Many Riskinfo readers were interested this week in NMG Consulting’s take on the impact it says a scaled advice model – and other reforms to simplify advice – would have on the number of Aussies eventually holding life insurance cover…

The combined effect of simplification of comprehensive advice and the introduction of a scalable advice model for life insurance would see a million more Australians with life insurance cover, according to new research released by the Financial Services Council.

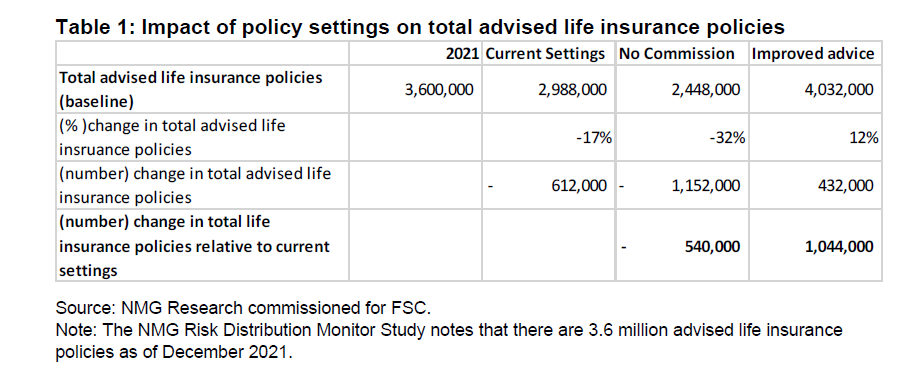

The council says that research by NMG Consulting has found that if the Quality of Advice Review results in the implementation of a scaled advice model and other reforms to simplify advice “…there will be a 12% increase in the number of Australians with life insurance cover, or 432,000 Australians. This is relative to a decrease in life cover for 612,000 Australians under the ‘do nothing’ approach.“

The FSC commissioned NMG Consulting to analyse under-insurance in Australia and to model three scenarios, including one in which the FSC’s reformed advice framework was adopted in conjunction with a simplified advice model that allows for scaled advice to assess cover required beyond default cover levels.

It says that proposals to reform the advice framework will reduce the cost of providing advice by almost $2000, while maintaining commissions, “…allowing people to get advice at times when they need life insurance protection but cannot afford an up-front fee to pay for it.”

CEO of the FSC Blake Briggs says the Government has a “rare opportunity” to deliver affordable and accessible advice to consumers as an outcome of the Quality of Advice Review (see: Clarifying Purpose of the QoA Review).

He notes that the council’s research shows “…how the unmet life insurance needs of consumers can be addressed by comprehensively reforming the regulatory framework, not just tinkering with it.”

…If nothing changes, the number of life insurance policies held by Australians is set to reduce by 17% in the next five years…

“If nothing changes, the number of life insurance policies held by Australians is set to reduce by 17% in the next five years, leaving Australians without cover when they need it.”

Briggs says these insights also suggest the benefits that a reformed financial advice framework can have “…across the broad range of financial services that consumers must navigate, from superannuation savings, to investing for the future for themselves and their families.”

In its submission to the Quality of Advice Review, the FSC advocated for a comprehensive reform of the advice framework “…that has largely been reflected in Michelle Levy’s proposed ‘Good Advice’ framework released for consultation in the Review’s Proposals Paper.”

It says these reforms will reduce the cost of providing advice and include:

- Abolishing complex Statements of Advice for a simpler, consumer-focussed ‘Letter of Advice’

- Breaking the link between financial products and advice

- Abolishing the safe harbour steps for complying with the Best Interests Duty

less than 10% of life insurance advice …placed without any commission

The FSC says the research also finds that:

- In Australia today, around 15 million people are currently insured, collectively paying a total of $17.3 billion in group life and individual insurance premiums each year

- In total, there is an estimated one million Australians who are under-insured for Death/Total Permanent Disability insurance and 3.4 million who are under-insured for income protection insurance

- Commissions on advised life insurance remains an important component of adviser remuneration – with less than 10% of life insurance advice being placed without any commission, and most consumers not being willing, or able to afford, to pay an upfront fee for life insurance advice

So the FSC thanks the QAR “thought bubbles” on less complexity for advice is a good idea?

Well, as Mandy Rice Davies once said about Mr Profumo’s denials, “he would say that, wouldn’t he?”

Of course, the FSC has skin in the game. They want what remains of their insurer members to be able to flog horrible products direct to unsuspecting and un-sophisticated consumers, without all those silly rules about personal advice.

The bottom line is that unless FASEA Standards three, five and six are heavily modified, most AFSLs will insist on full SOAs in the current format, backed up by copious file notes.

QAR is a show trial folks, set up by a previous government in its desperate last moments, and it will prove even more useless than the recommendations of a Royal Commission that get tossed in a drawer in a back room in a Ministers office somewhere.

Give me strength!

Comments are closed.