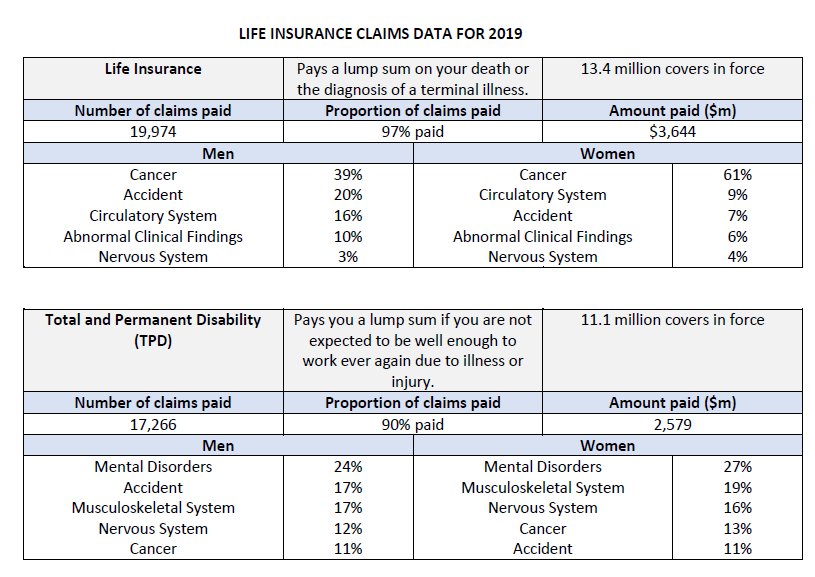

New data from the FSC, exploring the gender differences for claims, shows that the top cause of death claims is cancer for both men and women, but at a far higher percentage for women, and that for TPD claims, mental health disorders tops the list for both men and women at 24 percent and 27 percent respectively.

The FSC is using Life Insurance Awareness week as an opportunity to release 2019 data from KPMG, on behalf of the council, which provides in-depth analysis of the causes of life insurance claims, particularly for Australians of working age.

It says in a statement that this data is “…unsurpassed anywhere else in the world for its granularity and timeliness”.

The 2019 data released on Tuesday looked at the most common causes of life insurance claims that reveal some of the biological differences between men and women.

FSC senior policy manager for life insurance, Nick Kirwan says that the new claims statistics says a lot about the differences between men and women and across all three product lines the messages are clear.

- The top cause of death claims is cancer for both men and women. For men, it accounts for 39 percent of all death claims, but for women it accounts for a huge 61 percent, of which 29 percent are breast cancer and itself the most common cause, followed by colon cancer (15 percent) and lung cancer (14 percent). The second most common cause for men is accidents, accounting for 20 percent, whereas for women it’s the third most common cause at seven percent of female deaths.

- For total permanent disability claims, mental health disorders top the list for both men and women at 24 percent and 27 percent respectively. Once again, accidents come second for men at 17 percent, but for women it’s a different story, with accidents down in fifth place at just 11 percent.

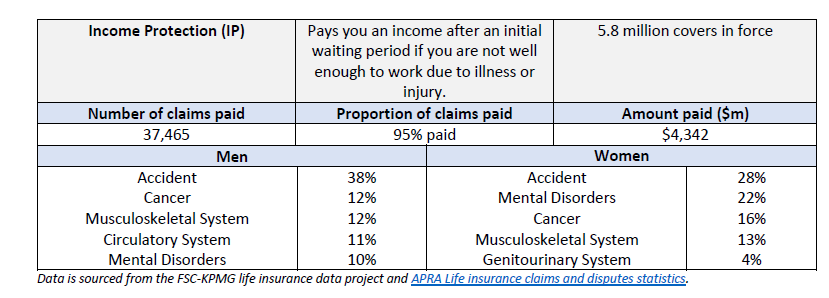

- Income protection claims reveals further granularity about the differences between men and women. The top cause for both is accidents, but again we see men having relatively many more accidents than women at 38 percent versus 28 percent. It also tells a different story for mental health, which comes in second for women at 22 percent, whereas for men it’s less than half that proportion at only 10 percent.

“This data confirms that for working age Australians, cancer is by far the biggest killer and it’s even more deadly for women than for men. We see that men have significantly more accidents than women, and women more mental health claims,” adds Kirwan.

The statement also laid out the proportion of claims being paid:

- Life insurance – 97 percent paid

- Total and permanent disability – 90 percent paid

- Income Protection – 95 percent paid.

At the FSC Life Insurance Summit on Tuesday a seminar on retail insurance also discussed this latest data with the AFA’s CEO Phil Kewin noting that the sums paid out and the number of claims fulfilled were amazing numbers. He said the industry has positively impacted people are who are negatively impacted by health issues.

And the FPA’s CEO Dante De Gori said in the same seminar the data highlighted the powerful role the life insurance industry is playing in putting people lives back together. If it was not funded by the life insurance industry, who would be paying for it, he asked.