Victorian risk specialist adviser, Andrew Dwyer, challenges the premise that a risk advice business can successfully operate under a model which includes charging fees for life insurance advice…

Having been open to the prospect of charging fees for risk advice in tandem with risk commissions – and having invested serious time, resources and effort into attempting to implement this model, Dwyer remains unconvinced that this proposition is a realistic, viable business model.

This conversation relates to risk specialist or risk-focussed advice businesses. It does not extend to business models where the adviser’s offer includes a financial planning proposition in which the cost of delivering life insurance advice can be absorbed or subsidised within the broader service package.

Dwyer was motivated to have his voice heard following the recent debate in Riskinfo sparked by our report on the release of the fifth edition of Elixir Consulting’s Adviser Pricing Models Research Report series (see: Fees for Risk Advice an Emerging Reality).

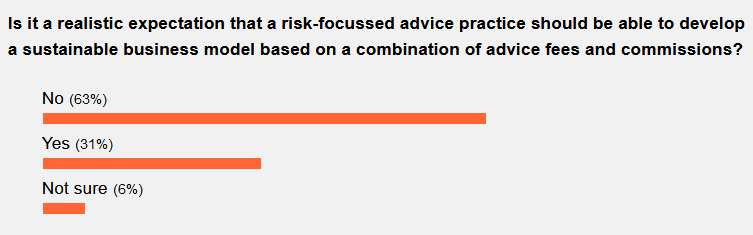

Significant debate followed the publication of this story, while the outcome of a poll we conducted which sought the views of Riskinfo readers appears to support the conclusion that the majority of advisers agree with Dwyer (see: Most Advisers Reject Fees for Risk Advice).

This chart summarises the results of the poll:

In speaking with Riskinfo, Dwyer was at pains to point out that his efforts in exploring the possibility of fees for risk advice reflected a ‘real-life’ rather than a theoretical experience.

He says that as an adviser whose passion is providing life insurance advice services, he has always been open to both sides of the ‘commissions versus fees’ debate and to trialing an advice proposition built around a combination of advice fees and commissions.

Dwyer’s blunt message, however, based on his own experience, is that this model does not work.

While he had already been moving to a hybrid commission model prior to the implementation of the Life Insurance Framework reforms, Dwyer says he seriously explored the business proposition where fees for risk advice acted as a supplement to the 80/20 hybrid commission model, followed subsequently by the 70/20 and eventually 60/20 mandates.

In exploring this model, he included different fee options in his clients’ Statements of Advice, which offered fees-only, a combination of fees and commission and commission-only options. In this trial phase, Dwyer says 100 percent of his clients and/or prospective clients rejected any pricing option which included fees.

He says the demographic range of his clients in this trial process extended from high-end ‘full advice’ clients who were also charged advice fees on superannuation and investment advice to ‘mums and dads’ clients whose annual life insurance premiums were $2k or less. He also noted that his under 35 YO clients overwhelmingly rejected any fee option, including the combined fees/commission model.

…the advent of the Covid-19 pandemic has seen this willingness from clients to pay even a small fee evaporate

In 2017 Dwyer says he began modifying his client conversations around fees and commissions to include smaller fee levels in the region of $200 – $300. While he says he was beginning to experience some engagement at that level, the advent of the Covid-19 pandemic has seen this willingness from clients to pay even a small fee evaporate.

At present, Dwyer says his advice business only remains viable because of the smaller proportion of his client base who receive a more holistic, comprehensive advice service including super consolidation services, cashflow and pre-retirement advice.

His point, though, is that he would prefer to focus almost entirely on life insurance advice because this is where his passion lies and this is the area where he believes he can make the biggest difference in the lives of his clients. He doesn’t want to extend the scope of his advice proposition just to ensure his advice practice remains viable. But he believes he has no choice.

Dwyer says he has left no stone unturned in his willingness to find a solution for his business which at least incorporates some form of fees for risk advice to accompany his commission income. This includes engaging business and financial coaches, seeking feedback from licensees and advice peers and subscribing to research and other publications which address this issue.

…listen to your clients

“In the end, listen to your clients,” says Dwyer, who have delivered him a resounding ‘no’ to any form of meaningful fees for his advice, whether stand-alone or in combination with commissions when appropriate.

While he appreciates the argument from business coaches about how to enhance the value he delivers to his clients, “…if the clients don’t see it, well, that’s where it’s at.”

Referring to other examples reported in industry media, including in Riskinfo, which have pointed to the successful implementation of a combined fees and commission model for a risk-focussed business proposition, Dwyer says “No-one can really show me the true, hard stats that say ‘this is how you do it’.”

He adds, “If they can do that, then I’m still onboard and I’m happy either way.”

Bombora Advice case study

Lending weight in support of Dwyer’s position is Bombora CEO and Founder, Wayne Handley. Referencing another ‘real life’ case study, Handley highlighted Bombora’s experience in dealing with one of Victoria’s largest and most successful regional accounting firms. He told Riskinfo the firm had reached an impasse in their business in which their financial planners – following referral of the client to them by the accountant – had introduced fees for providing life insurance advice.

Handley characterised this initiative as ‘spectacularly unsuccessful’ – an initiative which led to ever-increasing reluctance from the firm’s accountants to refer their clients to the planners where the client was required to pay a fee for the ensuing life insurance advice.

Bombora was called in by the firm to take over that portfolio for reviews, claims services and ongoing advice, the outcome of which Handley described as ‘spectacularly successful’. He says Bombora advisers provided advice to 50+ of the accounting firm’s clients in the first six months of the arrangement, which experienced a three-point ‘Win/Win/Win’ outcome, namely:

- The client is now in a far better position because they’ve been able to access life insurance advice

- The accountants and financial planners have met their best interest obligations

- The risk exposure to the financial planning part of the accounting business has been significantly mitigated

Handley reinforced the point that charging any form of fee for life insurance advice – in the cold hard light of day – does not work and will not support a viable advice business because, in reality, clients are rejecting the notion of paying fees for life insurance advice.

In affirming that Dwyer and Bombora were in the business of saving lives and saving livelihoods, Handley said their future rests in focussing on ways of engaging more consumers in life insurance discussions: “…not charging more, but seeing more people.”

Handley continued, “We want more clients receiving more life insurance advice in Australia and we know the current [commission-based] model works.”

Meanwhile, the agenda for Dwyer is to find the hard data – the ‘proof’ that demonstrates it really is possible to operate a successful risk-only advice business on a model that combines fees and commissions. His preference is to not deviate from the specialist model.

Handley’s final message was also clear: “In the end, it’s about client choice. And at the moment, our clients are choosing 100 percent – one way.”

We are a Risk Specialist business who was and is still open to the idea of charging a fee for service and currently provide clients with the CHOICE or Fees, Commission or a combination of the two. We are reasonably successful at charging an initial SOA fee, occasionally and Implementation fee, however, have ZERO success at ongoing service fees and the two clients we had on a FFS arrangement have now stopped paying their annual fee.

The debate should be isolated to Risk Specialists only as I’ve been grappling with this for over 10 years and fortunately we have branched into other areas where fees are more ‘natural’ such as estate planning, Business Succession and Claims Advocacy, in fact I generate more new business income in fees from these 3 areas today than new business upfront risk commissions which I am grateful for.

The challenge for a Risk Specialist is our upfront commission have effectively halved over the past three years so you have to supplement the loss of income in other ways, however I’m yet to come across a Risk Specialist ONLY business who has successfully fully transitioned from commissions to FFS but always open to learn. I’ve heard plenty of antidotal evidence but yet to find a Risk Specialist ie not a Financial Planning firm who is 100% FFS.

Having reflected on this a lot I think the government/ASIC/FSC and co should have left things at an 80:20 split whereby advisers could top up with a small SOA/Commitment fee but that’s history now so as a Risk Specialist we need to find other things to discuss with our clients that align with a risk model.

I’m hoping pragmatism will ultimately prevail in this debate as the 100% removal of risk commissions will spell the end of risk specialisation in my opinion.

Here’s a thought.., if a risk only client was on a FFS, as per Adam’s comment which reiterated that the client cancelled their FFS sometime after writing the policy. So, while the Insurance companies allow us to reduce the commission and the client pay us directly, (a wholesale rate if you like), then if the client cancels the premium, maybe the premium should rise back to the retail rate, being the full premium with the commission added back. This of course would not fly with the governing powers, (insurance companies receiving commission on their own product), however with some thought, maybe it should be called a Retail Rate and a Wholesale Rate and the Premium defaults to the Retail Rate if a client cancels their FFS/relationship with the adviser.

It is because of us, they received the best advice to suit their needs and at the best price and now we are left out in the cold, I can however see why the client would cancel the FFS as it stands now.

In some cases a superannuation client, once setup could cancel their FFS and be left with Wholesale fund manager MER/ICR’s..?

Adam – correct me if I am wrong but didn’t you feature in a book written by a well know promoter of fees-for-risk-advice only. As a reader, I was led to believe it HAD worked. Seems in the long run that is not the case, as I have argued occasionally with the author. If I am wrong I apologize in advance to yourself and the author

My experience is that you have to pick your mark – BUT most object to a fee when they know you are receiving commission, regardless of amount. As to levying fees on existing clients who came on board originally via commission only, stand by to repel boarders.

Yes that’s correct and I do incorporate fees with commissions for advice/implementation on a case by case basis, however charing an ongoing fee for service only year in year out has not been successful as the clients on these ongoing previous arrangements stopped paying the fees.

I love your comment Andrew – “No-one can really show me the true, hard stats that say ‘this is how you do it’.” I challenged Chris Unwin on this in Risk Info a few times in recent years when he advocated fees for insurance advice, but he never responded. Coaches like Chris and Elixar Consulting, must somehow get the message from the above article. For that matter, so do the retail life insurers. ASIC are supposed to be conducting an audit in 2021, and as Commissioner Hayne said, if ASIC cannot find a reason for keeping commissions, they must go. That will definitely be the end of the retail life insurance industry. We all know ASIC’s audit in 2014 was flawed and resulted in this mess we’re all in. Before they conduct the 2021 audit, the life insurers must go to the govt collectively, along with the AFA and FPA, and clearly show the mess we are in, the dire consequences moving forward if things remain unchanged, and present a solution.

I am totally on board with the theoretical charging of fees for risk advice. I am also totally on board with theoretical world peace & ending world hunger, eliminating Covid in 2 weeks by using common sense and the end of any and all industry compliance and education that has no benefit to the client. Then I open my eyes and see the real world…

Andrew and Wayne are reinforcing what has been the vast majority of Australians choice of how they wish to pay for Life Insurance advice.

What has happened, is vested interest groups and theory based experts have rejected what Australians want and instead, forced their opinions and agenda upon all and sundry, to successfully lobby and have the LIF and FASEA “regulatory maze to oblivion,” imposed on us all.

APRA will need to be hauled over the coals, as what they want to impose in the future, is not dissimilar to the current insane system, where another Regulator who knows very little about how Life Insurance works in the real world, wants to impose even more pressure to an Industry that is buckling under the weight of “over regulation” and unworkable restrictions of trade.

Comments are closed.