- No (82%)

- Yes (9%)

- Not sure (8%)

The headline to this story succinctly summarises the response we’ve received to our latest poll.

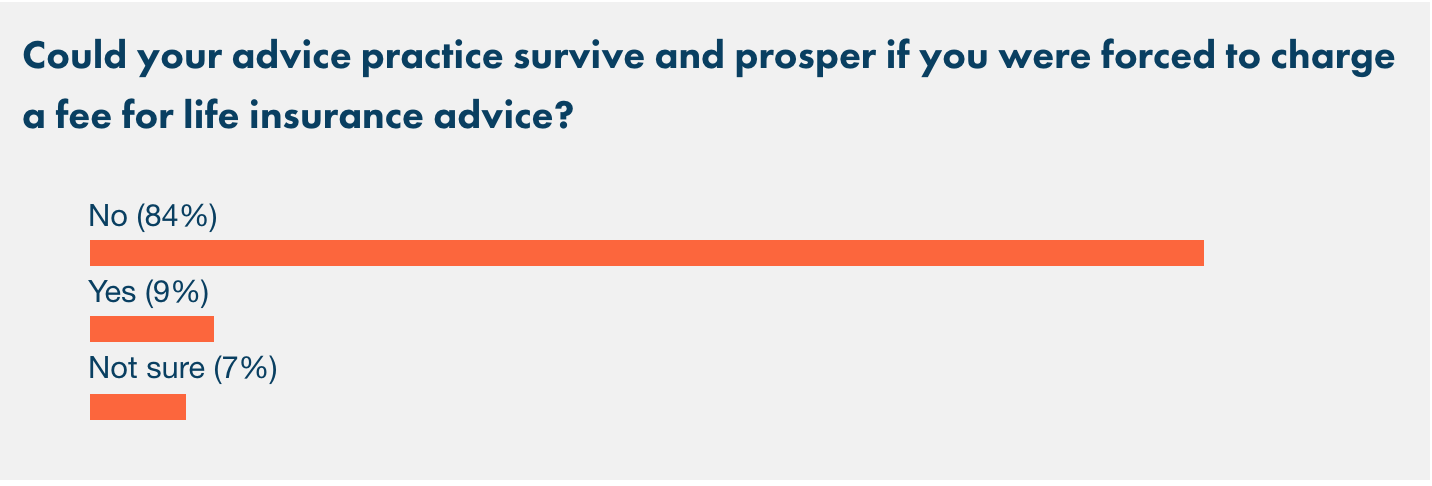

As we go to press, 84 percent of those voting in our poll have said their advice practice would fail to survive and prosper if they were forced to charge a fee for life insurance advice. Ten percent of our respondents remain unsure about the answer to this question, while only 6 percent think they could survive on fees alone.

This result bears a remarkable resemblance to the outcome when we asked you the same question in November 2012:

There are two differences this time. Firstly, there’s a minor difference in that a few more advisers are unsure of the answer. A major difference however, has been the volume of responses. We’ve already accumulated double the total number of votes we received in 2012 (and counting), which tells us this question is looming much larger for many advisers in terms of its potential future reality.

Some of the key themes emerging in your feedback include:

- If risk commissions are banned, will commissions also be banned for real estate agents, car sales people etc…?

- Rename the term ‘commission’ to an alternative such as ‘product fee’, ‘mark-up’ or ‘advice fee’

- Charge the regulator with having faith in existing compliance and best interest duty statutes and instead apply a more targeted approach, focusing on those who transgress (based on data that ASIC will now be receiving from insurers on a regular basis)

There are a number of arguments that can be made both in support of and against these comments, and we’ll hand it over to you to let us know what you think, as our poll remains open for another week…

Banning commissions on Life Insurances is the silliest idea ever. These commissions are the most important commissions of any commissions paid in any job in Australia.

Only the high net wealth clients with insurance advice tied to investment advice will pay for insurance advice. Everyone will be left to the mercy of the direct insurers and be basically uninsured.

Commissions everywhere else can be banned. Mortgage sales, car sales, phone contract sales, building material sales etc can all have commissions banned before Life Insurance as the customer can better understand these kind of sales and contracts and can make an educated decision on their own.

However consumers CANNOT understand the complexities of each Insurance offering and only work out that they were paying companies like Real Insurance all this money for nothing when it comes to claim time.

Without insurance commissions 95% of life insurance sales will be made through tied agents who are only allowed to recommend their employers insurance product. These advisers will still essentially be being paid a sales commission based on productivity (from their employer) however they will be limiting their “advice” to their employers products and will not have to comply with the best interests duty or research if their companies policies are better than the other alternatives or waste endless hours on pointless compliance.

Sadly the customer loses and advisers (despite our best intentions) will have to adapt, give up our independence, stop caring for our customers, sell our businesses and go work directly for the insurance companies selling their junk policies direct to the client.

Buy shares in the big law firms if commissions on life insurance are banned as they will be taking between 20-50% of all insurance claim payments.

One of the arguments about banning commissions is there will in fact be no advantage to the customer but there will be increased profit for the insurance company that manufactures the policy. Is this not evidenced today? Upfront commissions have been reduced since Jan 2018; can anyone tell me that insurance pricing has reduced by any small amount for new business?

This all started when conferences where abondoned as conflicted remuneration

What did that save the insurance companies ? Millions well they though that’s good let keep it up we can reduce commissions extend responsibility time increase complaints etc etc etc all in the name of creating a better bottom line to award themselves big bonuses ( another name for commissions) keep the share holders happy and drive the business like a cattle herd straight to the bank or the online insurers and there misguided and mis leading products

Employed advisers set wages no need to pay any extra because there is now no longer any competition

No commission means no opposition no one to stand by the client accept the blood sucking lawyers

Blind “Freddy” could see this unfolding for year

End of rant

Hey Don, isn’t it a fact that renewal commissions went up when the initial commissions went down? The present value of the commissions actual increased….so no, the insurance pricing hasn’t reduced as a result.

[And, all else being equal, if the cost of the commissions goes up, presumably the value goes up to those receiving them. Of course, the change in commission structure has a cashflow issue that businesses would need to work there way around.]

So, 84% of advisers have indicated that their practice cannot survive if forced to

charge a fee for life insurance advice. The fact that the survey results mirror

those from the same survey conducted 6 years ago, clearly shows how pertinent this current survey is. These results are from advisers – those who are in contact with Australians on an everyday basis; the ones who actually run a small business!

Yet the so called experts keep affirming their rubbish that clients will be happy to pay a

fee for life insurance advice AND pay a premium! Furthermore, we read in last

week’s edition that the new ASIC chair – who has only been in this country for three

months – stating that commissions should be banned because they would end

conflicts of interest. The incredible ignorance of that comment was shown in

the responses by advisers (again, those who actually deal with clients). And on

top of that, it was also reported in last week’s edition of Riskinfo that the FPA

supports a strategy for the eventual removal of commissions.

To all of the experts and regulators – the above survey results speak for themselves. It is to your detriment if you continue to ignore them. To use a metaphor – a balloon

can be blown up so far before it bursts. I fear the balloon has now burst!

The sad reality, even with the data provided by Life Companies, is even that is tainted data that cannot be relied on for accuracy or relevance.

The only consistency there has been from day one, is a lack of common sense, honesty and integrity with this whole debacle.

Two certainties will arise if Life Insurance commissions are banned.

1) The retail Life Industry will collapse.

2) Multi Billion dollar class actions will commence against all entities that colluded and conspired to bring about the demise of Life Insurance commissions.

The days of allowing unscrupulous organisations and Government to destroy honest hard working people, are not going to be tolerated in the future.

AMP is already facing, what will be, an avalanche of claims and class actions for all the Big end of town Companies and entities that want to gain market share by deception and dishonest plays, which clearly, this attempt to ban Life Insurance commissions has been about.

The executives of the Life Companies had better start getting more knowledgeable about the real truths around the LIF fiasco and start defending the vast majority of honest advisers, instead of sitting on the fence.

We have said from day one that rogue advisers should be thrown out of the industry.

Just make sure that the correct information has been provided to determine who these rogue advisers are and not rely on data that has little accuracy in the real world.

So the advice business clearly hasn’t got the message in the last 6 years.The commission model is in it’s dying days whether you like it or not. It’s simply a matter of time. 80% of life advisers need to think differently and act differently. The Fintechs are eventually going to put a wrecking ball through the industry. Don’t say you haven’t been warned.

Comments are closed.