The release of the Quality of Advice Review report earlier this week, which finally confirmed the recommendation to retain current commission caps and clawback requirements, is the ‘no-contest’ Riskinfo Story of the Week…

The final Quality of Advice Review report, released by the Government today, explicitly recommends that the current 60/20 risk commission caps be retained.

In an earlier issues paper on conflicted remuneration, which was released on October 31 last year, Review leader, Michelle Levy, had proposed retaining risk commissions, but did not explicitly recommend the level at which they should be retained (see: Retain Risk Commissions…).

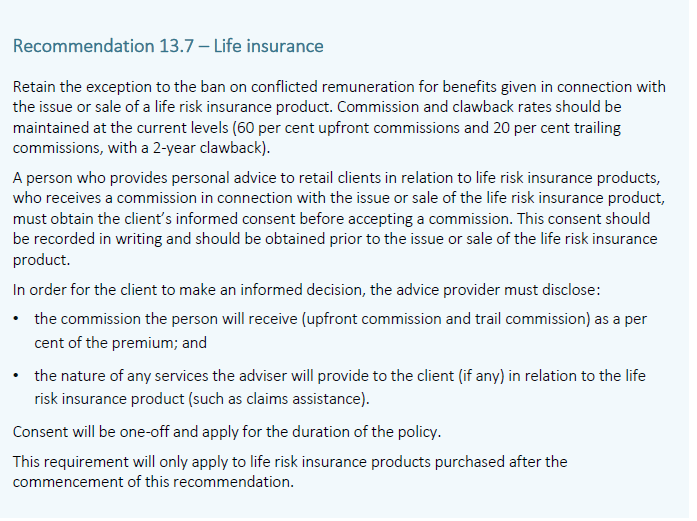

Levy’s recommendation in the full report confirms that the exception to the ban on conflicted remuneration for benefits given in connection with the issue or sale of a life risk insurance product should be retained at the 60/20 current level.

The final report states “…commission and clawback rates should be maintained at the current levels (60 percent upfront commissions and 20 percent trailing commissions, with a two-year clawback).”

The retention of current commission arrangements, if eventually accepted by the Minister, will be greeted with disappointment by some consumer groups, but will be welcomed by many within the financial services sector and the broader community.

There will also be a significant number of financial advisers and financial advice businesses which will view this outcome as a pyrrhic victory due to what they believe to be an unsustainable and unviable commercial restraint on their ability to earn an appropriate income in this current regulatory environment (see: Retaining Risk Commissions and Pyrrhic Victories).

Client consent

As stated in the earlier conflicted remuneration summary release, the commission recommendation reiterates that a person who provides personal advice to retail clients in relation to life risk insurance products, and who receives a commission in connection with the issue or sale of the life risk insurance product “…must obtain the client’s informed consent before accepting a commission.”

This element was clarified today, however, with confirmation that consent will be required only on a one-off basis and will apply for the duration of the policy.

Minister for Financial Services, Stephen Jones, says the government will now consult widely on the Review’s recommendations.

In thanking Levy for her work in leading the review Jones says she’s “…toiled hard and her report is already provoking valuable discussions within the government.”

“By releasing her report today, we want the public and industry to be part of those discussions too.”

The statement noted that anyone with an interest in financial advice “…should read it and make their views known.”

Click here to access and review the full report.

It has turned out that, in line with my comments over the past few days here, Levy has crafted this whole shebang as easy pickings for her benefactors – the industry super funds. I was highly skeptical when she offered initial comments the other day and this confirms my worst fears.

I’ve said before here that 100/20 commissions is the only way to make up for the onerous compliance and uncertainty and anything less is wholly unacceptable to thinking and caring risk specialists. This woman is no better than Dwyer – beholden to their masters. Sickening! She’s left life-risk commissions at the unsustainable rate of 60/20 AND WORSE has also left the 2 year chargeback period in place.

Risk specialists will be GONE before 2025 – GONE COMPLETELY. It simply won’t be tenable. The only option then for the marketing of risk products will be the life companies themselves (rarely successful by any description) and the few remaining investment planners who, in general, see insurance and an unwelcome ‘also ran’ only to be done if the client insists.

This is a disaster for risk specialists and investment planners alike. Just watch – come 2025 what the state of the industry is then. I’m old enough, ugly enough and bald enough to offer betting odds on this!

Michelle has put in place a foundation that for risk Advisers, could finally lay a solid platform that can be achievable for Advisers and enable them to do what they do best, which is to provide Advice. Technology advances will also help bring the time, cost and risk down for Advice Practices, Advisers and Licensees to acceptable levels, which will enable the Life Insurance Industry to bounce back from what has been a torrid period of years.

A foundation yes, but still based on an unworkable 60/20 coms AND the ridiculous 2 year chargeback provision. These people simply do not listen – completely tone deaf. Uncommercial, unfair and untenable.

Comments are closed.