Integrity Life has weighed into the impending Protecting Your Superannuation Package (PYSP) reform commentary, issuing its top tips to help super fund members prepare for the reforms.

In urging Australians to check their life insurance cover ahead of the July 1 PYSP changes (see: Advisers Cautioned on Potential Life Insurance Changes Inside Super), Integrity Life’s GM Distribution, Suzie Brown, warns that some super fund members are at risk of losing important insurance that could provide them with income protection, TPD or life cover if they don’t act quickly.

Brown notes there are Australians who may not be aware of how the upcoming changes to life insurance within super will affect them and their ability to financially protect themselves or their loved ones when they need it most:

“The new rules apply to inactive super accounts, that is, those accounts that have not received a contribution in the past 16 months,” says Brown in her message to fund members, sending a clear message that people who haven’t made a personal contribution or received mandatory employer contributions to their super accounts for 16 months or more need to be aware that they will lose their cover if they don’t take action by 30 June 2019.

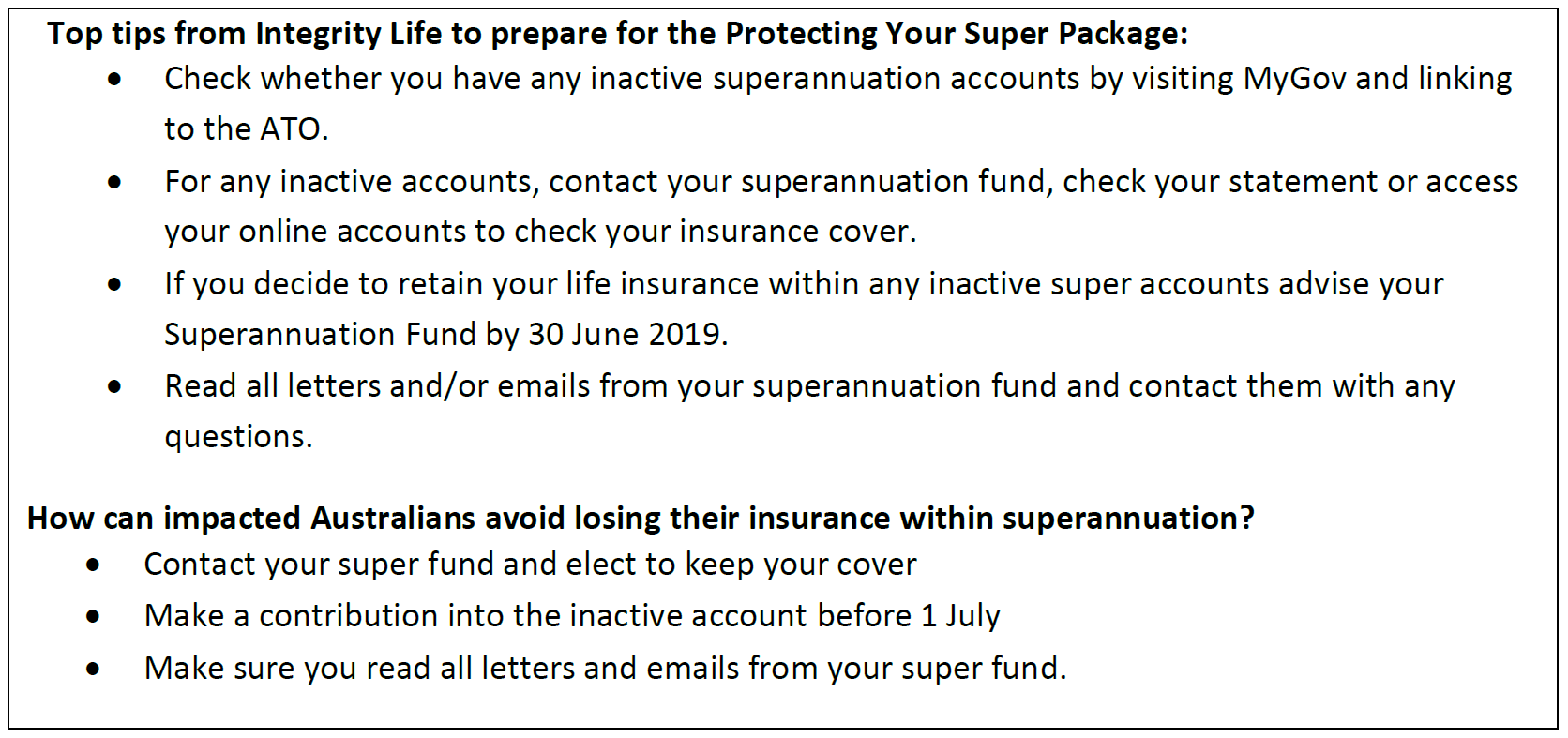

The insurer issued these top tips for super fund members in the lead-up to 1 July 2019:

“Despite the fact that super funds have communicated with people about the changes, the tight time frame means that there isn’t much time for people to opt-in to insurance, said Brown.

The Integrity Life release summarises for consumers the 1 July 2019 PYSP changes relating to life insurance:

- Insurance cover cancelled for inactive accounts, i.e. accounts that have not received a contribution for a continuous period of 16 months and the member has not elected to retain their cover.

- Inactive super accounts with balances below $6,000 will be consolidated

- Fees for low balance accounts ($6,000 or less) will be capped at 3% p.a

- Exit fees will be banned across the board

“The purpose of life insurance is to provide protection for those times when the unthinkable happens. If you are unsure how much insurance you might need should you experience a major health incident, or worse, it can be a good idea to seek professional advice, either through your super fund or from a professional risk adviser,” concluded Brown.