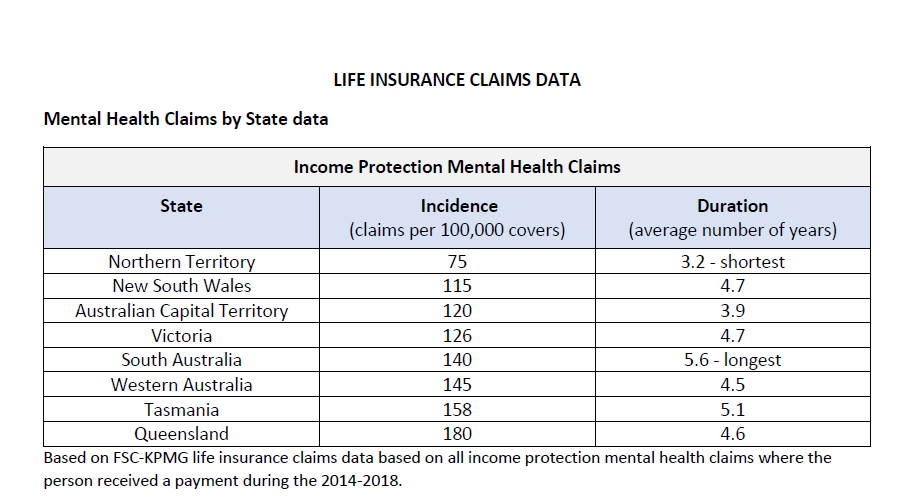

The incidence and duration of mental health claims for income protection varies widely depending on which jurisdiction the claimant lives in, according to new data from the FSC.

As part of Life Insurance Awareness week, the FSC last week published life insurance statistics on the incidence and duration of mental health income protection claims on a state-by-state level, reminding Australians that no community is untouched by mental health conditions.

FSC senior policy manager for life insurance, Nick Kirwan says that the data explains ‘what’ but doesn’t explain ‘why’. He says that the FSC hopes that by releasing this data it encourages debate on the topic, noting however that it’s clear that the prevalence and toll that mental illness takes on Australians needs to be tackled as a community.

“For their part, life insurers would like the option to pay for extra treatment as an early intervention measure. The longer somebody is out of work, the harder it is for them to get back to work,” he says.

The FSC earlier released life insurance claims data from 2019 confirming mental illness is now the highest cause of claim for total permanent disability and the third highest for income protection. (See: Mental Health Tops TPD Claims for Men and Women).

The statement says that together, life insurers paid $1.24 billion in 2019 to more than 9,500 Australians for these mental health claims.

Drilling down these headline figures, the council says the claims are for an extremely wide and complex spectrum of conditions. The list has a very long tail and the top five underlying types of mental health conditions account for less than half (46.9 percent) of all claims for mental health conditions as follows:

- 16.5 percent – depression, including single and recurrent episodes

- 13.4 percent – unspecified anxiety disorders, for example panic or anxiety attacks

- 11.3 percent – reaction to severe stress, for example post-traumatic stress disorder

- 3.6 percent – Alzheimer’s disease

- 2.1 percent – schizophrenia

KPMG on behalf of the FSC provides in-depth analysis of the causes of life insurance claims and this data is updated every six months.