This article is based on findings contained in a white paper published by the Beddoes Institute, which considers the critical issue of trust.

With our thanks, Beddoes shares some great insights into consumer thinking when it comes to their trust in advisers, from which they’ve been able to develop an Adviser Trust Model that can be applied within any advice business…

Trust. It’s an essential component not only for a strong adviser-client relationship, but also for the overall success of the financial services industry.

But amidst all the conversation about trust there has been little in the way of guidance or frameworks that provide advisers with practical steps on how to build trust and move forward in the post- Royal Commission landscape.

At Beddoes Institute our team has conducted a detailed and unparalleled study of trust in the context of the advice industry and subsequently developed a comprehensive model of trust specific to the advice sector based on the findings.

In analysing feedback from over 3,000 advice clients across 60+ different client experience metrics, we have been able to:

- Establish the determinants of trust specific to adviser-client relationships;

- Quantify the benefits of high trust adviser-client relationships; and

- Develop an Adviser Trust Model that outlines four trust pillars and a pathway of actions and initiatives to help build high-trust relationships.

Why is trust vital to the adviser-client relationship?

…trust is based on one core concept: client centrality

When it comes to the adviser-client relationship, trust is based on one core concept: client centrality. Above all, the client must come first. The client needs to have the confidence that their adviser will manage their financial affairs as if they were managing their own.

The issue of trust is unique for any service-based industry such as advice. Whilst trust normally develops over time, in financial services it is a prerequisite as it empowers a client to be confident enough to take their first step into the financial planning arena and entrust an adviser with their financial livelihood.

Simultaneously, it also lets them move forward with an adviser, trusting it will be a positive relationship with positive financial outcomes. Trust is integral for both the ‘here and now’ and for the tomorrow to succeed.

How can you build high-trust adviser-client relationships?

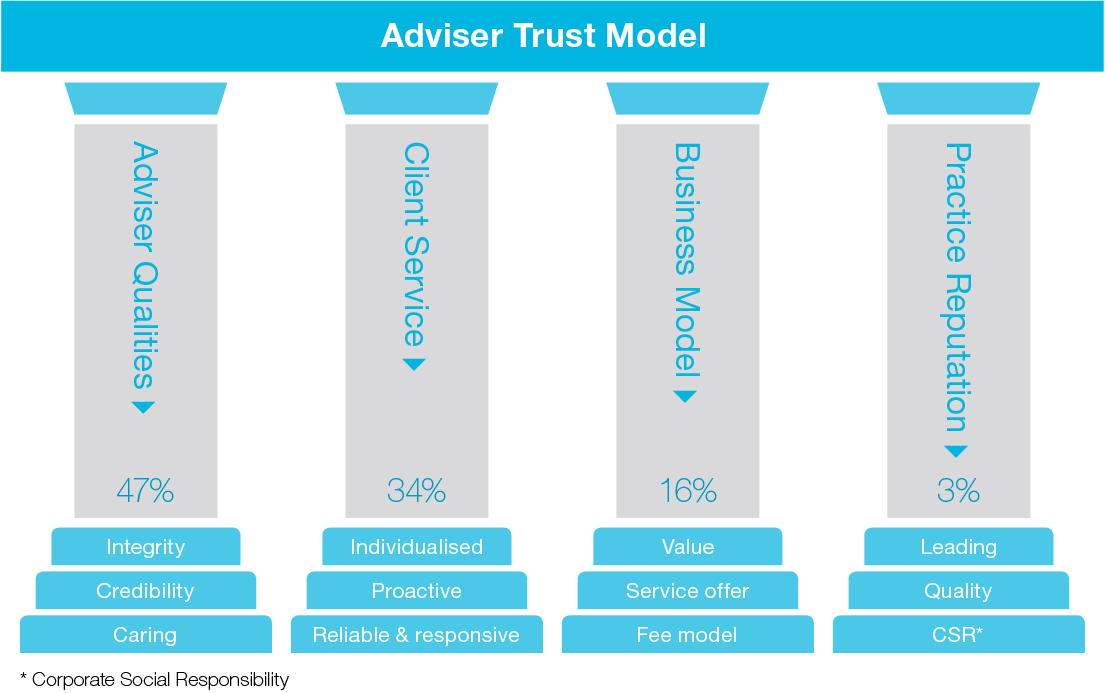

Our extensive research has not only enabled us to systematically deconstruct the meaning of trust as it relates to the adviser‑client relationship, but it also facilitated the development of our unique Adviser Trust Model.

This Adviser Trust Model is a predictive and actionable model of trust that defines four trust pillars. Strong performance on these pillars, and their respective foundations, creates high-trust relationships that deliver significant returns for a practice.

What are the four pillars of trust?

The Adviser Trust Model consists of the following pillars:

- Adviser Qualities

- Client Service

- Business Model

- Practice Reputation

Each of these consist of three foundational elements that contribute to the development of high trust adviser client relationships:

Pillar One: Adviser Qualities

Based on our research and adviser trust modelling, this pillar is a significant predictor of trust, contributing 47% overall to high trust relationships. Whilst strong technical skills are a “hygiene” factor that advice clients expect of their adviser, this pillar is based on the qualities outlined below which are key differentiators and determinants of trust:

- Integrity

- Credibility

- Caring

Pillar Two: Client Service

According to our findings, client service is the second highest predictor of trust in adviser-client relationships, contributing 34% overall to high-trust relationships. It is based on three foundational elements:

- Individualised service

- Proactive service

- Reliable/responsive service

Pillar Three: Business Model

We also discovered that the third predictor of trust, which contributes 16% overall, related to a practice’s business model. This pillar consists of the following foundational components:

- Value visibility

- A varied service offer

- A competitive and transparent fee model

Pillar Four: Practice Reputation

The final pillar of trust identified was that of practice reputation, which contributes 3% overall to high-trust relationships. This pillar consists of:

- A leading brand, employing high-calibre individuals with leading expertise

- Quality and excellence in systems and processes

- Corporate social responsibility

What is the value of creating high trust relationships?

There are a multitude of benefits that result from a high trust environment including the easy flow of information, collaboration, innovation, better quality advice and improved client outcomes, all achieved in less time, with less stress.

In essence, a high trust environment increases efficiency for advisers and improves outcomes for clients. But how can we determine this is actually the case?

In order to quantify the tangible benefits of high trust relationships, our team analysed client feedback and outcomes for clients of Beddoes’ Most Trusted Advisers (MTA) Network versus clients of other advisers. Here the MTA Network was used as a comparative point as these advisers exemplify high trust adviser-client relationships, so were ideal to use to quantify the benefits of high trust to the client and the practice.

The conclusion of our analysis is clear: trust matters. The significance of trust is apparent when we observe several high-level findings of our research:

Client Outcomes

MTA clients have significantly better outcomes in terms of being on track with the goals and objectives of their financial plan with 46% of clients providing a rating of 9 or 10 out of 10 compared with only 32% for other advisers.

This can be attributed to the fact that these clients involve their advisers more fully in their financial affairs and significant life events, share more information, and are more likely to implement the advice.

Client Satisfaction, Loyalty and Client Referrals

MTA clients are significantly more likely to refer their adviser business compared to other advisers with 77% of MTA clients rating their propensity to refer as at least 90% versus 53% for others.

MTA clients were also found to be more satisfied and have stronger relationships with their advisers than clients of other advisers. They also rated their advisers higher on all important adviser qualities, (which is the dominant key pillar of trust) as outlined below:

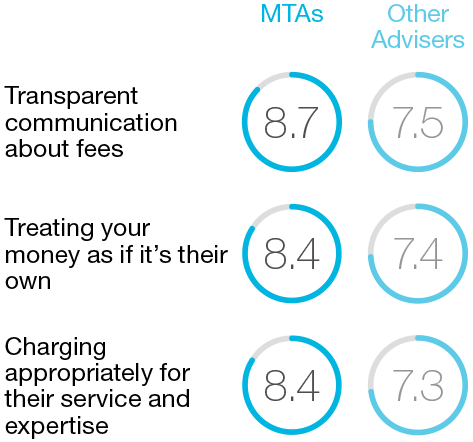

Fees and Value

Clients of MTAs are significantly more satisfied with the fees they pay, they rate their advisers more favourably on fee transparency and believe they are getting better value than clients of other advisers. As such, they are likely to pay advice fees more willingly, on time and without question. The difference in the ratings (out of ten) can be seen below:

Benefit from building high-trust relationships today

The value of trust is evident. It delivers economic benefits such as easier upsells and increased revenue, as well as goodwill benefits such as a stronger brand, better reputation, positive word of mouth and more.

So, how can you build high-trust relationships that benefit you and your clients?

The first step is to establish how effectively you are currently communicating your trustworthiness to clients by asking yourself these four questions:

- How well are you conveying to prospects that you will help them to establish their needs and goals quickly and easily?

- How well are you conveying that you care about your clients first and foremost and that you are honest and responsible?

- How clearly are you articulating the benefits your services provide, value for money and transparency of fees?

- How well are you demonstrating your practices’ technical expertise, qualifications, accuracy, skills and knowledge? Is your practice, the quality of your services, your staff and your processes highly rated?

Your answers will help identify areas that need improvement or processes that may need to be developed in order to help you build high-trust adviser client relationships. Consequently, you can leverage our Adviser Trust Model to help you implement the actions and strategies required to build high-trust relationships with both current and prospective clients.

Let the Beddoes Institute help you build trust and better your business.

To support your business and help you become truly client-centric, Beddoes Institute is offering you the opportunity to receive FULL FREE access to the Client Experience Survey. In addition to receiving your own Adviser Trust Score calculated from the trust framework outlined in this paper, this market-leading tool will enable you to find out what your clients really think about you, and it will also show you how you perform compared to Beddoes’ high-performing adviser and practice benchmarks and provide clear guidance on how to strengthen trust with your clients.

Plus you’ll have the opportunity to qualify for Beddoes’ Most Trusted Advisers (MTA) Network. Launched in 2014, the MTA network is a consumer-focused brand that represents the best of the advice industry to peers and consumers.

Simply complete Beddoes Adviser Experience Benchmarking Study to:

- Tell insurers how they can better support you and your clients;

- Have your voice heard on how industry changes have impacted your business;

- Receive FULL FREE access to Beddoes’ Client Experience Survey; and

- Take your first step towards becoming part of Beddoes’ Most Trusted Advisers (MTA) Network.

This article is based on a white paper published by the Beddoes Institute: “Why Trust is the Cornerstone of Business Growth and Sustainability”

Web: beddoesinstitute.com.au

Email: info@beddoesinstitute.com.au

Ph: +61 3 5974 8198