What interested advisers most during this past week has been the fact that the three largest licensee groups in Australia have accounted for 52 percent of the loss in net adviser numbers so far in 2021. This adds to a further weight of evidence supporting the fact that the financial advice sector continues to realign or re-set itself in the wake of the dismantling of the vertical ownership of advice distribution by Australia’s banking sector…

The three largest licensee groups represent 52 percent of adviser net losses in the year to date, according to Wealth Data’s analysis.

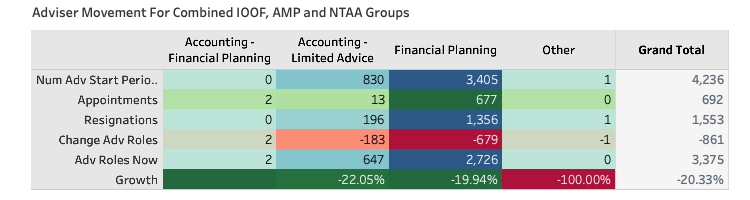

The key message coming from the firm’s latest update, which examines weekly adviser movements, is that the total net losses in the year to date is 1,649 and that the top three groups, AMP, IOOF and NTAA, have lost 861 roles or 52 percent of the total.

Wealth Data’s Colin Williams writes the latest data shows that these three largest groups represent 3,375 adviser roles, or 17.5 percent of all current adviser roles.

He says that at the start of the year “…they had 4,236 roles or 20 percent of all roles which was 20,968. Their net decline as a group was 20.33 percent.”

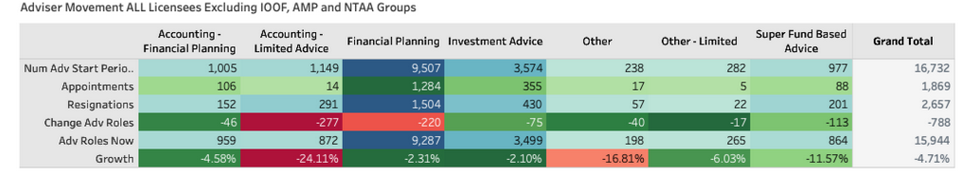

Williams adds that the sector as a whole, excluding the three groups, declined from 16,732 adviser roles to 15,944 down 788 roles (4.71 percent.)

The report points to IOOF being down 401, AMP Group (-279) and NTAA at (-181) to a total of (-861).