Two key trends are driving the financial adviser industry, according to Adviser Ratings – overall adviser numbers continue to decline and increasing numbers of advisers are being licensed by a privately-owned licensee.

The researcher’s year-end analysis of adviser numbers and adviser movement outlined in its report Musical Chairs 2019 Q4 states that overall adviser numbers declined again in the last quarter of 2019, registering a drop of 4.6 percent or 1,133 advisers.

“There are now 23,639 advisers which is the lowest overall number of advisers the industry has seen since December 2015.

“2019 saw the industry shed a huge 4,378 advisers (15.6 percent) throughout the year,” the research group says in its comprehensive report (see also: 3,000+ Adviser Exits From Major Institutions).

It notes that privately licensed advisers as a percentage of all advisers rose from 57.8 percent to 60 percent in Q4 2019. The report states that all the segments of the private licensee market have grown in percentage terms once again, except the 11-30 adviser group, which has slightly decreased from 9.6 to 9.4 percent of the entire market.

Other key points the report highlights are:

- Three out of five advisers are now privately licensed

- ‘Micro-licensees’ (10 advisers or less) have grown to more than 21 percent of the market

- 30 percent of the entire industry has been on the move (ceased or switched) in some form or another in 2019

Growth of Private Licensees

As to the continued growth of private licensees, the report says in looking more closely at the segmented groups of advisers [in Q4] the majority of advisers were shed from the institutionally aligned adviser segment, which lost 665 advisers (9.4 percent), decreasing from 28.4 to 27 percent of the total market.

“The loss was mirrored in the institutionally owned space, which had a net loss of 320 advisers (9.4 percent), shrinking from 3,409 to 3,089 advisers.

“Institutionally owned advisers now make up only 13 percent of the entire adviser market,” it says.

Adviser Ratings also noted a growth in the ‘micro-licensee’ segment.

“Advisers licensed by small privately owned licensees of 10 advisers or less, grew both in terms of total numbers (from 5,040 to 5,103) and proportion of the market (20.4 percent to 21.6 percent).

“The other private licensee segments remain relatively static in terms of changes to adviser numbers, but the decrease in total industry adviser numbers meant that, effectively, most of their market share segments increased.

Annual Changes

Adviser Ratings says that with the industry shedding 4,378 advisers from its peak at the beginning of January 2019, the total number of advisers in each of the three broad segments has fallen in the past year.

The report notes that the annual change of adviser numbers from Dec 2018 to Dec 2019 indicates:

- The institutional space has fallen from 4,318 to 3,089 (28.5 percent)

- In the same period, the aligned space has shed 1,958 advisers, going from 8,333 to 6,375 (23.5 percent)

- Number of advisers in private licensees have also fallen by 1,191, from 15,366 to 14,175 (7.8 percent)

…this inexorable across-the-board decline is being driven by a perfect storm of factors …

Adviser Ratings says that this “…inexorable across-the-board decline is being driven by a perfect storm of factors”, which include:

- The major banks exiting the wealth advice sector

- Removal or reduction of commissions

- Higher educational standards

- The challenges for many to restructure their advice businesses to remain profitable in this new ‘professional’ environment

It says that the number of privately licensed advisers is now at its highest level in the last six years.

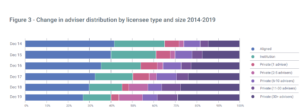

“Six years ago, in 2014, the largest segment of advisers was in the aligned space, which made up 42 percent of all advisers. Since then:

- Aligned advisers have shrunk to 27 percent of the advice market

- Institutional advisers made up 23 percent of all advisers in 2014, compared to 13 percent now

- This time period has seen the dramatic rise in the proportion of privately licensed advisers, going from 35 percent of the market to 60 percent today

The report says it’s also worth noting the changing make-up of the privately owned licensee market. “It is no longer appropriate to think of this sector as one homogenous group but rather a family of siblings each going through its own existential crisis.”

A breakdown of adviser numbers relative to the size of the licensee shows that the number of self-licensed single adviser practices has dramatically decreased – going from more than 1,500 to 856 in five years.

The report notes, however, that the number of advisers covered by a two-to-five-person licensee has exploded from 481 to 2,578 in the same period.

It says that last five years has seen growth in the 11-30 person licensee segment from representing 831 advisers to 2,225 advisers, while the 30+ segment has more than doubled from 3,258 advisers to 6,847.

30 Percent of Advisers On The Move

The report states that 2019 was a massive year for adviser movements. “Although the entire year saw only 38 new advisers added to the industry, there were more than 5,000 adviser cessations registered during the course of the year and more than 3,300 advisers switched licensees throughout the year.

“These numbers indicate that around 30 percent of the entire industry has been on the move – in some form or another in 2019.

Click here to see the full report.

The statement that privately owned Licensees are all facing an existential crisis, is very apt, though the Government, ASIC, APRA and the army of other Public servants who draw large salaries, while continually squeezing the life out of thousands of Businesses, with their utopian views and restrictive regulations and demands, could not give a damn.

2020 will be much the same, with declining advisers and millions of Australians being thrown on the scrap heap, for NIL benefit to Australia now, or in the future.

Let me try again as apparently my last comment was edited and removed ??

THIS EXODUS WILL GET WORSE as many older advisers cannot see themselves doing three or four years of uni study to stay in the “game” The FAESA exam is compulsory so if they can get through that they have until 2026 to organize and exit plan or sell up.

Unless i am mistaken i have not seen any mass entries into the system by young or older people. If you are looking for educated academics i doubt they want to do another 4 years at Uni. after completing some bachelor of economics degree {3 years} which does not give them any automatic entry into financial Services, maybe one credit not sure on that? And 12 months “apprenticeship under a licensee.

I find it hard to believe that the Insurance Companies who are “bleeding” profusely in all this cannot see its debilitating effects and call for a rollback of some description to turn this all around. It is not helping anyone let alone the clients and generally interested public it is purported to be for.

Without some change the risk industry and particularly Income Protection has a very short life span.

If nothing else indicates the Government is not interested in maintaining the financial advice profession as a going concern, the difficulty of entering advice is evidence. A degree and a professional year, fully funded by participants and employers with no government training incentives such as happens in other industries is why there were a pathetic number of new entrants.

Comments are closed.