Our report on the potential loss of thousands more advisers – on top of the ten or more thousand who have already departed the sector or handed in their authority – drew the most interest from Riskinfo readers this week…

The financial advice profession could lose another 3,500 advisers, with thousands still on the fence about whether to stay or go, according to Adviser Ratings.

In a “sneak peek” article, the research firm says that for those who are undecided about staying, the uncertainty is partly driven by the wait for clarity on how experience will be recognised.

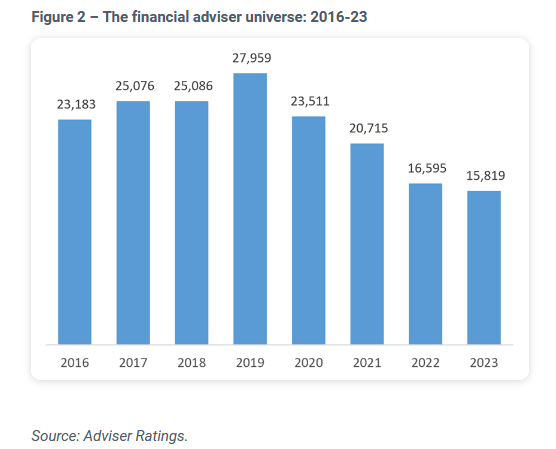

Adviser Ratings says this is based on analysis from its annual Financial Advice Landscape Report, noting that by the end of 2022, the financial advice universe had shrunk to just over 15,800 advisers, with more than 12,000 departing in the preceding five years.

…we still expect more than 1,500 advisers to leave…

“While there are positive signs the mass exodus has largely stalled, with a much quieter 12 months of departures last year, we still expect more than 1,500 advisers to leave,” the firm states.

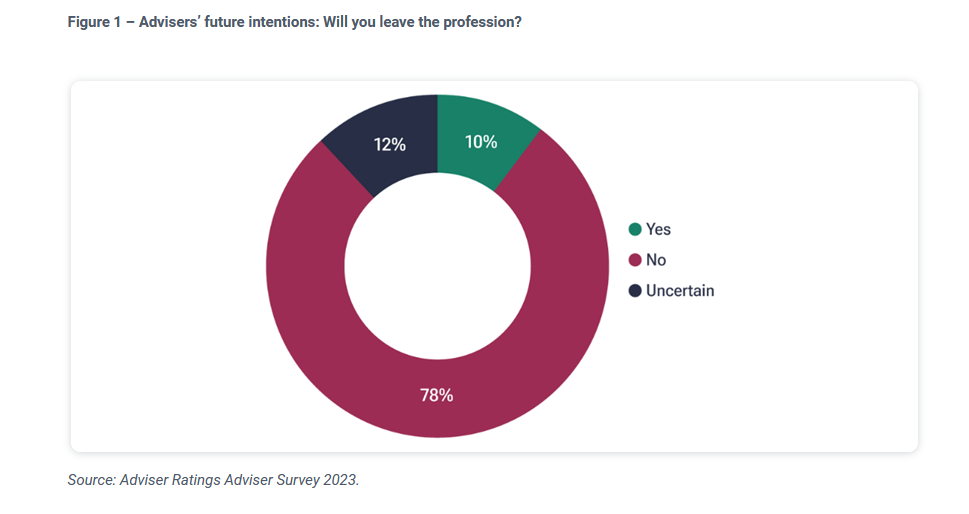

It notes its predictions are based on its annual adviser survey in which it asked professionals about their future intentions. “A further 2,000 are not sure whether they’ll stay at this stage.”

Adviser Ratings says while it’s unlikely that every adviser who is unsure will depart “…our analysis indicates the future of education standards will dictate the path for some advisers.”

Adviser Ratings says while it’s unlikely that every adviser who is unsure will depart “…our analysis indicates the future of education standards will dictate the path for some advisers.”

It explains that before winning the 2022 Federal election, the Government committed to scrapping tertiary education requirements for advisers who passed the exam, and had 10 years’ experience and a clean practice record.

The firm says that currently, advisers have until 2026 to complete their approved degree or bridging requirements. “However, the … Minister for Financial Services, Stephen Jones, said last year he would investigate how standards could change – in a practical sense – to recognise experience.”

Adviser Ratings says Jones has remained committed to keeping the adviser exam, but said Treasury would look at whether improvements could be made, such as reducing the number of questions. The consultation process also looked at how to attract new advisers to the profession at a time when numbers are quickly falling.

“We’re told the wait for certainty about what will happen with education requirements – specifically experience recognition – is creating anxiety among advisers,” it says.

The Adviser Ratings Landscape Report

The Adviser Ratings Landscape Report

The company says that the research on advisers’ future intentions was collected as part of its annual Australian Financial Advice Landscape Report, which paints a detailed picture of the financial advice market.

“For this year’s report, we’ve surveyed thousands of advisers, consumers and product providers, about topics including the demand for advice, practice health, areas of investment and divestment, profitability and revenue.”

It says that this year, it has incorporated more data sources, such as leads on the Adviser Ratings platform “..which provide rich information about who is seeking advice and what specifically they want.”

The firm will release 2023’s Australian Financial Advice Landscape Report later this month.

The question of how many Advisers might leave should be a major area of concern and based on the fact that 12,000 have already gone and natural attrition over the next 5 years will add up to thousands more leaving, is a pretty clear picture of how this whole fiasco has panned out and will continue, unless radical changes are made to make it easier for new people to enter and rebuild the Industry, especially in the risk advice sector that has been decimated.

Simple Math shows that 20,000 risk advisers as a minimum are required, which equates to 650 clients / Businesses per Adviser, based on a low estimate of 1 million Businesses and 12 million Adults who would need Life / disability Insurance to pay off debt and help pay ongoing expenses if they die or are unable to work and earn income.

Currently, very few University graduates over the last few years have come from Uni and said they will specialise in risk advice and the current mantra is that to enter the risk Industry, you must be subjected to a maze of irrelevant, expensive and time consuming study that defies all sense, unless you are a vested interest Education lobbyist who all they can see, are fat fees though are too blind and stupid to realise that their greed is their own undoing and has caused multi-billion dollar losses on all Australians due to clear and well documented warnings from myself and hundreds of other experienced practitioners, who for a decade have warned what would happen and as we foretold, did happen, with thousands of Advisers leaving and insufficient new people coming in to the Industry to plug the gaps, with the subsequent drop in New Business, premiums doubling and remaining holistic Advisers moving away from risk advice, further exacerbating the decline.

The solution today is the same solution years ago, when we said there MUST be a separation of risk and investment advice, with relevant studies that match the work performed.

This is not rocket science and with the current model, there will NEVER be a lift off for risk advice until the relevant bodies start to understand what they are doing is wrong and to make this simple change, which will encourage and allow Adviser practices to work towards the 20,000 Adviser minimum required.

All spot on Jeremy, good words as usual. Your last paragraph should include something about a substantial lift in remuneration for Riskies (sorry but 60/20 is an insult for the work/risks involved) as Riskies can’t charge their own fees. Well they could try, but it won’t work, as we all know only too well. This and a change from 2 year to 1 year chargeback responsibility period.

Without these two changes the distribution of risk products WILL be left to direct life company selling AND the hapless investment adviser, sometimes called a financial planner. They don’t, generally, have ‘risk’ as part of their passion or DNA as a pure risk adviser does. All I can do is wish the poor ol’ consumer the very best of luck getting proper and appropriate protection in place, keeping it current AND claiming on it.

As an ex trade unionist, the answer is simple.

With-hold your labour. Unless demands around rem and education etc are met. With-hold your labor. No new business, no client servicing etc, etc, etc. The problem is, at the moment the insurers and regulators think they have the power. Show them they don’t.

Comments are closed.