Growth of the retail wealth management market segment has been projected to slow, according to a recent DEXX&R Market Projections Report.

It stated this was to allow for the impact of:

- Change in ownership in several currently bank owned wealth managers

- Acquisition of life insurers with some now closed to new business

- Dismantling of several vertically integrated large wealth managers

- Outcomes of the Hayne Royal Commission including the banning of grandfathered commissions, the impact of fee for no service and remediation

- Impact of these changes and the phasing in of minimum educational standards for advisers on the advice distribution channel, the primary source of new business for retail wealth managers and life insurers

The report noted that the personal advice distribution channel, including aligned and unaligned financial planners and bank based advisers has traditionally generated the majority of new Individual Risk Product premium.

“The disruption caused by the breakup of vertically integrated product manufacturing and divestment of Life insurance and dealer group subsidiaries is expected to have negative effect on projected Risk segment growth rates,” it stated.

“The impact of these changes can be seen in the current slowdown in new sales in the individual risk market. Group risk premiums are also showing little growth as the switch to opt-in for under 25’s is adopted by some large industry funds.”

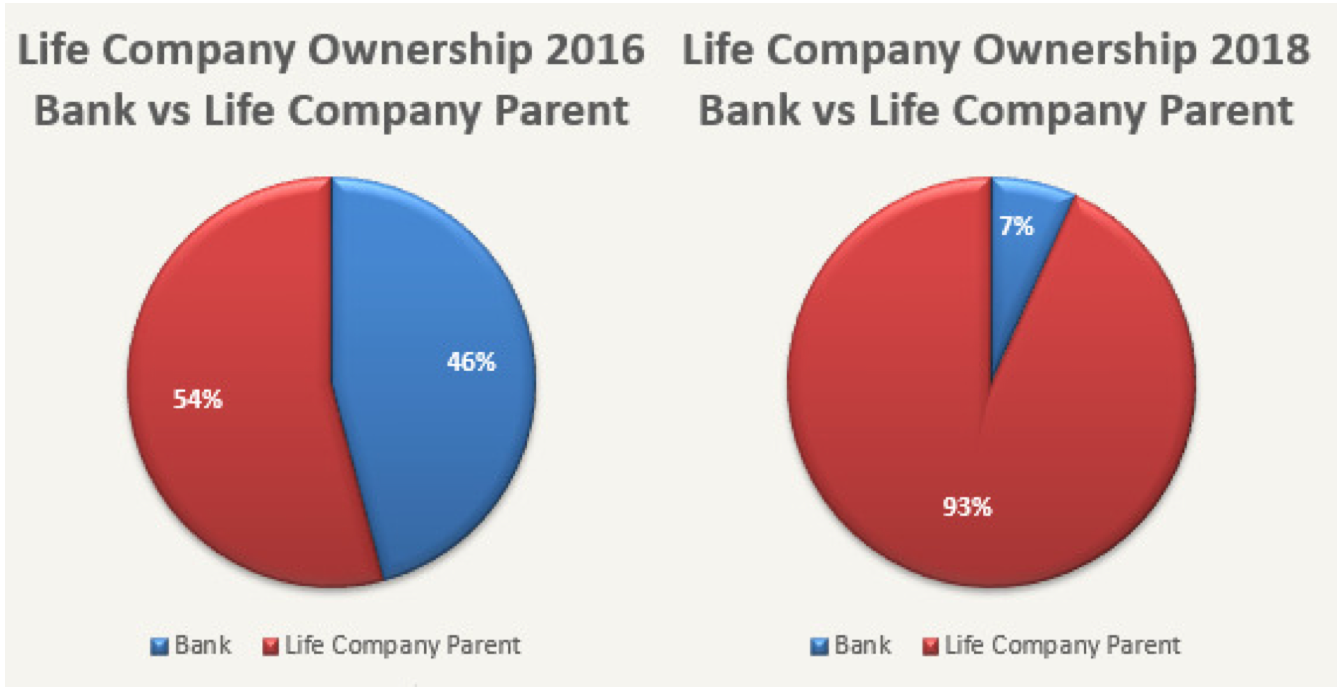

The report highlighted the shift in life company ownership away from banks since 2016, in the graphic below.

It noted the major Australian banks are in the process of selling their life insurance companies, except for Westpac and have held a significant share of the Australian life insurance market for the past 20 years.

They accounted for 46 percent of in-force business at December 2016 but this figure will drop to seven percent once all announced sales are completed and overseas owned life insurer parent companies will account for over 90 percent of the Australian market.

They accounted for 46 percent of in-force business at December 2016 but this figure will drop to seven percent once all announced sales are completed and overseas owned life insurer parent companies will account for over 90 percent of the Australian market.

Total Risk In-Force premiums are projected to increase by an average annual rate of 5.1 percent to $42.2 billion at December 2028.

It appears optimistic to be promoting an increase of In-Force premiums, when the path being laid, is designed to slow down and crush growth opportunities.

Life Insurance Companies need to reconfigure their priorities about how and where they spend the premiums entrusted to them.

Long Term Profit is the most important consideration, yet the Life Insurance Industry is following a set path that is going to fail.

There is plenty of innovation and expertise out there that can improve outcomes for the Life Companies and policy holders.

Unfortunately, these people and entities have been overlooked in favour of an incumbent policy of continue doing what we continue doing, no matter what the cost or consequence.

I find it hard to believe there will be any growth at all when the comparison of claims vs renewals and new business inflow is taken into account in the years to come.

Claims up ! income down and the worst is still yet to come with dealerships closing advisers leaving the business in unprecedented numbers and the outgoing of experience come 1st January 2024 for the rest biding their time.

Comments are closed.