ClearView Wealth has added its voice to the growing number calls for the retention of life insurance commissions as a valid remuneration option for advisers.

Speaking at the annual FSC Life Insurance Conference last week, and in a subsequent statement, ClearView’s MD, Simon Swanson, outlined his firm’s reform agenda and priorities post the release of the Banking Royal Commission recommendations.

While stating that ClearView broadly supports the recommendations made by the Banking Royal Commission, Swanson zeroed in on what he described as some elements worth protecting, “…namely the ability for product manufacturers like ClearView to fund the provision of life insurance advice through commissions.”

In a perfect world, consumers would …pay a fee …but that’s not how it works

Swanson’s rationale stems in part from how he says life insurance advice works in the ‘real world’: “In a perfect world, consumers would autonomously recognise the value of life insurance advice and willingly pay a fee for it,” says Swanson, before adding, “…but that’s not how it works.”

He reflects, “The truth is life insurance is a complex financial product,” saying that while it offers many benefits, these benefits may not be realised for 20-30 years. “While insurance provides comfort and peace of mind, and allows consumers to transfer risk to an insurance company, they’re effectively buying a promise. Financial advisers play a critical role because they help consumers understand and assess the value,” he said.

Swanson warns of the consequences if risk commissions were removed or further reduced, including the exacerbation of Australia’s ongoing underinsurance dilemma, quoting research which places the shortfall at around $1.8 trillion.

He notes ClearView’s three key advocacy priorities are:

- Stable life insurance commission rates

- Tax deductibility of financial advice fees

- Life insurance choice of provider

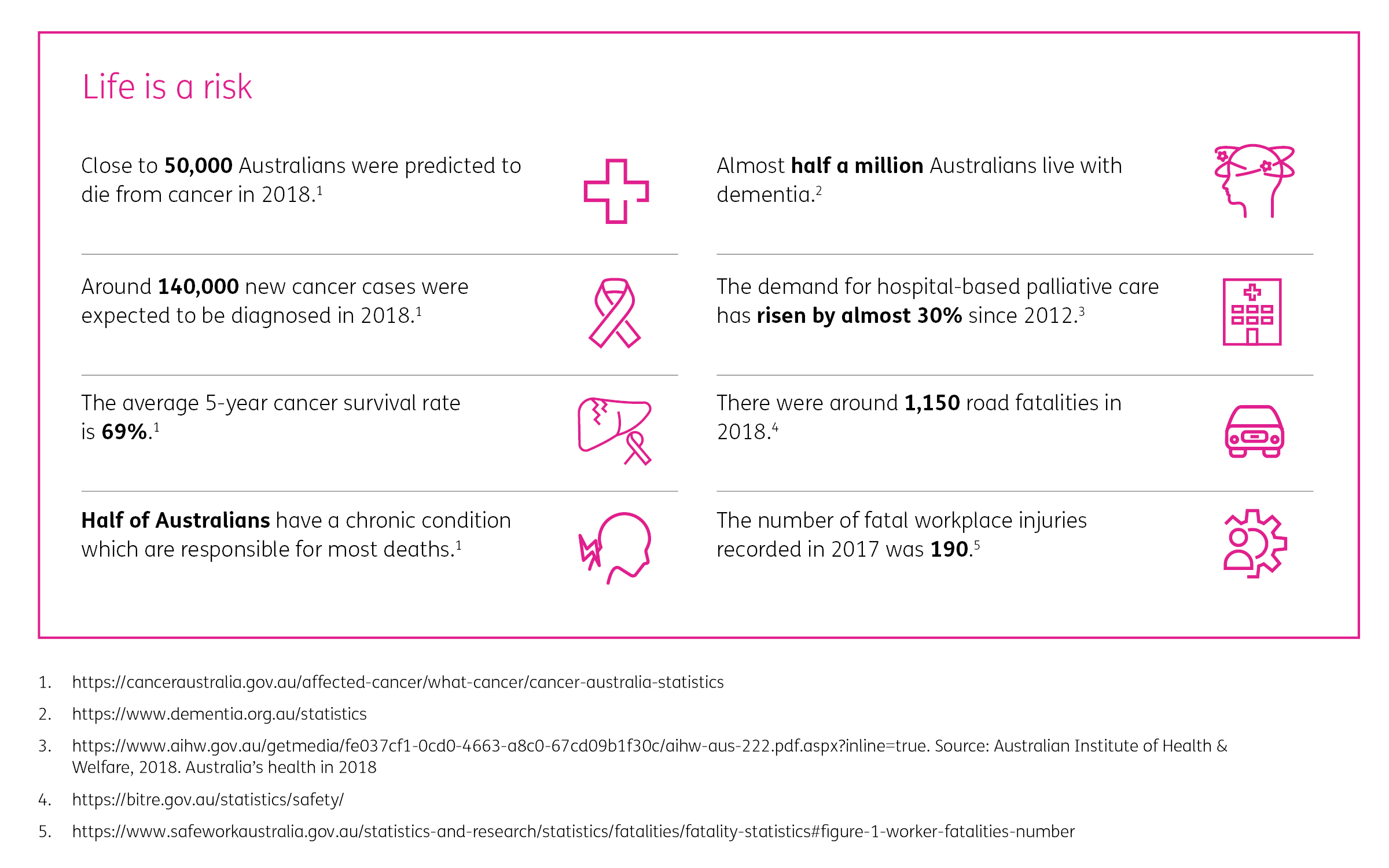

Advisers can click here to access ClearView Wealth’s Reform Agenda and Priorities statement, which includes its arguments in support of these three key advocacy priorities, as well as the following infographic that outlines some of the risks associated with life in Australia:

Simon has come out with some good arguments, though the horse has bolted.

FASEA will force out most Risk specialists on it’s own.

The 2 or in some Life Companies cases 3 year responsibility period is the other catalyst that is driving down NB production, as there is nil responsibility on Life Companies for their actions and 100% responsibility on adviser practices, no matter what the cause of a lapse.

The final insult, is an illegal regulation that mandates what a private Industry can pay private contractors, without any requirement for that Industry to improve their pricing for consumers, or to improve their administration, which is the main cause of frustration and cost to adviser practices.

Unless FASEA is dramatically changed to allow Risk advisers to do their job, the 2-3 year responsibility period is overhauled and made fair to all parties and the Life Companies start improving their whole admin processes, it does not matter what ASIC thinks, or does, there will not be a Retail Life Insurance Industry, FULL STOP.

Agree Jeremy. A patient doesn’t need a dermatologist to tell them they have an infected pimple. A GP is fully qualified to tell them that. Just as an insurance client doesn’t need a Financial Planner just to arrange a life and/or income protection policy. FASEA will effectively ‘kill off’ risk advisers and no amount of huffing & puffing will blow down the unnecessary brick wall FASEA has placed in front of us and our clients. $3,000 fee to obtain a $300 per month premium policy contract via our advice. Not in the real world.

Commissioner Haynes’s recommendation that commissions should ultimately be reduced to zero highlights the lack of understanding of the needs and mentality of the broader Australian public. The concept of a pure ‘fee for service’ model to provide & implement risk insurance advice to the general public is flawed for two reasons, the unwillingness of the general public to pay an appropriate fee for advice and importantly the ability to be able to afford to do so.. It may not be an issue for Commissioner Hayne and his learned colleagues (who are handsomely rewarded for their efforts) but for mainstream Australians it simply is not in their budget. Given the current onerous compliance requirements, the seven safe harbour steps (god help me!) which quite often conflict with ‘best interests duty’ the cost of providing risk insurance advice has sky rocketed. It is generally accepted that the cost of advice and implementation is between $3,000-$3,500 (arguably higher in the current environment. This may not be a lot of money to Commissioner Hayne but to the ordinary man and woman on the street, it is a considerable cost. The OPTION of either paying an adviser via commission or fee for service should be retained in the general interest of the public. To do otherwise would simply pander to those who can afford to live in ivory towers!

Comments are closed.