APRA has released life insurance statistics for the year to March 2019 which reveal a significant profit slump across the sector.

The Authority’s Quarterly Life Insurance Performance Statistics publication makes for sobering reading for life companies, where it reports risk products recorded a combined profit of $124 million for the March 2019 quarter.

Results by product:

- Individual Lump Sum Insurance: $334 million profit

- Individual Disability Income Insurance: $219 million loss

- Group Lump Sum Insurance: $59 million profit

- Group Disability Income Insurance $50 million loss

On a positive note, APRA’s commentary stated that profits for Individual Lump Sum insurance improved by $237 million over the quarter, caused by:

- Reductions in operating expenses

- The effective movement in net policy liabilities.

On the other hand, however, Individual DII continued to report losses. According to APRA, these losses were driven by:

- A significant reduction in discount rates

- Recognition of persistent adverse claims experience

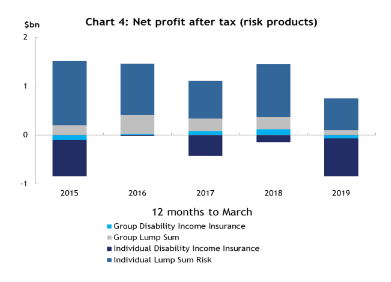

For the 12 months to March 2019, APRA noted risk products reported an after-tax loss of $94 million, significantly down from a profit of $1.3 billion last year.

All risk products deteriorated, according to the regulator, particularly Individual Lump Sum and Individual DII. “This deterioration is mainly driven by loss recognition caused by persistent adverse claims experience,” noted APRA.

I wonder how much this is connected with the abolishing of up-front commissions. If there is no supply of new clients who tend to be younger and have just been scrutinised by underwriting and are therefore lower risk, then profitability would be expected to deteriorate. These statistics also explain the recent sharp rises in Income Protection (DII) premiums though they don’t explain the recent large increases by Australian Super for their life and TPD insurance.

I have done some calculations and 80/20 is perfectly reasonable but 60/20 makes writing insurance much less worthwhile – level insurance is then better in many cases unless the insurer reduced that as well – so the pain may worsen. Personally I applaud abolishing up-front (110% or more in year 1) as it created a lot of harmful incentives but the reduction to 60/20 seems to pure greed to me.

Good points Christoph. May I put your first question in my own words – the decline in profits IS connected with the abolishing of upfront commissions. As a result, insurance companies are now recognising the slump in new business and are starting a campaign for the retaining of commissions, but as you say, the 60/20 split is much less worthwhile.

As a long term adviser 40 years I really am in a position like many others that want to stay on and help but are going to be forced into retirement prematurely as I cannot support 5 staff members rent and all the other costs involved in running my business

I can only assume I am not alone in this and it is bordering on criminal the legislation they think we are just going to accept

I cannot run my business on 60/20 worse still with a 2 year responsibility period regardless of why the policies lapse

Not only do I lose 60% if the policy lapses in year 2 but the insurer also keeps the premiums received in that time

How is that commercially viable to me let alone fair

6 months is all we have now to change this or its all over not just for the advisers but several smaller life companies who will be bought by AIA or Zurich at a base bargain cost

What a mess these beurocrats have made Make up some ridiculous changes based on floored information then move onto some other portfolio and leave it to some other poor sap to pick it up and mage sense of it

Tick tock time is running out

Ken, what you say makes a lot of sense. I really would look at level commissions in more detail as a possibility. As far as I know they don’t have the mandatory 2 year clawback period and – from what I have heard – even year 1 lapses may only require a proportional refund. As the details of level commissions are not legislated it depends on the insurer how much they pay and what lapsing conditions they attach.

Also, even with typical lapse rates and applying discount cashflow models (valuing future revenue lower than current revenue), level commissions over five years equal 80/20 (and even 110/10) and then pull ahead.

Yes, there is initial cashflow pain and it hurts if a big sale cancels after two or three years but it is often surprising who cancels and who remains. I have used them regularly and have had good experiences.

Has anybody done a comparison of level commissions between insurers? I would love to have access to that.

There is an undeniable truth that cannot be belied when it comes to the Life Insurance Industry.

People are born, they live and die and no matter what happens between that space of time, virtually every one of us needs Life and Disability Insurance.

The Life Insurance Industry, creates and produces Promissory notes and for that bit of paper, they are given multi Billions of dollars by policy holders.

What is required for the Life Industry to thrive, is a growing flow of New Business to compensate for increasing claims, life events that can cause policies to lapse, like divorce, retrenchment, etc, which is a normal part of the Business cycle.

The simple reason for the decline in profits and this is going to become a MUCH bigger problem unless it is easily remediated ( which has been discussed many times )

is New Business revenues are dropping, existing revenues are under threat and claims are doing what they will always do, which is rise.

How does the Life Insurance Industry solve these issues?

Our Business has spent years and a considerable amount of time and money, coming up with a solution, which if it comes to fruition, will help advisers going forward.

WE love the Life Insurance Industry and it has been a major part of my life for 32 years, my son and daughter also work in the Business and we have sacrificed a lot to build what we have now.

All we need is for the Life Companies to start listening and start supporting the important issues facing us all.

No Sh*t Einstein! Hammer the Advisers into submission with non nonsensical legislation and education requirements. Keep dropping the commission levels and we must remain positive and keep writing business!!!!

Warren, thanks for reading my mind! Jeremy, again well said as always.

My 43 years sees me selling up this year, more to do with FASEA. I started taking hybrid commission in 1993. So my recurring income is very healthy. What I totally lack is any interest in doing exams on an 86 year old pensioner’s financial situation. And as to the ASIC bureaucracy forced upon my AFSL and it’s associated long-winded compliance requirements – just makes any new business a burden rather than a feeling of achievement and benefit for my clients.

Comments are closed.