News that advisers delivering insurance-only advice charge their clients an average advice fee of $1,689 in addition to any commission income they receive, generated strong reader interest this week…

Advisers delivering insurance-only advice charge their clients an average advice fee of $1,689 in addition to any commission income they receive.

This is one of the key findings stemming from Elixir Consulting’s latest practice management research study, set for release shortly, but also shared with advisers by Elixir’s consulting team during this month’s Riskinfocus 24 Risk Advice CPD Tour during a session entitled: Delivering profitable risk advice – pipe dream or possibility?

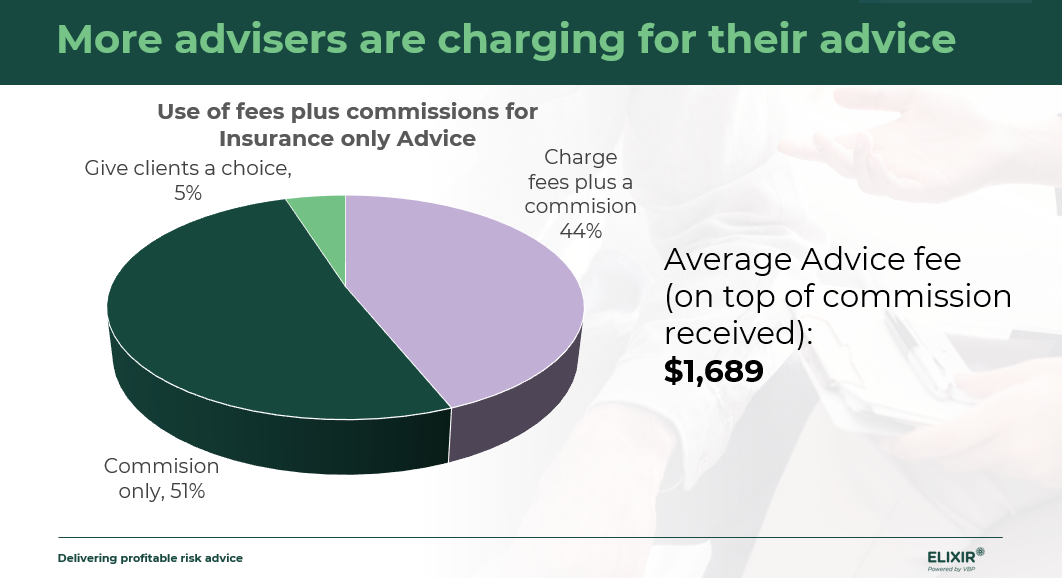

…44% of those providing insurance-only advice now charge a fee

In its largest industry study yet, Elixir (which was acquired last year by services firm VBP) consulted with 171 advisory firms representing 561 financial advisers and 43 risk specialists.

It found 44% of those providing insurance-only advice now charge a fee in addition to any commissions attaching to the advice outcome. This number represents an increasing proportion of those charging fees for risk-only advice. 51% were found to still operate under a commission-only model, while the remaining 5% offer their clients a choice between fees and commissions.

Of the 44% charging a combination of fees and commissions when risk-only advice is delivered, Elixir has revealed the average client fee amount in this group came to $1,689.

The Pricing Logic

With a focus on how to deliver profitable life insurance advice to Australian consumers, Elixir Consulting’s Sue Viskovic, Graham Burnard and Lana Clark offered their adviser audiences around the country a context in which to position the logic attaching to charging a combination of both fees and commissions for risk-only advice, termed The Pricing Logic.

Within this context, Elixir advocates that ‘Advice’ is an adviser’s intellectual property, which has inherent value for the client and which is powered by their knowledge and expertise and supported by the extensive capabilities of their business.

Clients should pay for that advice, says Elixir, which it separates from the implementation work necessary to navigate what it refers to as the complexities of setting up the agreed insurance solutions. It says the cost of the implementation work is built into the product and paid by the life company in the form of a commission.

Pro-Active Life Insurance Advice

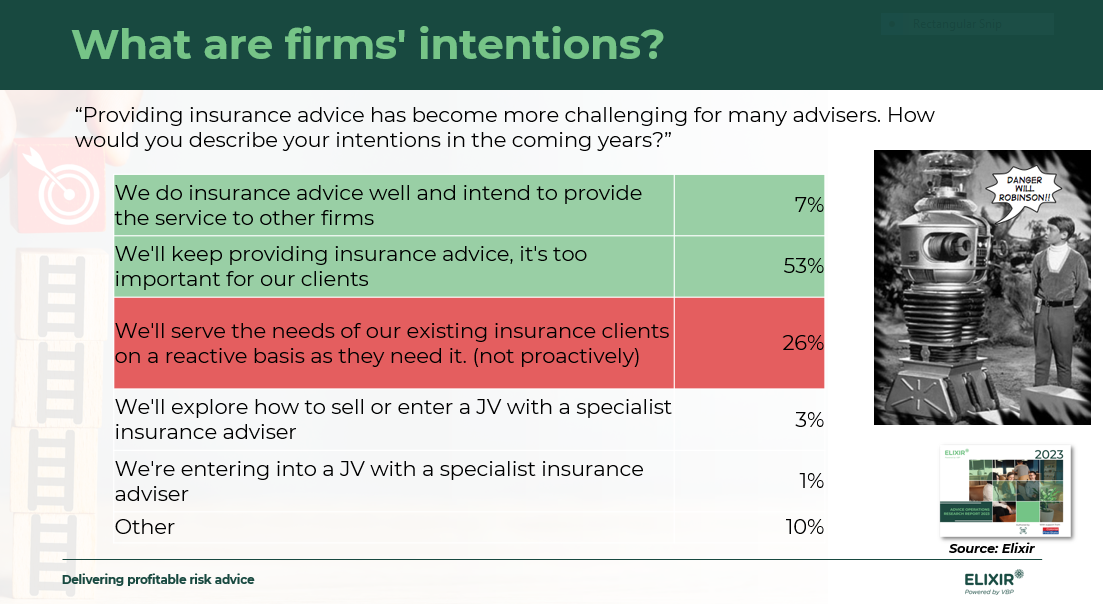

While the increasing trend in advisers applying a combination of fees and commissions for risk-only advice is generally being welcomed, Elixir also highlighted a cautionary finding which may also be considered as an opportunity.

Of the 171 advice firms surveyed, just over one in four firms (26%) reported they only service the life insurance needs of their existing clients on a reactive basis – only when they ask for it.

…more and more firms are reluctant to write risk

One of the trends that became clear in the research, according to Elixir’s Graham Burnard – which he says is also backed up by first hand conversations with advice firms – is that more and more firms are reluctant to write risk.

While acknowledging that risk advice is often complex and can sometimes lead to errors in product selection, Burnard says these errors can often occur in firms which don’t deliver much risk advice. His message to those advisers and advice firms is to either do it properly or outsource it, while those advice firms ‘stuck in the middle’ of writing a little or a lot of risk business need to find a way to address the challenges presented by delivering reactive, as opposed to proactive risk advice.

Riskinfo will report other key findings stemming from Elixir Consulting’s most recent practice management survey and also acknowledges and thanks Sue Viskovic (Perth), Graham Burnard (Adelaide, Hobart, Melbourne, Sydney) and Lana Clark (Brisbane) for the quality of their presentations at the Riskinfocus 24 Risk Advice CPD event series and the value that was delivered.

Accepting commission only is like a doctor bulk billing.

It means that your practice is borderline non-commercial or you have to have a very lean high volume low engagement business model.

Commissions have halved over the last decade and they alone don’t cover the increased costs all businesses face.

I charge very similar advice costs to the average stated here and do not face any pushback. Maybe one client a year from the 100 or so I see.

Most client’s accept that they need to pay for the value in the advice part of the process and commissions look after the implementation/product sale side of the deal

Martin & Caroline, I’m strongly tipping you deal predominantly with HNW clients and/or clients who come to you for investment advice which cross-subsidize your risk fee. Many more professionals than I, ones even better at the craft, have tried risk fees over a number of years for mums and dad market scenarios and have been left wanting. Simply doesn’t fly whichever way you choose to package it to the mid-lower tier markets on top of commission. All those whom I know – some very successful risk advisers, have failed miserably at charging fees for non-HNW pure risk advice. If you’ve found the holy grail for that wider market beyond HNW and the cross-subsidization with investments then please share it.

Hey Squeaky. Just the opposite actually. Although we do wealth/retirement planning our core focus is risk. We predomienently deal with the mass market (mum’s & dad’s) accumulators, and have no HNW clients. We bring on 2-3 new clients each week in this segment and charge fees for risk and super, risk only and super only, sometimes with non-super investment plans. We get almost no push back or declinies to proceed based on our up front fees. We allow monthly payments where the up-front cost is not possible and charge some of the fee to super where permitted under sole purpose. We don’t charge ongoing fees for these types of clients

Well, in that case I would offer you congratulations. You’ve succeeded in charging risk-only fees to the mid-tier market where no adviser of any ilk has succeeded in Australia, or at least no adviser of which most advisers have heard. I would suggest you patent the method(!) or at least work with your AFSL and have them present it to the industry because you have, it seems, discovered the holy grail. If what you are saying is true you may have the means to singlehandedly save the Australian risk insurance advice industry. Don’t delay, get to it!

This discussion has been around for many years.

As a percentage, 44% of 43 “Risk only” advisers who participated in the survey, which equates to 19 Advisers, is not a conclusive success story of Australians willing to pay for risk Advice that covers even a fraction of what it costs to provide.

The only way to gauge if what these 19 risk Advisers are doing, is achievable across the broad spectrum of Australians, is to dig much deeper and extrapolate “what” it is they actually do, “how” do they provide this service and answer “why” do their clients pay an average of $1,689 when the vast majority of Australians have stated they would pay NIL for risk advice, a small percentage would pay up to $300 and a very small percentage would pay above that.

Thousands of experienced Advisers tried to bring fees into the equation and the overwhelming response was NO.

This was not some theory-based consultancy firm who was being paid to promote another viewpoint.

I doubt there was even one Adviser who would not have charged a fee to help recover costs, though in every transaction, you need both parties to agree.

No-one can argue against charging a fee, though if the intended client says no and it could jeopardize the business relationship, then reality must override wishful thinking.

Well said Jeremy, agreed 100%.

Comments are closed.