Elixir Consulting’s Graham Burnard sets out his rationale in this article which supports his argument that fees for life insurance advice can be a viable option for advice businesses, particularly when used to supplement life insurance commissions.

Graham’s perspective is informed by the data collected by Elixir Consulting in the five editions of its Adviser Pricing Models Research Report, the most recent of which has just been released.

While many will disagree with Graham’s argument, we thank him for the opportunity to present his case and we will welcome your comments in response…

It’s safe to say that the business of providing insurance advice has gone through more change in the past few years than it has in the past fifty. Compliance requirements have increased significantly and, when coupled with increased underwriting requirements, we have seen the typical cost to serve rise dramatically.

The perfect storm for advisers is made worse when this increased cost to serve is coupled with significantly reduced revenue because of the legislated reduction in commissions to a maximum of 60% plus GST. As a result, in only a few years, most advisers have seen their year one revenue from a given client nearly halve while incurring much higher costs.

In the 5th Edition of the Elixir Consulting Adviser Pricing Models Research Report, published this week, we looked closely at the impacts of these changes and how advisers have responded. This research uncovered the pricing models of 714 financial advisers, 59 risk specialists and 46 mortgage brokers across 273 advice businesses located around Australia. We looked closely at how advisers charge for their insurance advice, both when it’s included in a comprehensive financial plan, as well as when provided as a standalone piece of advice. For the purpose of this article, we will look only at some of the relevant findings for insurance-only advice.

While 60% of the advisers surveyed said they still provide insurance-only advice to new clients, a worrying trend is that many advisers commented that they only did so reluctantly because it was not profitable, and it was often done only as a favour for an existing client. The evidence is that off the back of increased costs and reduced revenue advisers are increasingly reluctant to provide insurance-only advice.

…many advisers have not been able to make the shift from price takers to price makers when it comes to insurance advice

The reason for this reluctance is that many advisers have not been able to make the shift from price takers to price makers when it comes to insurance advice. Insurance remuneration has been determined by the commission rate set by the Life Company (now the Government) and the amount of premium paid, rather than being a factor of the cost of the advice and service provided.

However, some advisers are taking control and becoming price setters. These advisers are determining the cost of providing their insurance advice and service and then ensuring they get paid appropriately via a combination of fees and commissions.

As part of our research we wanted to understand how many advisers are charging fees in some form to help ensure their insurance advice is profitable. Of the advisers surveyed by Elixir, 52% said they were commission only and never charged a fee for insurance-only advice. Many comments along the lines of “Clients will never pay a fee for insurance advice” were provided by these advisers. However, this means 48% of the participating advisers do charge fees of some sort. While only 8% charge fees alone, a further 10% of participants give clients a choice of a fee or a commission and a significant 30% of respondents said they charge fees in addition to commissions.

…a lot of advisers have a limiting belief that clients won’t pay fees for insurance advice

A limiting belief is something that holds you back because you perceive it to be true but, in reality, it may not be true. It would seem that a lot of advisers have a limiting belief that clients won’t pay fees for insurance advice when there is evidence that a significant number of advisers can and do charge fees in addition to commissions for the insurance advice they provide.

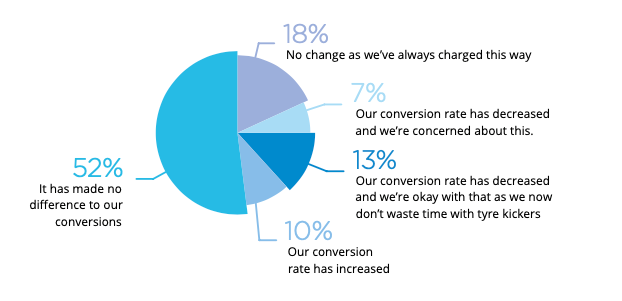

We wanted to understand whether clients not being prepared to pay a fee is a fact or whether it is a limiting belief holding many advisers back from introducing fees. To do this we asked advisers what impact the introduction of fees had on their conversion rates. As seen in the following chart, only 7% of the advisers who had introduced fees had a negative experience where conversion rates had decreased, and this was of concern.

Once advisers have realised they need to charge fees to ensure risk advice is profitable the question we’re often asked is, “How much should I charge?”. The problem is that this is like asking, “How much does it cost to build a house?”. To have any hope of answering that question you need to know things like the number of bedrooms and bathrooms, the level of finish, size, location and so on. Pricing advice is very similar. You need to understand the variables that drive cost as well as understanding the value created in order to determine an appropriate fee.

Our Adviser Pricing Models Research Report reveals the range of fees quoted and there are huge variances in the fees that are charged and how they are structured. Our observation is that there is no one right way or right amount to charge.

To determine your right fee and the right structure to use, you need to understand your own cost to serve, the types of clients you work with and the typical complexity of their needs along with your desired profit margin. Once you have a view of this you can determine your minimum recoverable amount, i.e. the amount you need to earn from a client for them to be profitable. With that in mind you can determine a mix of commission and fees that works for you and delivers the business outcomes you need while still reflecting appropriate value for the client.

Of course, there is the challenge that not everybody that needs insurance can afford to pay a fee for the necessary advice. Unless advisers choose to do some of this work on a discounted pro bono basis the choice advisers need to make is to identify and work with clients that do have a capacity to pay or develop a lower cost digital engagement process to service these clients cost effectively. Once advisers have a clear understanding of their cost to serve, they can make informed choices about who to work with and what revenue they need to earn in order to have profitable and sustainable relationships.

The key is to have confidence in the value of your advice

The key is to have confidence in the value of your advice. We see all too often that advisers underestimate the value they add to clients and as a result do not feel confident about quoting an appropriate fee. Whenever someone says something is too expensive what they are really saying is there is not enough value compared to the price charged. Our Pricing Research shows that many advisers can and do charge an appropriate fee for their insurance advice and therefore, when presented clearly, clients will certainly pay for quality insurance advice.

Graham Burnard is a business coach with Elixir Consulting and co-author of the Adviser Pricing Models Research Report, Fifth Edition. The research is available from the Elixir Consulting website. He can be contacted at: graham@elixirconsulting.com.au.

Graham Burnard is a business coach with Elixir Consulting and co-author of the Adviser Pricing Models Research Report, Fifth Edition. The research is available from the Elixir Consulting website. He can be contacted at: graham@elixirconsulting.com.au.

Back to Adviser Focus Main Page…

If Fee For Service is so unbelievably good for clients and so lucrative for advisers to build sustainable businesses why in 9 years of promoting FFS on Risk advice are less than 2% of the advisers involved in risk advice working that way based on Elixir Consulting’s own figures?

I’ll tell you why, its because the large minority of clients are not interested as it doesn’t make sense to them. Or to the Risk advisers for that matter.

No-one ever takes into account that premiums paid via commission policies are many times tax deductible for Income Protection or Death & TPD structured through superannuation. Where advice fees for FFS are not tax deductible. so the client saves 25% approx less under FFS but has a lower tax deduction to claim and an increased non tax deductible payment to make for the FFS. Sounds pretty average to me.

Plus, if you can”t trust the insurance companies to maintain current series policies or to not increase base rate premiums at varying percentages every two or 3 years, what makes you think that clients will be silly enough to expect that the Fee For Service policy premium will still be good value in 2 or 3 or 5 years. Do you still believe in Santa also?

You are absolutely deluded Dearest Friend.

Graham, your intentions may be admirable, though unfortunately you are missing the mark.

A limited amount of clients may pay for Insurance advice, the majority will not.

Of the small percentage who will pay, it is only for the advice, not the administrative work which makes up most of the time and cost of providing it.

Holistic Financial Planners have more ability to incorporate risk fees into their overall service offering, though many of them are no longer doing the Insurance work, as they realise the cost is too prohibitive, the risk too high and the Insurance work eats into their Investment planning revenue.

It is not up to advisers to force clients to pay for Life Insurance advice and administration.

The facts are, the Life Insurers cause huge cost imposts on advice Businesses due to their impractical and inefficient work practices, so why should clients pay for the Life Companies inefficiencies that we are always fixing.

Advisers are in Business to provide a service and make a profit. For risk advisers, that includes bringing millions of dollars to Life Companies in the form of premiums that they would not otherwise get.

There is a cost for advice practices to do this and it is only fair that the end recipient of all that money, being the Life Company, should pay for this.

It is incongruous, that any entity should think otherwise and Graham, your argument could be construed that clients paying for advice is another opportunity for Life Companies to argue this point again. A point which has been repeatedly shown to be wrong.

You make an interesting observation Jeremy… “Of the small percentage who will pay, it is only for the advice, not the administrative work which makes up most of the time and cost of providing it.”

This is why I think advisers need to charge a small fee for their advice, and retain the reduced 60/20 commission from the insurer. This is only fair as the client benefits from the advice, but the insurer benefits from the adviser doing the admin work which the insurer would otherwise have to do themselves if the client went direct.

Advisers, insurers, clients, and regulators all need to realise that in a world of Best Interest Duty and reduced commissions, those commissions are purely servicing commissions. They are not for sales or advice.

How empowering! “Have confidence in the value of your advice”!

Be a “Price Setter”, make the shift from being a “price taker to a price maker”. I’m so pumped.

How about being transparent and ethical? You know, more than an exam check box :-).

Hello Mr and Mrs Client, I can see that your available cashflow after expenses is diddly squat, don’t feel bad about it, that is the MOST COMMON family balance sheet. I can sort out your life cover needs, it should only cost $2,000 plus the insurance premiums of about $2,000 and we are pleased to be able to offer AfterPay or we can out you in touch with a NON-CHARGING mortgage broker to extend your mortgage.

You are not interested?

But…but…I don’t understand, I set the price and I have confidence in the value of my advice.

Yeah ok, I understand you don’t pay for advice from a car salesperson, or a mortgage broker, or a computer systems salesperson. Yeah, I understand they are specialist technical salespeople/advisers.

THINK ABOUT IT.

How many people pay for a $3,500 Wealth Advice service? Less than 15% of population?

How many people pay for a $5,000 cosmetic program for face wrinkles? Less than 5% of population?

People struggle to pay for a car repair bill (a car is a tangible thing in the driveway that gets the kids to soccer).

The UK abolished life insurance commissions outright in 2012, slashed them to zero overnight.

Then what happened?

Life insurance sales took a step dive; life insurance companies got a bit upset and really confused.

Life insurance commissions were reinstated to rescue the industry (errr and the policy holders).

Same thing will happen here.

In other related news “Responsible Lending” measures from ASIC have been put on hold at this time due to a large decrease in mortgage applications.

the best

A simple scenario Graham – mum and dad need insurance. The premium is say $3,000 pa. Under the 80/20 split, the adviser received $2,400 (less policy fee, stamp duty, and modul loading). Now you are saying that the mums and dads in this day and age are happy to pay an extra fee on top of the $3,000 premium, because if the way we “value our advice”. Will you please justify that without any philosophical mumbo jumbo?

Comments are closed.