The continuing strong sales growth reported by APRA in the retail IP market has captured the attention of Riskinfo readers and is our Story of the Week…

Latest APRA data reveals Individual Disability Income Insurance profits continue to significantly outperform all other risk product sectors.

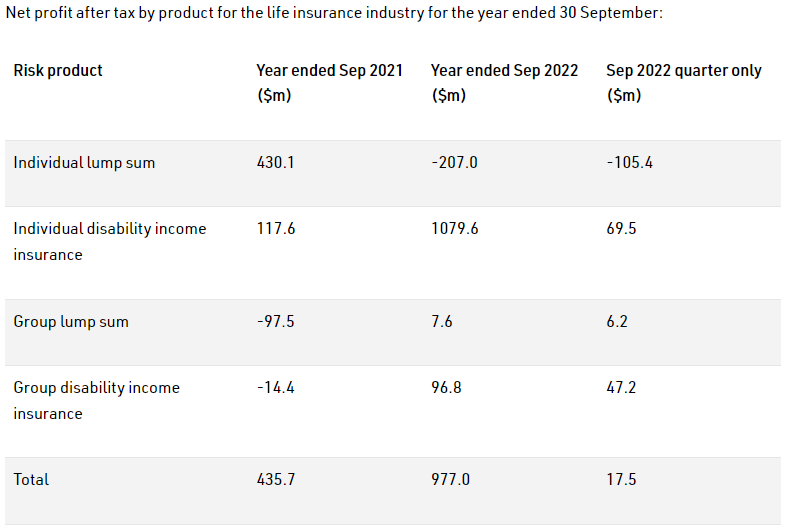

The corporate regulator’s life insurance performance statistics for the September 2022 quarter, released late last week, report an improved result for the sector for the year ended 30 September 2022, recording an overall profit of $977 million compared to the September 2021 profit of $435.7 million.

This result, however, was predominantly driven by an approximate $1.1 billion profit recorded by Individual Disability Income Insurance, which APRA notes can be attributed to:

- Repricing activities

- Reserve releases as a result of increases in bond yields over the past 12 months

The September 2022 report also revealed a loss of $207 million for individual lump sum insurance products. This represents a decline in performance compared to the previous year, with APRA noting this is the only risk product segment (across individual and group sectors) to report a loss, which it says can be attributed to an increase in net policy expenses:

The year ended June 2021 was the last time APRA reported a 12-month loss for individual IP products ($-345.5m), which was followed by a progressive trend in profitability as follows:

- Y/E June 2021: $345.5m loss

- Y/E September 2021: $124m profit

- Y/E December 2021: $546m profit

- Y/E March 2022: $723m profit

- Y/E June 2022: $1.15 billion profit

Click here to access APRA’s highlights report for its Quarterly life insurance performance statistics for September 2022.

Not hard to achieve with annual premium increases of 20-30%. Keep it going & no one will be able to afford IP products

“This result, however, was predominantly driven by an approximate $1.1 billion profit recorded by Individual Disability Income Insurance, which APRA notes can be attributed to:

Repricing activities”

If clients are walking because of the gouging currently being experienced in IP, then profits will be up because there won’t be too many claims from ever decreasing number of policies.

And I haven’t seen any evidence which proves that the justification made by Apra in 2021 that premiums for IP would go DOWN with the new contracts, compared to the legacy policies.

Anyone who believed that promise from Apra should go and smell the roses with the rest of the fairies in the bottom of the garden, or even join the Greens party

Do not forget the 40% commission retained by the Life Offices on new IP policies as well as

Life, TPD and Trauma policies. That 40% new business commission will have had a big impact on IP profits as well. Think about of it this way, for every $10,000 of IP new business commission $4,000 is retained by the Life Offices, that alone will have added to increased profits. The annoying thing is Life offices should have used the 40% equally by reducing client premiums.

Life offices across all products should be booming with profits.

I am not sure what we the advisors receive in return except dealing with clients who have found premiums are now so high they are unable to afford Life office IP Premiums.

Spot on Reg. Good words. Clearly unsustainable. What can’t continue . . . won’t.

The life company does not “retain” any commission. The commission is a cost to the life company. No-one gives them money for that to “retain”.

I agree the life company is paying 40% less upfront commission. But they are also paying 10% more renewal commission in every other year. On balance, the cost of commission is actually not much changed or even higher (especially if you have good retention). So, not sure there was any value to give away there.

There is some education needed on what results get reported by APRA and the life companies.

Perhaps riskinfo could do a short article on that?

The short version: The results are NOT “soaring profits” of $1b. Instead, it means the life companies are forecasting $1b less in losses than what they were expecting 12 months ago.

The longer version:

When life companies expect to make losses, accounting rules dictate that life companies must bring all future losses into account in reporting. [Eg if you expect to lose $10 for the next 10 years, accounting makes you declare $100 loss this year and nil for next 9 years]. So the large reported losses over the last years was all the life companies accounting for all their expected losses. You can see by the trend up until 2020, the companies were predicting larger and larger losses.

When life companies expect to make less losses in the future, they reverse the expected future losses they previously booked. For example, in the example above. If the life company thinks it will now lose $5 a year for 10 years, it expects to suffer $50 in losses. Because it previously accounted for $100 of losses, it releases $50. Which looks like a $50 profit. But it’s not.

[An aside. New accounting rules start next year (2023) which will make it nigh on impossible to understand results for life companies that have loss making business at the transition to the new accounting rules.]

Comments are closed.