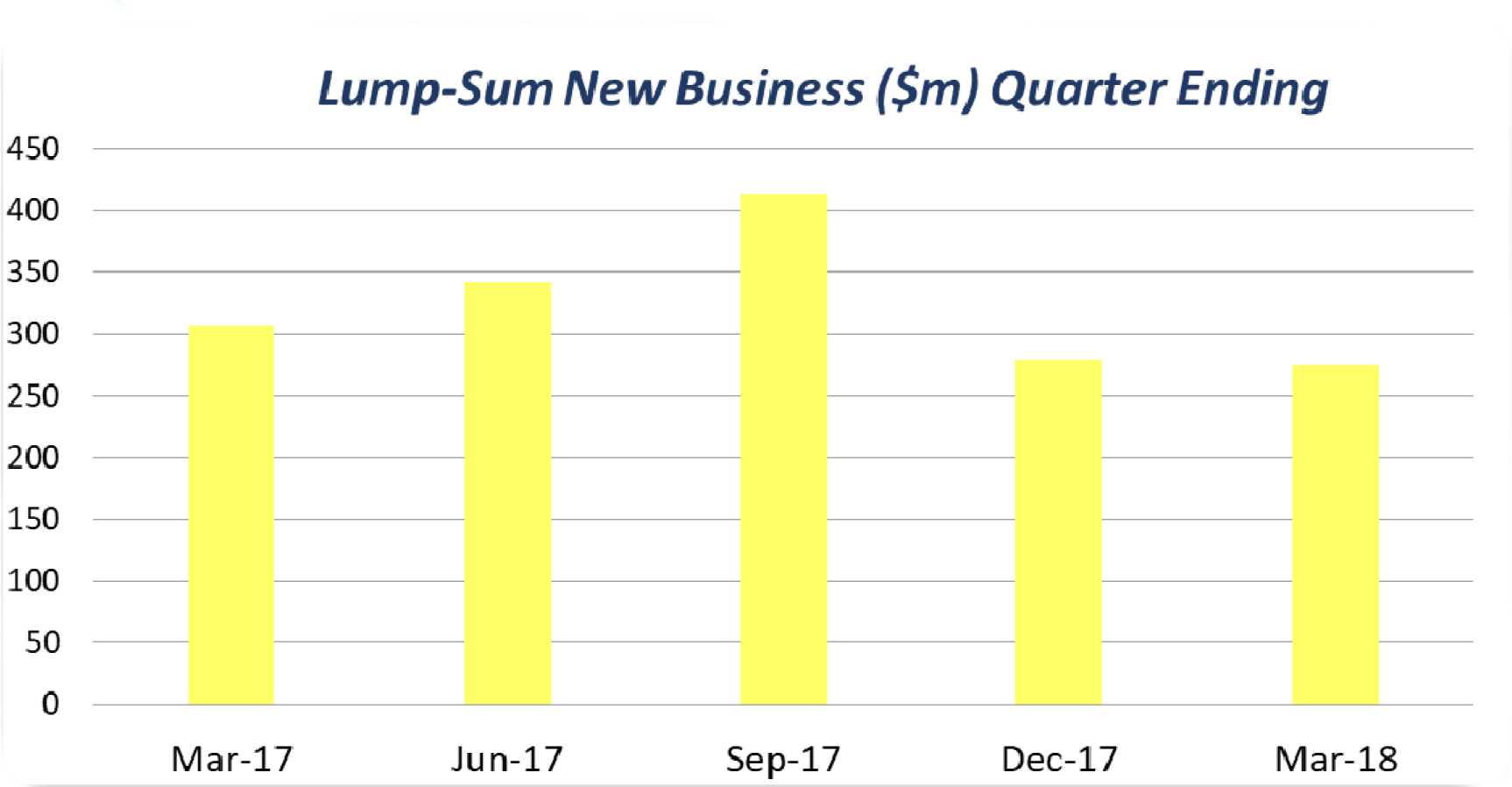

The sales of individual lump sum new life insurance business have slumped to their lowest levels in a year and a half, according to new data released by research house, DEXX&R.

In its quarterly Life Analysis Report, Dexx&r reported that individual lump sum new business sales to the end of March 2018 of $274 million were lower than those recorded in any of the past six quarters and were 10.6 per cent lower than the $307 million recorded in the March 2017 quarter.

The figures continue a trend seen in the last quarter of 2017 where individual lump sum new business sales were at their lowest level for the past five quarters despite sales of of individual Death, TPD and Trauma insurance reaching a five year high for the whole year to the end of December (see: New Business Sales Hits Five Year High).

Following the downward trend in individual lump sum new business sales, Disability Income new business in the March 2018 quarter was also down, by 10.3 per cent to $113 million from the $126

million recorded in the December 2017 quarter but increased by 1.2 per cent from the $111 million recorded in the March 2017 quarter.

Total sales for the year to the end of March 2018 were also down in both areas with Dexx&r reporting lump sum new business sales were down 1.6 per cent to $1.31 billion for the 12 months to the end of March 2018, compared to the $1.33 billion recorded for the year to the end of March 2017.

At the same time, Disability Income new business also decreased for the year to March 2018, falling 0.7 per cent to $514 million compared to the $518 million recorded in the twelve months to March 2017.

Of the insurers who recorded an increase in lump sum new business over the twelve months to March 2018, Zurich posted the highest growth of 18.1 percent to $163 million, followed by AIA Australia (11.8 percent to $74 million), and ClearView (3.7 per cent to $39 million)

Insurers recording an increase in Disability Income new business over the same period were led by AMP with an increase of 49.1 per cent to $77 million, followed by ClearView (13.2 per cent) and CommInsure (11.1 per cent).

Individual lump sum and Disability Income discontinuances continued to fall away for the quarter after peaking in around 16 per cent in 2013, both falling to 12.6 per cent at the end of the March 2018 quarter.

TAL remains the largest life insurer based on market share for in-force risk annual premiums with $2.88 billion in premiums and 18.1 per cent market share, followed by AIA Australia ($2.48 billion – 15.6 per cent), MLC Life ($1.96 billion – 12.3 per cent), AMP ($1.98 billion – 11.9 per cent)and OnePath ($1.62 billion – 10.2 per cent).

what the hell did they expect? They have continually attacked advisers for years, now cutting their incomes, add a 2 year clawback a uni degree to sell insurance etc etc and maybe it is getting to be too high a risk to continue in the business?

There’s a (yet) totally un-substantiated rumour that “incomings” of all types have dropped WAAAY down for a certain insurer and fund manger.

Eventually the truth will out as it usually does but the PR folks will, of course, attempt denial and fudging!.

And these figures are reflective of only the first quarter of the first year following the introduction of LIF. What will happen next year when our income reduces another 10% and 2020 when it drops yet another 10% again? As emkay has stated – what did they expect?

Comments are closed.