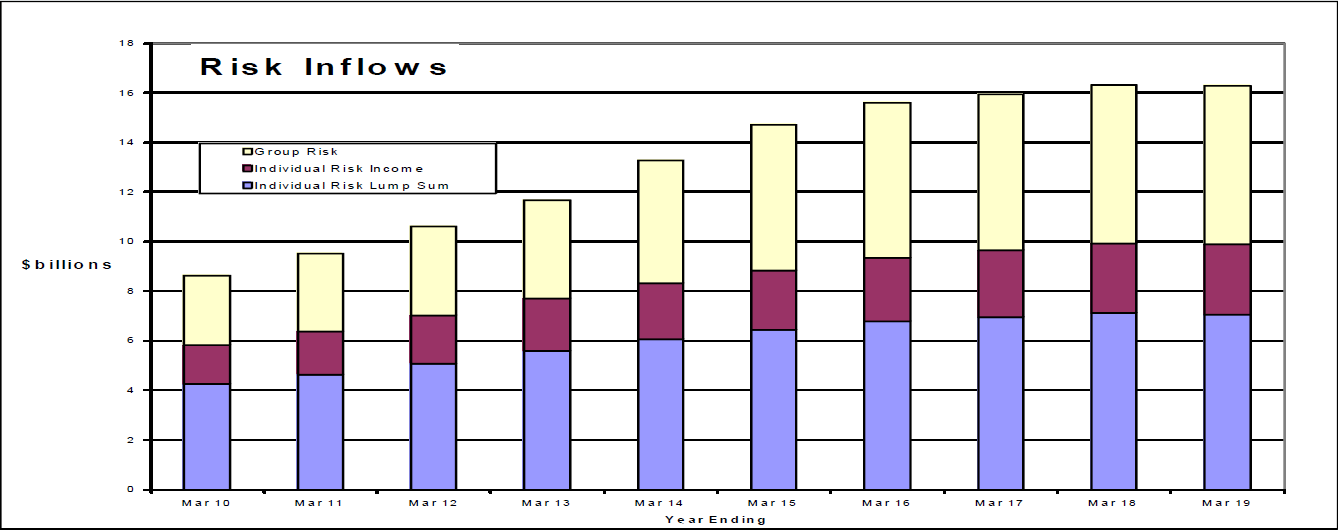

Zurich continues to dominate individual new business sales growth in Australia, at a time when overall sales have declined and risk insurance inflows remain flat.

These are among the key take-outs from Strategic Insight’s risk premium inflows and sales data for the year ended March 2019.

The researcher reports risk premium inflows are effectively static for the year to March 2019 – down only 0.1% on the previous year-end numbers. But it also reports new business sales declined by 24.5% year on year. This decline, however, mostly represents volatility within the group risk insurance sector.

While group risk sales are the main contributor, new business sales within the individual life insurance market are also down, but to a lesser extent:

- Group risk sales fell by 52.3% in the year to March 2019

- Individual risk lump sum sales declined by 7.6%

- Individual income protection insurance sales declined by 9.3%

Notwithstanding these falls, Zurich continued its stand-out sales growth across all product types (see: Zurich Risk Sales Soar), recording a jump of 21.3% in individual risk lump sum sales (Term Life, TPD and Trauma), whereas the next best result was ClearView, which experienced an increase of 1.1%.

Within the income protection product space, Strategic Insight reports Zurich sales were up by a huge 31.4%, followed by OnePath at 18.9% and CommInsure with 2.0% growth.

We note these exceptional sales growth numbers for Zurich do not include any spikes from the acquisition of Macquarie Life’s insurance book, nor are they related to the recent completion of ANZ’s sale of OnePath to Zurich.

Zurich is getting better.

Would it be possible to have the new business numbers for the last five years?

That will allow us to see the impact of the changes in commission.

The current up-front is actually as good as the old hybrid (80/20), though once up-front is 60%, things will be worse.

Interesting to see that Zurich along with AIA, MLC, OnePath and TAL are all offering discounts for new business of 10-15%, whilst at the same time increasing premiums for existing customers (including those on level premiums) by at least that much because apparently claims are up and so the insurance pool needs to remain sustainable. At the same time of course, Advisers income is dropping thanks to LIF.

I had one BDM tell me that Foxtel and Optus do this kind of new business discounting in order to justify the transfer of cost from new to old clients, because her employer wants to be Number 1 (for new business) in the market.

Interesting business model. And clearly in the clients best interests. And definitely not going to encourage ‘churn’….

Comments are closed.