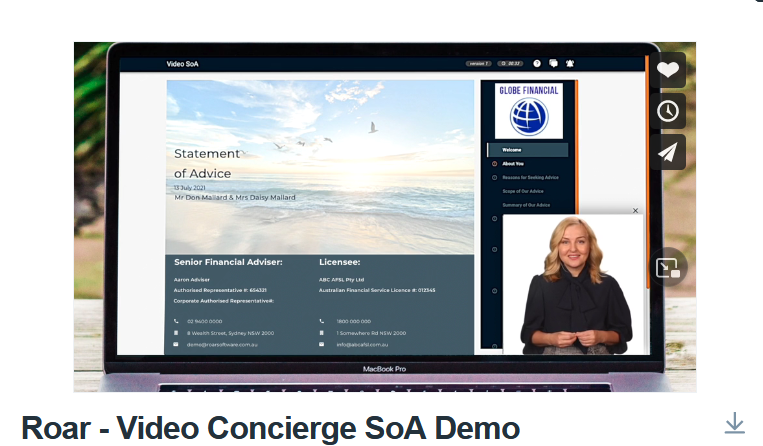

Financial planning technology company, Roar Software, has announced it has launched what it says is Australia’s first dynamic statement of advice tool with a human avatar to help drive client engagement amidst ongoing Covid lockdowns and business disruption.

The company says in a statement that the launch of DynamicDocs follows Roar signing an exclusive partnership with Australian customer engagement video software platform, HumanableCX, to leverage the group’s “…innovative human avatar technology”.

Kevin Liao, Chief Executive Officer at Roar Software, says DynamicDocs is designed to help advisers run more efficient practices, manage their compliance obligations and build a scalable proposition for low account balance clients.

The company says the tool effectively converts Word-based SoAs into an interactive web-based experience that includes:

- Personalised tables and graphs, using data pulled from an array of advice applications in the Roar Advice Marketplace

- The tracking and recording of time spent reading materials

- The ability for clients to interactively post questions for their adviser

Liao says the latest round of Covid-19 restrictions “…highlights the limitations of traditional advice processes which are too rigid and haven’t kept pace with changing consumer trends”.

He adds that the format is still largely based on lengthy face-to-face meetings in an adviser’s office to walk through spreadsheets and documents together, noting that in 20 years that formula hasn’t evolved, but people are engaging their service providers differently.

“Advisers don’t need to spend hours in front of every client to demonstrate their value and, as the cost of providing advice continues to rise, they will need to embrace scalable technology to drive efficiencies and make advice more affordable.”

Roar Chairman Darren Pettiona says that DynamicDoc’s built-in features – such as the ability to add consent check boxes to specific pages and sections, and keep an audit trail of updates and changes – provided a layer of protection for advisers.

“If the institutions, with their large teams and budgets, struggle to manage risk and compliance then small practices will find it increasingly difficult, which is why they need to utilise readily-available technology solutions to help them meet their obligations to all stakeholders including clients, regulators and equity holders,” he says.

Liao says that DynamicDocs supported visual learning in addition to verbal and written communication.

He adds that in the context of Australia’s impending $3.5 trillion intergenerational wealth transfer, digital tools like DynamicDocs could help advisers bring a client’s children and grandchildren on the journey, aiding client retention and acquisition.

“The way advice is presented using DynamicDocs, with the ability to add a human avatar to guide clients through the process, enables parents to share information with children and grandchildren. They can then view and digest that information in their own time,” he says.