The Federal Government has released the implementation program it has developed for the 76 recommendations stemming from the Banking Royal Commission.

The implementation program is split into three main sections which require action variously from:

- The Federal Government (Appendix A)

- The Government regulators, APRA and ASIC (Appendix B)

- Industry associations and organisations (Appendix C)

There has been little change to the Government’s intentions when it comes to a number of the Banking Royal Commission recommendations that impact financial advisers and advice businesses. Re-stated within the Government’s implementation roadmap, these critical recommendations include:

Recommendation 2.4 (banning grandfathered investment and superannuation commissions)

Legislation ending grandfathered commissions for financial advisers was introduced into Parliament on 1 August 2019 (see: Government Confirms Grandfathering Ban Date).

Recommendation 2.5 (the future treatment of life risk commissions)

Covered under Appendix B – for action by the regulators, the Government has reaffirmed that ASIC will include the factors identified by the Royal Commission in undertaking its post implementation review of the 2017 Life Insurance Framework reforms (see: Royal Commission Casts Doubt on Future of Risk Commissions). ASIC’s review is set to take place in 2021.

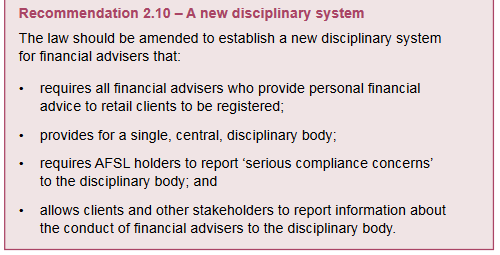

Recommendation 2.10 (a new disciplinary system)

Under an agenda of enhancing accountability, the Government has confirmed it will implement Banking Royal Commission recommendation 2.10, which calls for the establishment of a new disciplinary system for financial advisers. Taken directly from the final report of the Banking Royal Commission, recommendation 2.10 reads:

In confirming the establishment of the new disciplinary system for advisers, the Government has noted that in relation to Commissioner Hayne’s recommendation 2.10 ‘…builds on the Government’s professional standards reforms to raise the educational, training and ethical standards of financial advisers [via FASEA].’

The Government notes it will proceed with monitoring of the Code of Ethics introduced as part of those reforms, which will require all financial advisers to subscribe to a code monitoring body from 15 November 2019, which will enforce the Code of Ethics from 1 January 2020 (see: Joint Code Monitoring Proposition).

In the various statements accompanying the release of the Government’s Banking Royal Commission implementation roadmap, and reinforced by Treasurer Josh Frydenberg at the formal announcement of the program at an industry event in Melbourne, the Treasurer has given a perspective to the scope of these reforms, characterising them as the largest and most comprehensive corporate and financial services law reform package in three decades.

Delivered under the theme of Restoring Trust in Australia’s Financial System, the Treasurer said the need for change is undeniable, and the community expects that the Government’s response to the Royal Commission will be implemented swiftly.

Advisers can click here to access the full details included in the Government’s Banking Royal Commission reform agenda implementation roadmap.

The more we read, the more we realise that NO-ONE in the Government or the Regulators and to a lesser extent, our representative bodies AKA the AFA and FPA, fully or even partially understand, that there will be NO RETAIL LIFE INSURANCE INDUSTRY within 4 years if these stifling and unworkable regulations, LIF and FASEA continue as stated.

The AFA and FPA have said they are fighting to retain the current commission structure which will drop another 10% from 1st January.

The AFA and FPA still do not get it.

Thousands of the most experienced advisers have already stated they are exiting the Industry if;

1) FASEA is not radically overhauled so experience gives them the opportunity to continue providing advice.

2) The 2 year responsibility period is reduced to 1 year for any lapses that are NOT caused by the adviser.

We still have the situation of premiums rising at a level that Australians WILL NOT AND DO NOT ACCEPT, which is causing most of the lapses.

The full onus of responsibility against retail Life advisers for the sins of the Banks and Life Companies who created the vast majority of problems, is totally unacceptable and advisers are sick of this whole fiasco.

The AFA and FPA say they are united in our cause.

They had better get their act together, because currently they are not putting in simple English, what is going to happen if this insane circus continues.

Put simply, the Government will be responsible for millions of Australians being unable to attain advice, tens of thousands of Businesses and employees who pay billions of dollars in TAX, will be out of Business and unemployed, with the economy falling further.

FOR WHAT GAIN? NONE.

The stated Best Interest Duty, can only be applied if there is a Retail Life Industry left standing and Advisers who can profitably work to help clients, which based on the current strategy the Government is following, clearly will fail, as there will be no advisers left who will work under unworkable Regulations.

Totally agree Jeremy! Although it seems the AFA and FPA have banded together when it comes to maintaining commissions, I have said before and will say again – the FPA, AFA, dealer groups and life insurers all need to go to the government as one collective body! The governent just doesn’t understand and this is the only way to get the message across. It happened when the truckies blockaded Canberra a few years ago and it happened with the mortgage industry following the Royal Commission. Come on AFA and FPA – get the ball rolling!

When did a retired lawyer become god? Why is the Government just adopting Hayne’s recommendations without thinking critically about the consequences.

Just because Hayne made a recommendation doesn’t mean he was right. Sure there is some poor behaviour and practices to adjust but simply adopting every recommendation seems bizarre if not negligent

Comments are closed.