The Financial Adviser Standards and Ethics Authority (FASEA) has confirmed advisers will be able to gain four credits for holding the Advanced Diploma of Financial Planning and an industry designation, and has altered the focus of the proposed Financial Adviser Examination.

In the first official statement from the Authority on education standards since the release of consultation papers in July, FASEA confirmed comments from the Assistant Treasurer, Stuart Robert, that existing advisers with the ADFP would be eligible for two course credits.

It also confirmed that advisers who held the FPA’s Certified Financial Planner (CFP) designation or the AFA’s Fellow Chartered Financial Planner (FChFP) designation would be eligible for a further two credits (see: FASEA Win For Advisers).

FASEA has, however, placed timeframes on when those designations will be considered eligible with advisers who attained the CFP after 2007 or the FChFP after 2014 eligible for credits. No timeframes have been placed on when an adviser had attained the ADFP, confirming what a FASEA spokesperson told Riskinfo in late October (see: No Cut-Off Date for ADFP Credits).

The details were released as the Authority begins the release of legislative instruments for each of its proposed standards which will be open for consultation until mid-December before the release of finalised standards

Study Units Required

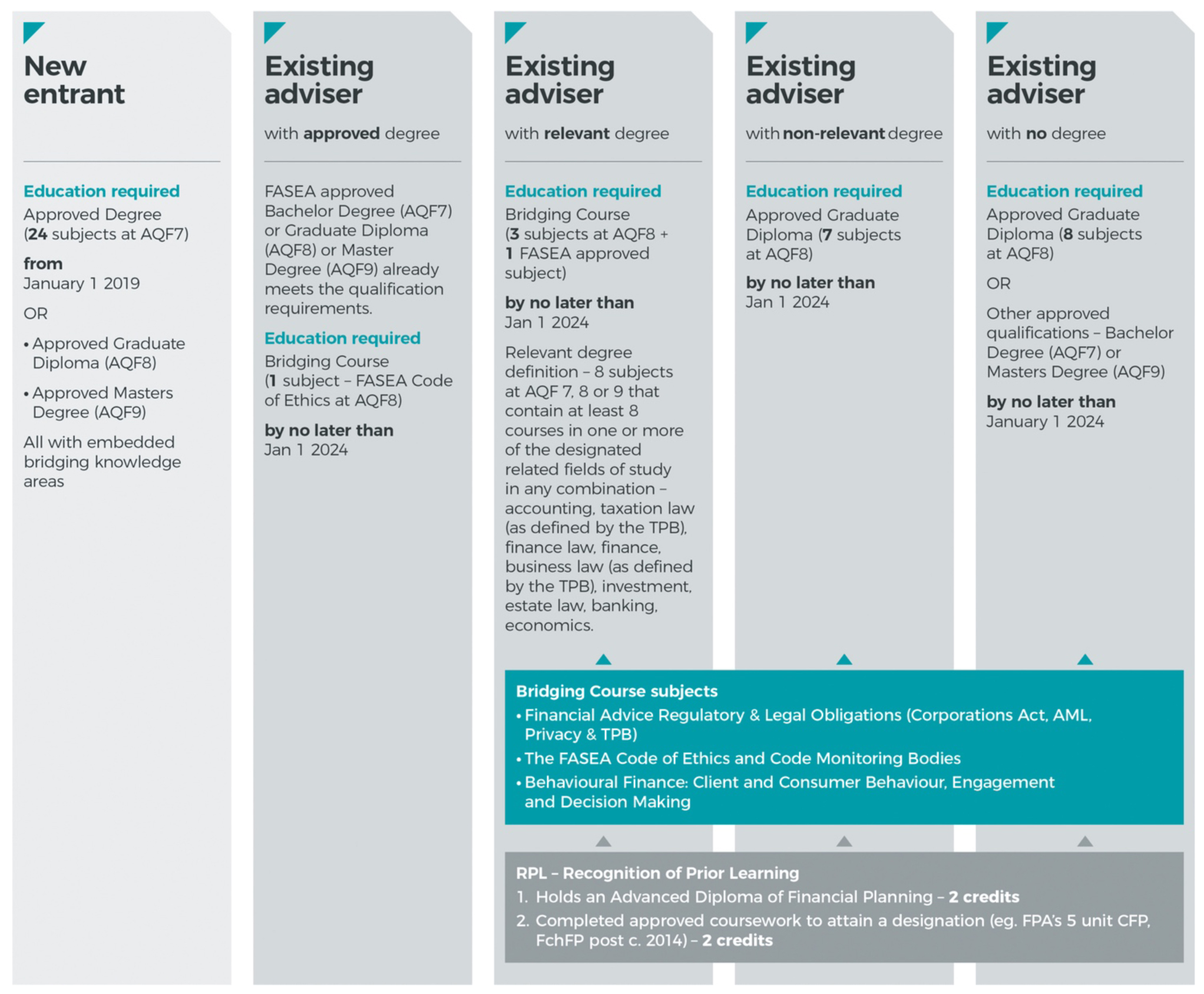

The Authority has also added a new method for people who wish to enter the advice profession from another career with the Post Graduate Career Changer pathway requiring new entrants to complete an approved eight-unit Graduate Diploma. New entrants choosing this pathway will be able to seek Recognition of Prior Learning (RPL) from an education provider, and may be able to reduce the number of units required.

A newly released Standards Summary from FASEA shows that only existing advisers with no degree and no other form of training, including the ADFP and industry designations, will be required to complete all eight units of a Graduate Diploma, as will new advisers undergoing a career change. Most advisers, including those with non-relevant degrees will be required to complete seven units or less by 1 Jan 2024.

New advisers with no formal education will still be required to hold a Bachelor degree, and all advisers will be required to complete a single unit on FASEA’s Code of Ethics.

Adviser Exam

In releasing the new Standards, the Authority also announced that it had made changes to the Financial Adviser Examination, reducing it from five sections to three which “…will focus on applied knowledge acquired in actual financial advice scenarios”.

The three areas will be:

- Corporations Act – with an emphasis on Chapter 7 – Financial services and markets

- Financial Advice Construction – suitability of advice aligned to different consumer groups, incorporating consumer behaviour and decision making

- Applied ethical and professional reasoning and communication – incorporating FASEA Code of Ethics and Code Monitoring Bodies

FASEA stated the exam will be 3.5 hours in length, including reading time, will consist of multiple choice and written response questions and has confirmed that it will be open book exam for the part relating to the Corporations Act (see: FASEA Adviser Exam to be Open Book For Corps Act).

Resits will be available and a curriculum framework, recommended reading lists and a practice exam will be made released to advisers.

Other Changes

The new standard also stated that CPD hours for advisers will be set at 40 hour per year, instead of the 50 hours first proposed (see: Advisers May Face 50 Hours of CPD), of which 70 per cent will need to be approved by the licensee.

The Authority also announced that new advisers practicing during their first ‘professional year’ of practice will be titled Provisional Financial Adviser or Provisional Financial Planner, and will be required to undertake a professional year comprising 1600 hours, of which 100 hours is to be structured training.

FASEA stated it made the changes after receiving around 800 submissions during the consultation period following the release of a series of draft guidance papers in the first half of 2018.

“FASEA has taken time to listen, analyse and reflect on those submissions in reviewing each standard,” the Authority noted, adding that much of the original content of the guidance papers was supported by the submissions.

FASEA Chief Executive, Stephen Glenfield said the consultation process assisted FASEA in creating standards which addressed industry and consumer needs as well as balancing the Authority’s legislative obligations.

“Industry and consumer feedback has helped to create a balanced set of standards that, taken as a whole, offer a workable framework for how the industry will evolve into the future – for the benefit of both advisers and consumers,” Glenfield said.

Invest in Education providers. They are going to make a lot of money in the next 4 years. Surely the timeframe is now ridiculous?

Having done CFP well before ’07 I’m saddened that it’s considered useless, as well as all my other quals. Who are these arrogant and self-absorbed people to say that I need to do a huge amount of RE-learning? And only because the institutional managers designed a system that allowed SOME self-interested sales folk to prosper too much. These slick sales people didn’t benefit to nearly the same extent as the mid & upper managers who designed the system to reward each of them with $100,000 plus ANNUAL bonuses based solely on sales volume. Sure, kick out bad advisers, but why punish the genuine advisers who’ve always realised that the client’s best interest is always in their best interest too, and not only because it helped the adviser’s business.

Might as well go fishing – it’s much more satisfying that making Fasea happy.

If this was a joke it wouldn’t be funny. I have been a CFP since 2005, held my ADFP since 1999 and been in the industry for almost 25 years, specialise in SMSF’s, gearing, aged care etc yet I clearly know very little according to FASEA. The education groups seem to be able to pull some handy string as well it appears. But the reality is that those that run FASEA have absolutely no idea about what we do and how we do our job. I 100% agree with ensuring ethics and morals are at the heart of our profession (frankly if you have neither of these then you definitely shouldn’t be in this industry) but to tell us how to suck eggs, again, is just plain out insulting. I suspect, as an industry, we are going to lose many excellent advisers because of this farce and the only ones that will suffer are the people who really need our advice, because so much experience will leave the industry and be lost. Tell me FASEA how does a rehash of education teach me how my clients feel when going through something like the GFC, or when a loved one dies and we are there to help them through the process? I suppose those scenarios don’t matter to you do they, just as long as we have done your courses all will be well in the world. The nanny state just keeps growing.

As a “non-relevant degree holder”, my qualifications in Psychology and Criminology, and lecturing experience in both at two top universities (Melbourne & RMIT), award of an honourary CPA, plus 12 years experience in management consulting, 6 months hands-on experience managing an Aged Care facility to improve its performance ready for sale, I have found my ability to understand and work productively with people has been extraordinary. My client group, including some who have been with me for 20 years now, have included those whose marriages I have helped save, others who have had a smooth transition through what otherwise would have been bitter financial settlements and children’s arrangements, elderly parents guided into Aged Care profitably, teenagers guided through Uni and into their first jobs, marriages, first homes, plus planning & starting their own families, smsf’s successfully grown and clients guided into healthy, active retirements and living quite comfortably on their smsf investments, single mums helped to manage financially and all their Centrelink issues managed and taken off their shoulders by me, Family & Testamentary Trusts investing profitably, distributing income and making loans to members to help them in life, clients all properly insured and able to sleep easy at night, and many other success stories resulting from my advice over 18 years, now mean nothing. Apparently, I am not good or knowledgeable enough at what I do, according to FASEA and the ‘new’ educators. Also, my four years work, experience and completed training as a Responsible Manager for an AFSL, mentoring other Advisers, developing and running a 12 month intense training program for a large group of Paraplanners to lift their knowledge and skills to an adequate level, developing and running compliance policies and programs from an intimate knowledge of the Corps Act, also get no acknowledgement that I have adequate knowledge, skills & experience to do what I do, well and ethically enough. FASEA says I have to improve…I have to know more, study 7 units of some piddly Graduate Diploma (what, I have a Bachelor and Masters degree and a Post Graduate Diploma already, but I don’t even get a Post Graduate Diploma?) that was probably thought up by academic nerds less than half my age and vast experience & studies in ethics, commercial law, psychology, accounting, property, finance and investments, plus running my own dedicated research office that checks on almost 10,000 managed investments across the globe each month, to ensure my clients can always have the best investments possible and our AFSL’s APL is sound. Not to mention of course 18 years of reading industry & legislative updates and racking up PD points at the rate of 40 each year, 3 years as the head of a large super fund, 6 years consulting to large insurance providers and Adviser businesses, involvement in the move of Australia’s largest employer super fund from Defined Benefit to Account Based pensions (in the client’s best interests?).

Nope, all of that is not good enough!

I apparently have to go back to FASEA’s version of Financial Advisers’ kindergarten to study what they deem I need to know.

Not that it will be hard, mind you. If I don’t know what they think they can teach me, then they definitely should not be attempting to say I should know it. But, if I don’t know it, then I am probably just some arrogant old fart who needs to shut up and listen to some young hot shot impart his new found wisdom in a FASEA classroom. I wonder if the many clients I serve now and those I have served and helped be successful for many years,would see me that way?

Apparently those who will make a lot of money from me having to enrol for 7 subjects I could probably already teach myself

Max

If at all possible can you get to the FPA conference tomorrow and outline your position to the FASEA CEO directly. It just may make a difference.

Comments are closed.