The Australian Prudential Regulatory Authority has sent letters to insurers in which it calls on them to urgently address concerns it has with the sustainability of individual disability income insurance.

The regulator says its concern relates specifically to individually-sold income protection business, rather than group income protection, due to the ongoing poor performance of individual DII.

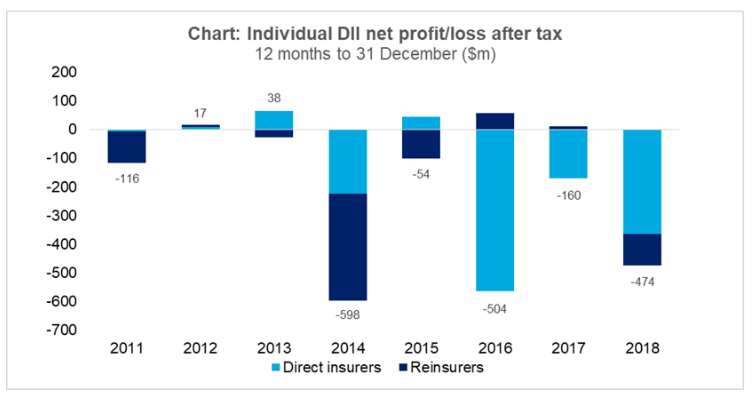

In registering its concern, APRA notes the industry has collectively lost $2.5 billion through this product offering over the past five years, with no signs of improvement.

In its letter, APRA details its concerns, which it says were identified by a recent thematic review of individual DII and has issued a series of requirements for life companies to address those concerns.

The review examined the eight largest providers of individual DII, representing more than 90 percent of market share, where APRA says it found shortcomings with insurers’:

- Strategy and risk governance

- Pricing and product design

APRA also noted it found there was inadequate data and resourcing within the companies dedicated to dealing with DII and its related issues.

In a critical assessment of the current issues surrounding DII product sustainability, APRA Executive Board Member, Geoff Summerhayes, said most life companies have long been aware of the issues, but their efforts to address them have so far been inadequate:

…life companies have focused on attracting policyholders through pricing and product features that are not sustainable

“In a highly competitive environment, life companies have focused on attracting policyholders through pricing and product features that are not sustainable. The result has been ongoing losses and a failure to deliver a satisfactory customer experience,” he said, adding:

“Unless these adverse trends are reversed, there is a risk some life companies will ultimately exit the market for DII, worsening consumer outcomes through reduced competition, accessibility and affordability.”

APRA has given life companies eight weeks to start taking a range of steps in response to its concerns, including formulating a strategy to address the issues identified by the thematic review, and reviewing DII product design and pricing practices to enhance its sustainability.

In seeking to address a number of factors the regulator says are impeding life companies’ ability to improve the performance and sustainability within the individual DII market, APRA has identified four key themes where it says greater attention and action are needed by insurers:

Strategy and risk governance

- Formulating and executing a co-ordinated strategy with a clearly defined long-term target state. The board needs to own and drive that strategy with appropriate level of oversight and challenge.

- Clearly articulating risk appetites that are supported by risk and performance metrics at a product level, in this instance, specifically in relation to individual DII.

- Lifting the capacity and capability of risk functions to provide a sufficient level of oversight and challenge on individual DII associated risk matters.

Pricing and product design

- Greater consideration of, and transparency around, risks associated with individual DII related pricing decisions and new product developments.

- Ensuring that product designs adhere robustly to the principles of insurability.

Data

- Improving the quality, quantity and timeliness of data.

- Proactively contributing to the industry experience study and collaborating with APRA’s initiatives to consider options to improve the industry experience data.

Resourcing

- Proactively ensuring resourcing and skills in key disciplines are adequate for the workload and complexity associated with individual DII business

Mr Summerhayes said life companies that failed to promptly and effectively meet APRA’s expectations would face consequences.

Click here to access APRA’s open letter to all life insurers and friendly societies.

Source: APRA DII Thematic Review letter to life insurers

Does APRA understand the intricacies and variables of the Life Insurance Industry

enough, to make informed decisions and directions?

I very much doubt it.

When it comes to Income Protection, it should be a relatively simple fix to remedy the

losses, though “simple” is not part of the Life Industry vocabulary.

The ability to turn a loss into a profit, relies on data honesty and an overhaul of the current insane distribution channels that cannibalise each other, by creating a level playing field where direct product floggers are closed down if they fail BID, Group and Industry Super Funds are forced to charge a more realistic premium for life, TPD and Income Protection for their members, as it is obvious that there is a cross subsidization going on that clearly disadvantages the retail Life sector.

The reason the retail industry is losing money is obvious.

1) BID in retail is undermined by Group, Industry Super fund and Direct Insurers who

do not follow BID.

2) Retail BID requires advisers to do like for like comparisons, extensive reporting, underwriting. Etc.

The rest do very little and are a main cause for lapses in the retail sector.

3) The stupid solution Life Companies come up with to stem losses, by raising premiums 10-30% which then creates higher lapses.

The Life Companies must stop this cannibalising, by looking at their strategies of

attaining and retaining insurance premiums in it’s entirety and as a collective, rather than each entity within the organisation regarding the others as a competitor.

The Industry needs to ask APRA and the Government to introduce BID across the full

spectrum of Retail and the Direct product floggers, allow the Life Companies to properly scope and price Group and Industry Super Insurance premiums, so the Life Companies can make a profit without gouging the Retail area, which in turn will reduce the current fiasco, bring proper pricing protocols across the whole of Australia and stabilise the industry.

I note Mr Summerhayes states “most life companies have long been aware of the issues, but their efforts to address them have so far been inadequate”: Was he unaware of this issue when he was at the helm of an insurer?

Having said that and in reading the letter to the insurers I still cannot see how these initiatives will make one iota of a difference.

Below is a document I have written and kept on file for some time while which exposes the issues and provides practical logical solutions.

Under the current (and past) model the products, in particular disability and trauma, will and do fail to meet this need as consumers are price forced off their policies. We talk about a sustainable and healthy insurance industry. This should work both ways and cannot only be sustainable for the Insurers, which is currently the case! Very few can afford annual Stepped, Hybrid or Level premium increases as they get older.

For example, if a 30 year old effects an income protection policy with a benefit period to age 70, the expectation is that the product, whether funded on Stepped, Level or Hybrid premiums, will protect them through their working life at a fair and correctly costed premium. History has provided empirical evidence this will not be the case and they will be price forced off their policy, notably income protection and trauma cover.

Surely a contract between two parties that favours the one party (the insurer) so significantly is an unfair contract under the legislation?

What occurs:

• Insurers bring to market new policies at lower premium rates than their closed product, or prior series offering. How can this possibly be responsible behaviour? The Insurers have done this for years knowing this is not sustainable.

• Under-pricing to artificially drive new business with full knowledge they the Insurers are going to increase the base rate regularly and within a short space of time of the product or series since brought to market.

• Insurers discount new policy premiums for new clients to get business on the books. These improved rates are not passed on to the existing clients. How can Insurers in the same breath argue the need to increase rates and bring to market a new series (or product) of income protection at a lower rate than the prior product that had a rate increase or was simply more expensive?

• Insurers provide lower rates for new clients on policies within a series. This behaviour results in consumers insured under the exact same product, however paying different premium rates depending on when they took out their policy.

• Cross-subsidising or providing package discounts and in some cases provide 3rd party services that if taken up will result in premium discounts for period of time. Insurance should be priced correctly from the outset. Each product needs to be correctly priced on its own merits

Reasons Insurers give for increasing rates.

• Bad claims experience. Insurers are in the insurance business. Surely, they expect there to be claims? The Insurers use their claims experience in order to price their books…if the existing book really was above expectation surely this should be factored into the pricing of the new book. In fact we see the opposite and new products are artificially priced lower with the Insurer knowing full well that this pricing is not sustainable as history has proven.

• Reinsurer treaty arrangements. These arrangements are not well designed and don’t price for the long term. Reinsurer ‘musical chairs’ with Insurers is an issue.

• Past poor underwriting of cover. Insurers advise they now have “tighter” underwriting processes. Not sure what this means as we have seen no significant change in underwriting. The application questions haven’t really changed much in 20 years.

• Past poor engagement with disability claimants. Once again not sure what this means as every legitimate claim needs to be paid and in good faith.

• Low interest rate environments. This the current most recent excuse for income protection rate increases. Curiously we are seeing lower cost IP policies coming to market at a time of a low interest rate environment whilst prior policies are on higher rates.

Actuaries are the brightest and best (both Insurer and Reinsurer). How is it that they get is so wrong all the time? This is not work experience. We are dealing with peoples’ lives and in some cases protecting their biggest asset which is their ability to generate income.

Potential solutions

• The appointed actuary Chief Actuary’s role should change for both insurers and reinsurers. The Chief Actuary needs to stand separate from the management of the company and definitely not be party to campaigns to drive new business at any cost.

• The Chief Actuary should have a “Trustee” like responsibility to ensure the product is priced sustainable for consumers. This would provide the counter balance required.

• The Chief Actuary has to report to the Regulator each time they increase base rates and include an acceptable explanation. Insurers to be penalised for poor pricing models.

• The Chief Actuary to report to the Regulator each time they price reduce within a product for new clients and not immediately pass back to existing product clients. The Regulator to monitor and step in when there is gross under-pricing or incentive discounting.

• Do not force clients to have to change products (or within a series) to obtain better rates that are on offer. Insurers should be obliged to pass back pricing improvements to existing clients. Not uncommon to find rates lower for cover within a current product (simply called a different series number).

• Do not allows Insurers to have multiple series in a single product. This allows for price and definition changes and at the same time creates the impression the product has not changed, as there is no name change. What is occurring is the product name e.g. ABC Income Protection does not change however the Insurers are releasing a new series within ABC Income Protection, this allows them to create the impression it is single product when in fact it is a conga line of legacy products. This has to be stopped for so many reasons, one of which is pricing new products cheaper at the expense of existing current clients and legacy product clients.

• Do not allow for continual legacy product or series behaviour. If the consumer believes their insurance policy is going to be current throughout their working life, then the Insurers need to be obliged to design products that are correctly priced at the outset

• Do not allow discounts on new policies if these discounts are not passed back to existing policy holders.

• Do not allow cross-subsidising within a product series or across legacy products as this is not sustainable.

• Do not allow for products to be closed without a clearly defined (and acceptable to the Regulator) strategy to manage the closed book of business. We have found with closed products (don’t take new clients) healthy lives leave whereas unhealthy lives are forced to remain on the product. Notably the recent announcement that with the sale of AMP insurance to Resolution Life, if the book is closed for new business millions of Australian consumers are going to find themselves locked into expensive insurance policies as healthy lives leave AMP as clients. A disaster in the making as this will become the largest legacy book in Australian history.

Comments are closed.