The pass rate for advisers re-sitting the FASEA exam in July was only 39 percent, according to Wealth Data’s Colin Williams.

Writing in his Weekly Financial Adviser Movement report Williams says what was not explicitly stated in the FASEA media release on the July exam results were the pass rates for those re-sitting the exam. (See: More Than 16,000 Advisers Have Passed FASEA Exam.)

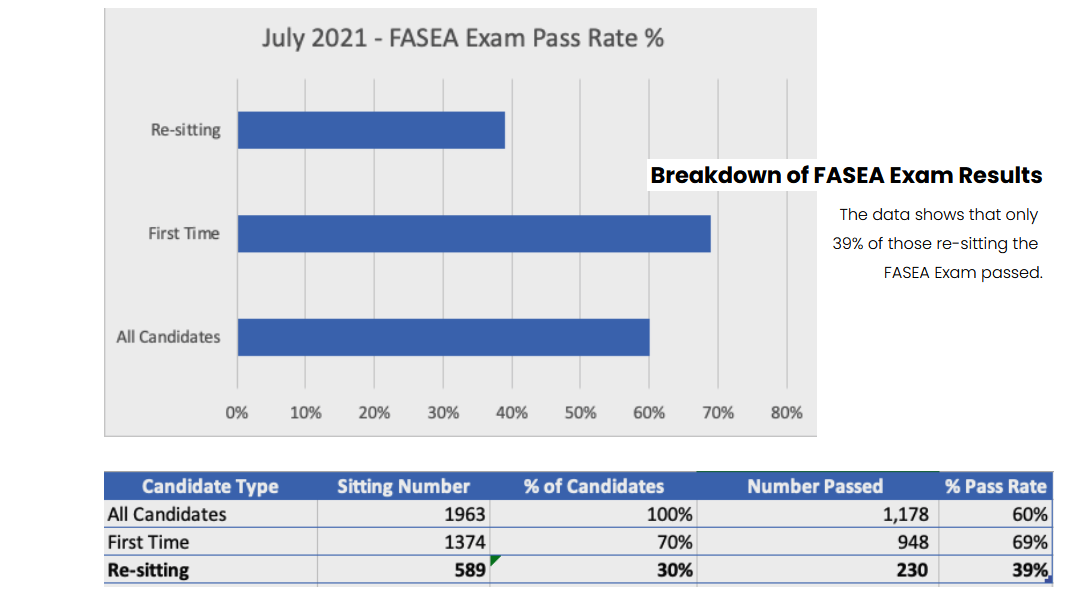

He says the release did highlight that the pass rate for July was only 60 percent out of 1,963 candidates, and for those sitting the exam for the first time the pass rate was 69 percent.

“Lets break this down further as it also stated that 30 percent were re-sitting. This means that out of a total of 1,963 candidates, 589 were re-sitting and only 230 passed or 39 percent.”

This, he says, is a significant fall from the 65 percent who have re-sat the exam in total.

Williams adds that there are still exam sittings in September and the “…big one in November whereby anyone willing to have a go can sit as opposed to waiting out three months.” He also notes that in 2022, advisers who had failed at least twice by Dec 2021 will have an extension of time to September 2022 to pass.

He says that given all of this, it is quite hard to predict the total number of passes and in return the number who advisers that will remain on the FAR.

“FASEA states that 18,140 have had a go and one would have to suspect not many more will join this list, i.e. we will be down to mainly re-sits.

“With some 2,000 advisers passing but not current [on the FAR], this would suggest we will end up with between 15,000 to 16,000 advisers.” He says this is currently sitting at 14,070 for those who have passed and are current on the FAR.

…the bigger issue will be post the FASEA Exam…

Williams says the bigger issue will be post the FASEA Exam.

“Advisers will continue to leave through natural attrition (retirements, change of career etc) and assuming that there are 16,000 advisers and natural attrition is only 4 percent, we would need 640 new advisers just to stand still.”

He notes that new incoming advisers are currently very low numbers and that there is the requirement of advisers to hold a degree equivalent by Jan 1, 2026 “…which will inevitably see a further fall in experienced advisers.”

“Eventually, licensees and practice owners will have to develop new advisers to make up for the lost nursery of advisers that was once the domain of the banks.”

He says some licensees will give this a go, “…for example, Infocus just announced that they will support their practices to bring on new advisers for their professional year. Will need to see a lot more join in and develop new talent.”

What was stated from day one of the FASEA fiasco, was that it was flawed and needed to be changed, or the end result would be a mass exodus of advisers.

No-one listened and it has only been after the Industry has seen many thousands of Advisers who said they would leave unless FASEA was overhauled, actually did exit, that led to a paltry change that has only delayed the inevitable and will still lead to further massive losses of Advisers for NIL BENEFIT to Australia.

Jeremy, we have lost. I’m not certain about Labor’s stance on FASEA, but I know for a fact the Lib’s agenda is to “ drag the industry (kicking & screaming if necessary) into becoming a profession. Big mistake to make a blanket statement about an industry that still sells product in return for commissions. If the AFA et all, continue down the path of supporting the industry becoming a profession, then my fear is that whoever is in power will have no choice but to abolish commissions on life insurance. After all a profession can’t scientifically be known as one and still sell products for commissions. It’s a conundrum.

Comments are closed.