The Financial Services Council has called out ASIC’s reliance on data from 2016/17, used in the regulator’s recently released report that found ‘significant industry-wide problems’ with the design of total and permanent disability insurance and the claims handling process.

ASIC called on insurers and trustees to take action to improve consumer outcomes from TPD insurance, stating the issues it uncovered mean many consumers can’t rely on this cover when they need it most.

“Over 12 million Australian workers automatically pay for TPD cover through their superannuation to provide financial protection when they are so sick or injured that they can never work again. ASIC expects industry to make prompt changes to ensure this cover provides real value,” the regulator stated in its release presenting the report, ‘Holes in the safety net: A review of TPD insurance claims’.

The FSC responded with an analysis using more recent 2018 data on TPD claims in life insurance.

FSC CEO, Sally Loane, says ASIC’s report fails to highlight the significant positive reforms the industry has initiated since then, including the introduction of the Life Insurance Code of Practice and the world-class FSC/KPMG claims data initiative.

“The 2018 data tells a very different story…”

“The 2018 data tells a very different story and ASIC’s report serves to highlight the substantial progress the life insurance industry has made in the last couple of years,” said Loane.

“KPMG on behalf of the FSC collect TPD claims data every six months and we know this data collection initiative is unsurpassed anywhere else in the world, both for its granularity and timeliness.”

According to ASIC’s review:

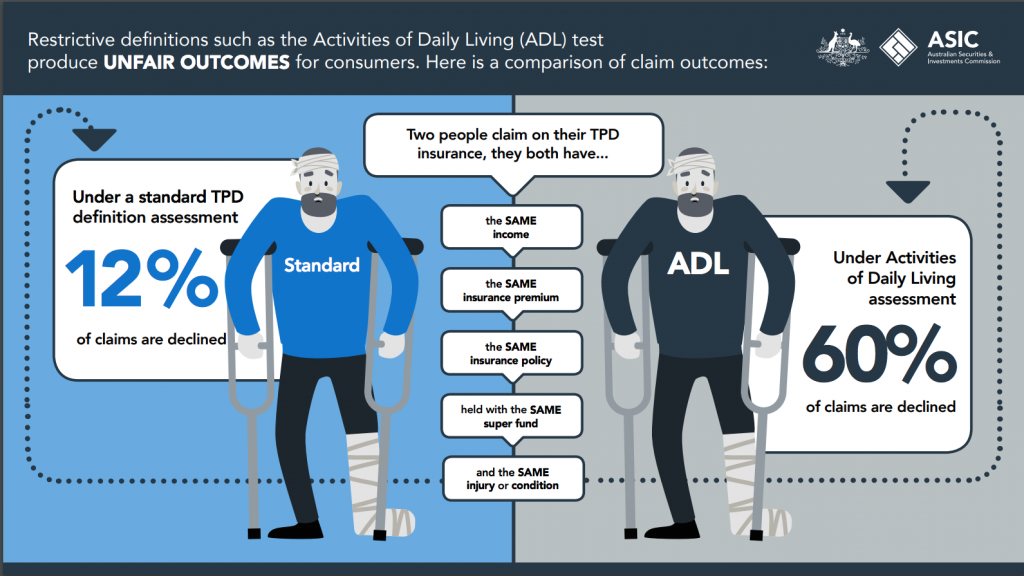

- Nearly half a million Australians are covered by a very narrow TPD policy definition that only pays out in the most catastrophic circumstances, if they are unable to perform several ‘activities of daily living’ (known as ADL cover), such as feeding, dressing or washing themselves

- 60% of claims assessed under this narrow cover are declined, which is five times higher than the average declined claim rate for all other TPD claims (12%)

- Poor claims handling processes contributed to some consumers withdrawing their claims: one in eight, or 12% of claims lodged with insurers did not proceed to a decision

- Insurers lacked key claims data to help them effectively manage the risk of consumer harm – including being able to identify the value of products to consumers and key friction points in their claims handling processes

“…three TPD claims a day are assessed under the restrictive ‘activities of daily living’ definition.,.”

ASIC Commissioner, Sean Hughes, says, “Alarmingly, we found that three TPD claims a day are assessed under the restrictive ‘activities of daily living’ definition, which has a concerningly high decline rate. People that hold this type of automatic cover through superannuation are typically paying the same premium – for what is essentially junk insurance – as people who can access less restrictive definitions under general TPD cover.”

He added: “We also find it inexcusable that insurers did not use, or in some cases even collect, data to enable them to identify the very poor consumer outcomes that are being produced because of these restrictive definitions.”

ASIC’s review found some of the problems consumers had during the claims assessment process included:

- Difficult lodgement processes

- Poor communication practices

- Multiple requests for medical assessments

- Excessive delays

Loane explained the FSC’s data to the end of 2018 shows 88 percent of TPD claims are paid in the first instance and 91 percent for mental health TPD claims. This includes claims against all definitions, including activities of daily living (ADLs), an initiative from the international medical community.

Loane explained the FSC’s data to the end of 2018 shows 88 percent of TPD claims are paid in the first instance and 91 percent for mental health TPD claims. This includes claims against all definitions, including activities of daily living (ADLs), an initiative from the international medical community.

She added the FSC’s 2018 data assessed a total of 11,427 TPD claims, of which 11,008 were assessed against an occupational definition, and only 419 or 3.6 percent were assessed using either a non-occupational or ADL definition.

“What this shows is that non-occupational definitions such as ADLs are almost always used as part of a hierarchy of definitions in group insurance in super,” said Loane.

“ADLs then only apply in the tiny proportion of TPD claims where a definition higher up the hierarchy can’t be used. This can be because, for example, the person isn’t in paid employment so a more generous occupational definition has no relevance.”

Loane also noted that the Life Insurance Code of Practice (The Code) now provides additional consumer protections at claim interviews and for surveillance to ensure claims are not withdrawn for inappropriate reasons.

She said that since the Code has been in effect, data from the Life Code Compliance Committee shows 92 percent of all lump sum claims in the year to 30 June 2018 were paid out within the Code timeframes.

ASIC conducted the review between 1 January 2016 and 31 December 2017 and focused on the following seven insurers which represent 65–70 percent of the total number of TPD claims:

- AIA Australia Limited

- AMP Life Limited and the National Mutual Life Association of Australasia Limited (part of the AMP Group of companies)

- Asteron Life & Superannuation Limited – previously Suncorp Life & Superannuation Limited

- MetLife Insurance Limited

- MLC Limited

- TAL Life Limited

- Westpac Life Insurance Services Limited

How dare they challenge the FSC they are omnipotent arn’t they ?????

Comments are closed.