The life insurance industry paid out more than $12 billion to nearly 102,000 Australians during 2019 or almost $33 million to 279 Australians and their families every day of the year, data from the FSC shows.

A statement from the council says it’s using Life Insurance Awareness week as an opportunity to release data which reveals insights into the health of the nation – with Wednesday’s theme being ‘data’. KPMG, on behalf of the FSC, provides in-depth analysis of the causes of life insurance claims – this data is updated every six months.

(Also see: Mental Health Tops TPD Claims for Men and Women – New Data).

FSC senior policy manager for life insurance, Nick Kirwan says that it’s important to remember that behind every data point there is a human, a family, a loved one getting financial support when they need it most.

“When we see the collective data, and especially the many and varied causes of claim and just how often they occur, it reveals the scale of the human tragedies that Australians and their families can, and all too often do, go through.”

Data insights for the 2019 year shows:

- More than $12 billion was paid out to 101,821 Australians

- For death cover there were 13.4 million covers in force, 97 percent of lodged claims were paid and the highest cause of claim was cancer at 43 percent

- For total and permanent disability (TPD) there were 11.1 million covers in force, 90 percent of lodged claims were paid and the highest cause of claim was mental health at 25 percent

- For income protection/disability income there were 5.8 million covers in force, 95 percent of lodged claims were paid and the highest cause of claim was accidents at 33 percent

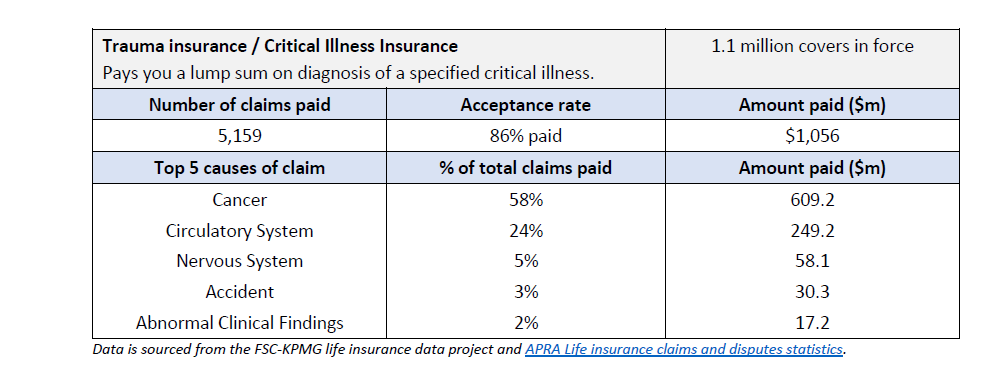

- For trauma insurance there were 1.1 million covers in force, 86 percent of lodged claims were paid, and the highest cause of claim was for cancer at 58 percent.

Interesting and one has to assume the FSC insurer members have not fudged the figures

Importantly the report states that “86% of LODGED trauma claims have been approved.” For years that figure was around 93%, so whats happened, given we have had “standardized” definitions ( read minimal) for some years.

Traditionally risk specialists have filtered out spurious trauma claims IF the client lodged via the adviser. With huge loss of risk advisers, are the spurious claims now actually reaching the insurer without filtering, costing the insurer time and money to deny the claim AND run the chance of being referred to AFCA and losing that lottery, all has changed, .

Chickens and roosts. Insurers are reaping yet another piece of un-intended collateral damage from their acquiesce to LIF when pushed by the banks. That’s on top of a 50% reduction in genuine NEW BUSINESS which is weakening every Statutory No 1 Fund in the country

Finally no mention from the FSC if these figures are retail( including Direct) ONLY, or combined with GROUP. That’s a long standing fault with these figures because the way insurers provide the information.( and yes I know there is very little Group Trauma)

Comments are closed.