- Yes (78%)

- No (19%)

- Not sure (3%)

Three in four advisers support a separate classification for risk advice when it comes to their minimum education requirements.

As we indicated last week – there’s not a right or a wrong answer to this question. In the end, it comes down to which future you prefer, or at least envisage:

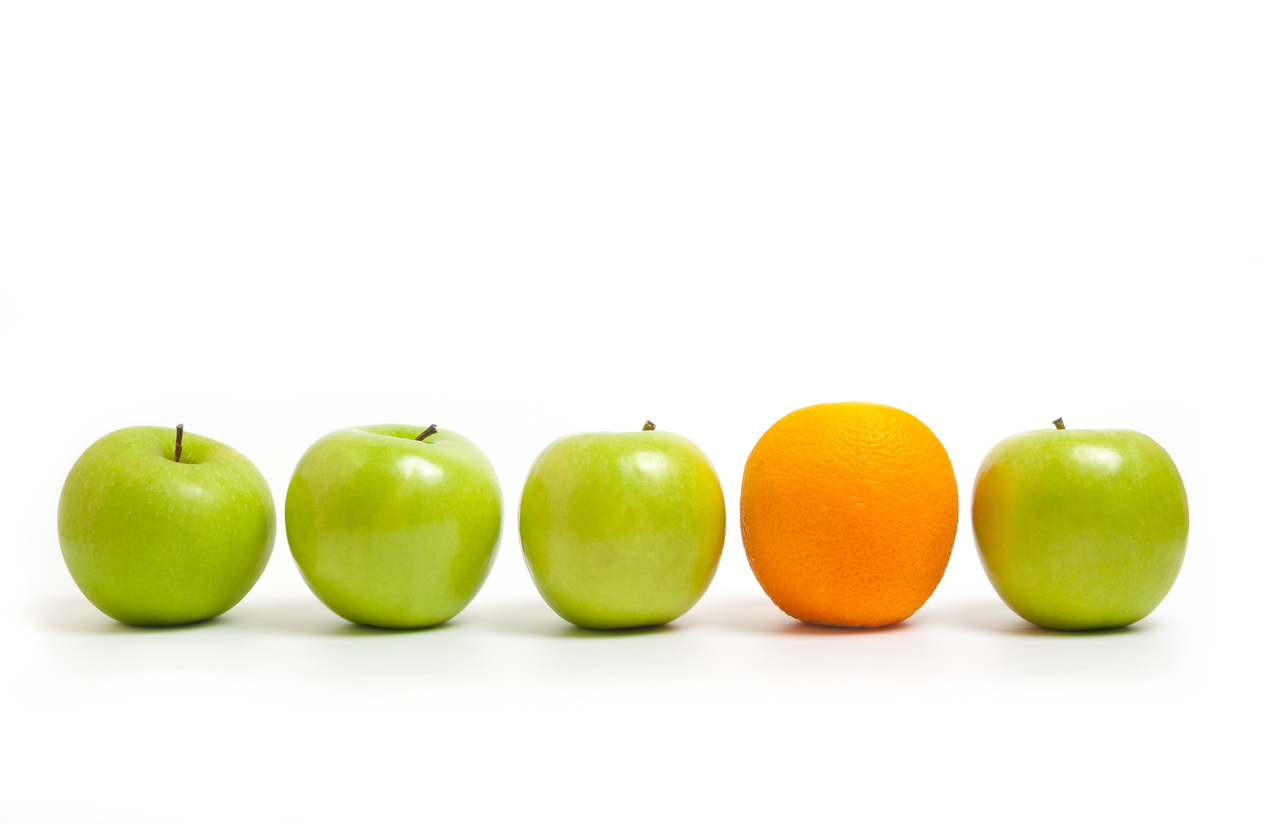

Future Scenario 1 – Apples AND Oranges:

Every authorised representative is required to achieve the same or equivalent qualifications, regardless of the nature of their advice proposition. This is an easier package to take to the public in the quest to restore and build trust in the value and quality of personal advice. This future would see the decline of the stand-alone risk advice business and is the most likely outcome.

This scenario declares there’s little-to-no difference between apples and oranges.

Future Scenario 2 – Apples OR Oranges:

Minimum education standards are revised for risk-focussed advisers, so they are not required to attain a degree or equivalent-level qualification in order to advise on life insurance. Specialist risk advisers would qualify for a licence that would limit the scope of their advice to general and risk-only. Naturally, Scenario 1 will always be open to the risk specialist who would prefer to advise across the broader spectrum, but at least Scenario 2 offers a choice.

This may be a harder ‘sell’ to the public, but would allow thousands more small advice businesses to remain viable and allow those advisers to continue in their capacity as risk specialists. In all probability, it would allow more Australians, especially more ‘mums and dads’ clients, to access the advice and support so many of them desperately need.

Other Scenarios:

There are other scenarios as well, because – as is often the case – nothing is quite that simple. For example, there’s a body of opinion which holds that because life insurance advice is so frequently linked with superannuation structures, qualification for this separate, restricted licence, would require the adviser to also achieve minimum competency across superannuation as well as risk.

We think this would work, too. But where and how does FASEA draw that line? It’s not easy.

Other Industries:

One of the consistent messages being sent to FASEA relates to what many advisers perceive as appropriate analogies from other sectors. For example, one adviser made the comparison with medical specialists, noting that an ophthalmologist doesn’t need to know how to perform a knee replacement to help their patient with their eyesight. Another commented that in the building trade, plumbers don’t need to qualify as carpenters, plasterers or bricklayers in order to be able to work onsite to build a house.

…plumbers don’t need to qualify as carpenters …to be able to work onsite to build a house

FASEA’s requirement, that every financial adviser must in future hold a relevant degree qualification or its equivalent, is a blunt instrument. It’s an ideal requirement in an ideal world. But we don’t live in an ideal world.

As challenging as it may be from a political perspective, the solution that will, in all probability, see better quality advice delivered by more advisers to more Australians is a solution that makes exceptions – a solution that acknowledges the difference between apples and oranges. Risk advice is one of those exceptions.

While this debate may be somewhat academic, given the existing FASEA education requirements have already been legislated, our poll remains open for another week and we encourage you to have your say…

The carve out for risk specialist should be they must do the exam on ethics and have the diploma of financial planning that would be more than sufficient and could be done in their own time. Most fisk advisers would have 1 to 4 as minimum so just get them to do the balance and allow them to to provide insurance advice only. If what to do investments then need to do the degree as per FASEA.

Pretty simple and fair to all.

Simple Solution – I am a risk specialist and I completed the TAL FASEA Masterclass – full marks to TAL for this program and their desire to help advisers. I don’t know if you are aware, but TAL had us complete trial questions throughout their class and some questions did relate to planning (retirement planning, investments). Although the entire exam is about ethics, I did struggle with those questions on planning simply because I did not understand the concept of each. Whereas I did not have a problem with those questions focused on Risk because I understood the concept behind the question. TAL stated that the FASEA exam will be more difficult than what TAL presented in their training. This is why there should be a carve out for risk specialists.

I am a Risk specialist & I did the TAL masterclass as well as the BT practice exam. I sat the 19th of sept the real exam and trust me it is so much harder than TAL & BT it is not funny. all I can say is good luck and unless you are an academic Id say you will be spending a lot of money resitting the exam. I reckon there was 1 question relating to risk

well that just filled me with confidence…..

Did you pass ??

Firstly, I am a risk adviser.

I just don’t see how this is workable. Risk isn’t a completely stand alone ,you need a good understanding of other aspects of financial planning to be able to deliver sound risk advice. It’s a discipline of, not a stand alone function to fin planning.

It would be the equivalent of a tax lawyer only studying tax law and ignoring all other aspects of law, it wouldn’t work.

All the intellectual debate means nil if there is a mass exodus of experienced risk advisers.

It does not matter what people think is important, if the consequence of those thoughts, brings to reality, the disaster the Retail Life Insurance Industry faces, if FASEA continues on it’s current trajectory.

There will be either a carve out, or a collapse and eventual withdrawal of the Retail Life Industry in favour of inferior quality, expensive rubbish that does not have any BID interests for Australians.

For all those “experts” who continue to push ridiculous ideologies, like the fee for service scam that was never going to work, though was pushed aggressively by Life Companies, vested interest entities and left wing theorists, may I suggest you try a strategy of first understanding the topic, gain some practical experience and start listening to what is being explained to you by people that actually do understand the full implications of future actions.

Great article firstly! I’m really pleased to finally see some ground swell to this common sense approach for risk advisers now surfacing and love the alternative industry comparisons to demonstrate the point because they make sense.

I don’t see too many positives coming out of a ‘one size fits all’ education standard solution for Aussies or the industry; the only people that stand to really benefit from that are the education bodies trying to make a quick buck out of a situation that should never have occurred in the first place.

The signs are everywhere that what’s happening to this industry are dire…it’s about time the pollies started taking notice before it’s too late. Carving out a specialist risk / super education standard is an extremely positive move towards that…

Without wanting to be too picky the question was should the government consider developing a special classification rather than necessarily developing a special classification for risk advice. This may or may not have swayed the response one way or another.

I don’t understand your point. The question specifically includes the wording “…consider developing a special classification for risk advice?” Risk advice means just that – risk advice.

Comments are closed.