super fund 96.2% acceptance with an average claim time of 1.7 months compared to 94.2% acceptance and 1.6 months average claim time through an adviser.

Not saying you can read anything into the figures but I am sure ASIC and the ALP will.

Comments are closed.