- No (63%)

- Yes (30%)

- Still not sure (6%)

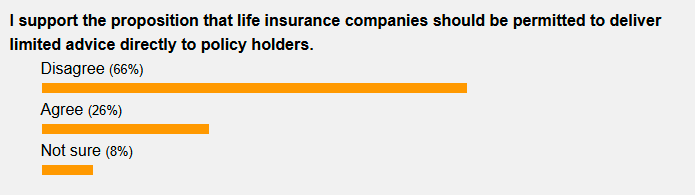

A solid majority of the adviser community, our latest poll result suggests, continue to be challenged by the idea that life insurance companies should be permitted to deliver limited advice directly to policy holders.

As we go to press, 67% of respondents to our latest poll disagree with the proposition that a new class of adviser should be able to deliver limited advice to policy holders, although more than a quarter (28%) agreed with the idea, while 5% are still not sure.

This mirrors the results of our poll in June when we posed the same question. At that time 66% disagreed with the proposition while 26% agreed and 8% weren’t sure:

Riskinfo understands the exposure draft of Tranche 2 of the Delivering Better Financial Outcomes reform package will be released shortly, in which one of the reforms flagged by Financial Services Minister, Stephen Jones, will be the adoption of a new class of adviser who can be employed by institutions to deliver simple, limited advice to consumers.

In the lead-up to the tabling of this and other reform measures proposed to be included in DBFO Tranche 2, the industry has been debating the merits of life companies having the capacity to retain salaried staff to provide simple advice to consumers who contact them direct, and at no cost to the consumer.

We remain keen to hear your thoughts as our poll remains open for another week…