The top five life insurance companies in Australia now dominate the market in 2019, new research shows.

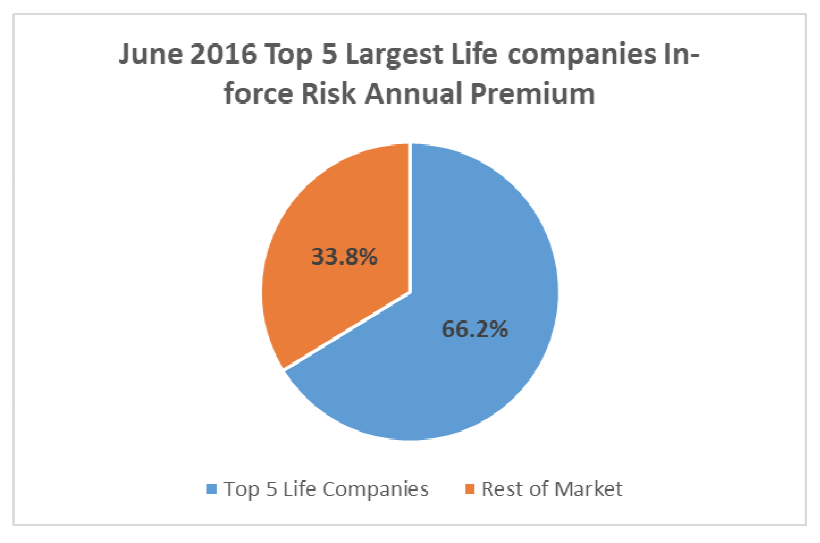

The five largest life insurers have gained an additional 19.2 percent of the total market in the past three years, according to DEXX&R’s Life Analysis Report based on data for the year ending June 2019.

In June 2016 these insurers accounted for 66 percent of the total market.

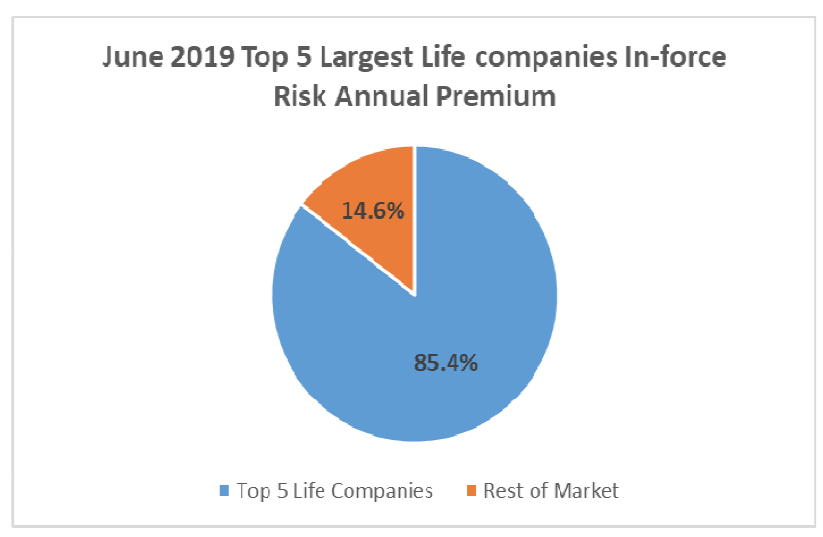

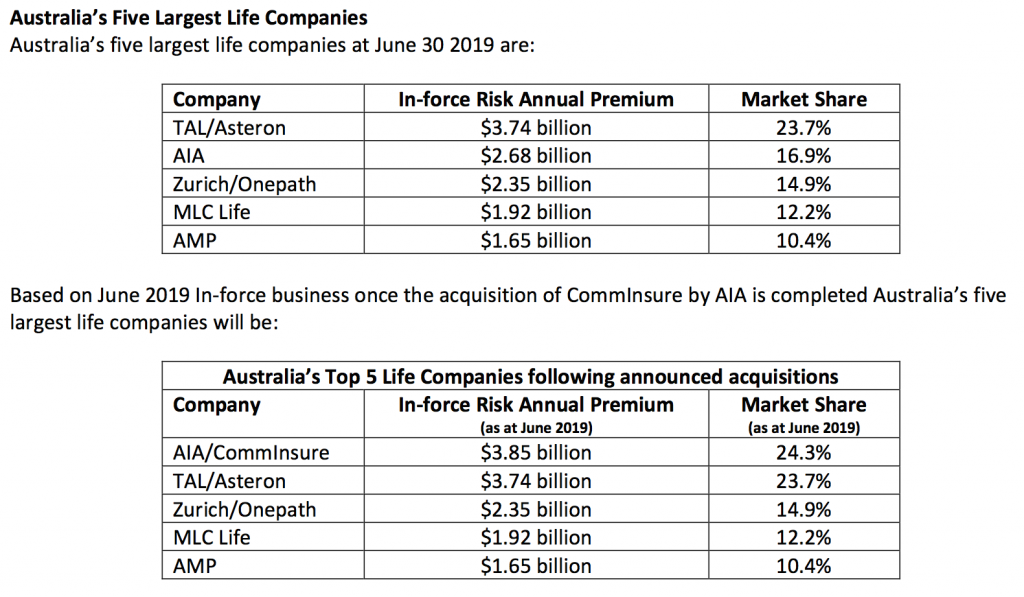

As at June 2019 the five largest life insurers account for over 85 percent of the total life insurance market measured by in-force premiums.

The amount of new business continues to fall. For individual lump sum (Death, TPD and Trauma) the industry wrote $1.13 billion in new business in the 12 months ending June 2019, down 12.2 per cent on the $1.29 billion recorded in the year to June 2019. This is the lowest value of new sales recorded in the past five years.

“The continued decrease in business is the result of lower sales through advice channels and the suspension or cessation of sales of direct lump sum products by several major life companies,” the report stated.

“This is the lowest level of sales in any June quarter over the past five years. With both AMP, one of Australia’s largest life company’s, and Asteron following its acquisition by TAL, now closed to new business there are now fewer life companies competing for new business than at any time in the past.”

Total risk in-force business (Individual and Group) written by life companies decreased for the year by 0.6 per cent to $15.8 billion.

As good as scale is, it is a worry to see declining insurance being written, which means, declining cover for clients in general – more people under or uninsured.

Well said Mark. All the insurers will do PUBLICLY now is to say to Government that “life risk must retain commissions and the ASIC review for 2021 must continue”

Like you, I call BS ! The insurers know that genuine new risk business ( not indexation) is down 40%. There is a huge margin in the above figures for FUDGING – we all know that that there is huge inconsistency in terminology across this industry. LIF and CLAWBACK are the problems.

LIF was invented by the 4 banks to reduce distribution costs on the Life Offices they were selling, targeting the Japanese Life Offices. Think “mutton/lamb”. Well that’s ALL DONE, so the need for LIF has passed. And Report 413 has been discredited after ASIC was forced to declare at the PJC that the claimed level of churning might have been difficult to substantiate

Its time for the CEOs of life offices to find some kahunas and demand that LIF be discarded back to 88/22 levels and the dreaded TWO YEAR CLAWBACK be reduced to ONE YEAR. Then we can start on FASEAs attack on experienced advisers!

And is APRA still asleep at the wheel. Does it really know the capital adequacy and solvency situation with all the STATUTORY Number One funds or are they too scared of Frydenberg to point out that the Emperor is naked?

Mark, Your words are gold, so true. I’m one that you talk about. Given up writing new business. Not fun now, too hard. This once great industry will lose me after 33 years next year at age 60 when I can sell up and get my super tax free. I honestly can’t wait. Was gonna stay ’til age 70+ but not now. Upskill? Exams? Dozens of hours study? – for what? – at $10K+++ ? -forget it!

.

Until then i will live on my risk renewals and tend to clients as needed but will NOT look for new business to write as I have for over 30 years. Certainly NOT with a 2 year embargo on owning my fairly-earned ‘reduced’ pay!! Not the least bit interested. Inconceivable it would have been to me 5-10 years ago to hear myself say this. These STUPID, STUPID life company execs can’t see what is going to happen or if they can they all have cognitive dissonance about it. They didn’t stand up for advisers when needed but were complicit in our demise.

.

When advisers are not paid for their efforts they will find some other industry – simple as that – I would if i was a 25 year old adviser! These idiot execs will see inforce business tumble along with new business coming in. All gone with the advisers. They see themselves as Ivory Tower Immune. What a rude shock they will get. The poor simpletons probably think roboadvice will save them . . . well, I hope they let us all know how they go with that . . .

You seem to be part of the problem Mark, your view on insurance is why the industry is poorly viewed by consumers.

Insurance should only ever be offered, and only bought it understood. This only happens when the adviser does their job well in explaining how it works and why it’s important.

The insurance industry will still be here, it just seems you won’t.

I have only just started my new business and I can say business is going extremely well.

So keep complaining and threatening to leave, because it sounds like your clients are leaving you.

Comments are closed.