New research has revealed a meaningful reduction in replacement policy activity across both lump sum and income protection insurance products.

…replacement activity is occurring at lower levels than in the past

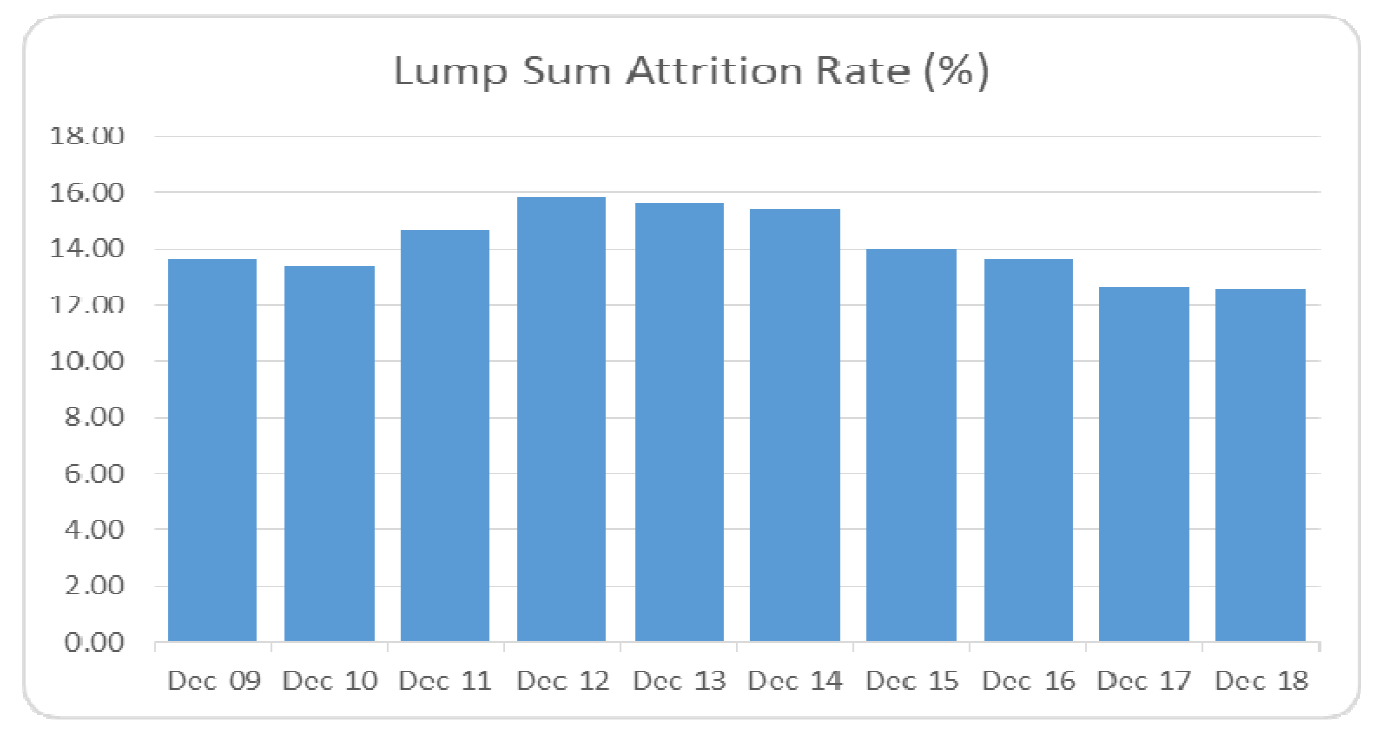

In what may prove to be an early indicator of a new trend, research firm, DEXX&R’s Life Analysis Report for the year ending December 2018 reports both a decline in lump sum new business rates for the period as well as a decrease in attrition rates.

Importantly, the researcher notes, “In the past a decline in new business has been accompanied by an increase in attrition rates. The continued decrease in attrition rates indicates that life insurance policies are staying in-force longer and replacement activity is occurring at lower levels than in the past.”

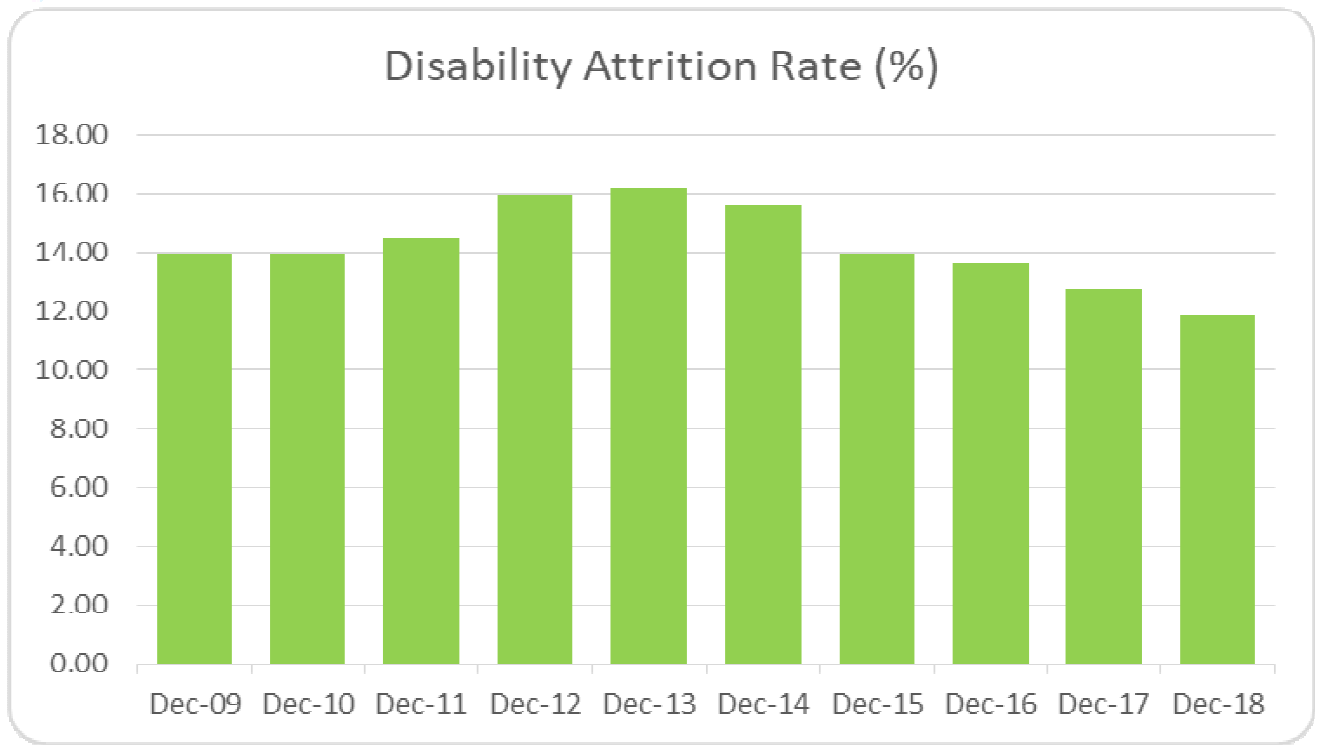

DEXX&R says this same trend has also been revealed in its analysis of disability income new business for the year ended December 2018. It says the attrition rate for disability income business has decreased for the fifth consecutive year, placing the rate at its lowest level in

ten years, indicating both a substantial improvement in the number of policies remaining in force and a decrease in replacement activity.

Increasing Life Company Reliance on Advisers

Life Companies are now becoming increasingly reliant on sales made by aligned and non-aligned advisers

In other news stemming from DEXX&Rs December 2018 reporting, the researcher has linked what it refers to as a large fall in risk sales in the twelve months to December 2018 with several of the major retail banks suspending or closing down direct sales of life insurance products. It says:

“Life Companies are now becoming increasingly reliant on sales made by aligned and non-aligned advisers providing personal advice for

future lump sum new business growth.”

There are few simple reasons for this. Firstly aside from a very few it has been proven that churn was in fact not an issue (as admitted by ASIC) post the LIF being passed.

Since the LIF Insurance companies have been doing three things. They have all been increasing existing policy holders premiums and they have all been reducing premiums for new business only effectively trying to encourage a churn issue that was not there in the first place. They have also been worsening product features and benefits on new business.

There are three very simple reasons for a decline in product replacement:

1. Despite the insurance companies best efforts to encourage churn advisers are doing the right thing and not replacing customers for a worse product.

2. The biggest perpetrators of churn. The insurance companies dodgy direct offerings are being shut down post Royal Commission.

3. Under the LIF advisers cannot afford to write risk business and we have all rapidly reduced our new business and costs and relying on existing trails and servicing existing customers.

Are the insurance companies suddenly in a panic over drops in new business. Yes and so they should be. Their only hope is to realise they need advisers again and lobby to fix the LIF’s ridiculous rates and other problems they created themselves.

spot on. Our new business has virtually ceased for the last year as compliance needs took over, exams etc and burn out. I say, there is no more new business from this big past risk writer.

Comments are closed.