APRA has announced an updated organisational structure, in which a new supervisory division will focus on insurance.

The corporate regulator notes the changes to the way it is structured are designed to better align its organisational structure with the strategic objectives set out in its recently released Corporate Plan for 2019-23.

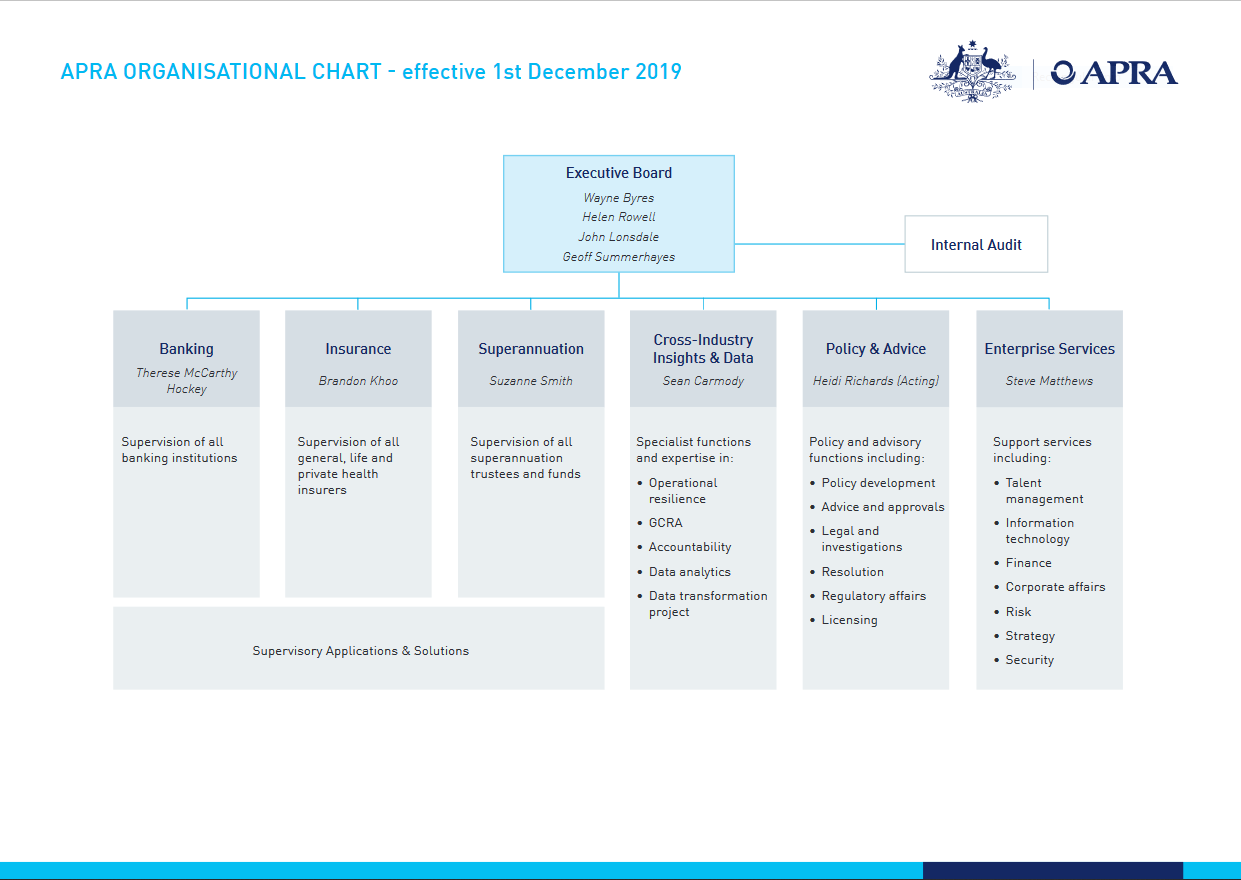

APRA will be moving to an industry-based supervision model, with separate supervisory divisions responsible for:

- Insurance

- Superannuation

- Banking

Under this new structure, each of APRA’s six operating divisions will be led by an Executive Director, with the following appointments announced:

- Brandon Khoo: Executive Director, Insurance

- Suzanne Smith: Executive Director, Superannuation

- Therese McCarthy Hockey: Executive Director, Banking

- Sean Carmody: Executive Director, Cross-Industry Insights & Data

- Steve Matthews: Chief Operating Officer and Executive Director, Enterprise Services.

- Heidi Richards: Acting Executive Director, Policy & Advice (pending a permanent appointment to that role)

Set to commence from 1 December 2019, APRA Chair, Wayne Byres, said the changes will assist the regulator “…to maintain its focus on protecting the financial well-being of the Australian community, while sharpening focus and lifting capabilities in supervising newer and emerging risks.”

Fantastic!!!. Congratulations !!!

Now Mr Khoo, your mission, for which you have no choice but to accept, is to recognize that LIF and FASEA have caused a 40% loss in genuine NEW BUSINESS, threatening the sustainability of every Statutory Number 1 Fund in life insurance.

You have to tell the idiot savants and assorted ideologically-bound idiots that populate the Morrison front bench, and your fellow regulator, that life insurance will be dead in 5 years, and explain that the much vaunted surplus will disappear in a cloud of compliance dust unless action is taken now.

We can start with special licencing for risk advisers!

Comments are closed.