Our report on a presentation by Acenda’s Marshall Ross at Riskinfocus 25, where he spoke of the delicate balance pre-retirees face when it comes to helping their children, attracted plenty of reader interest this week…

Parents on the cusp of retirement are facing a significant dilemma as they seek to financially support their family without compromising their own financial security.

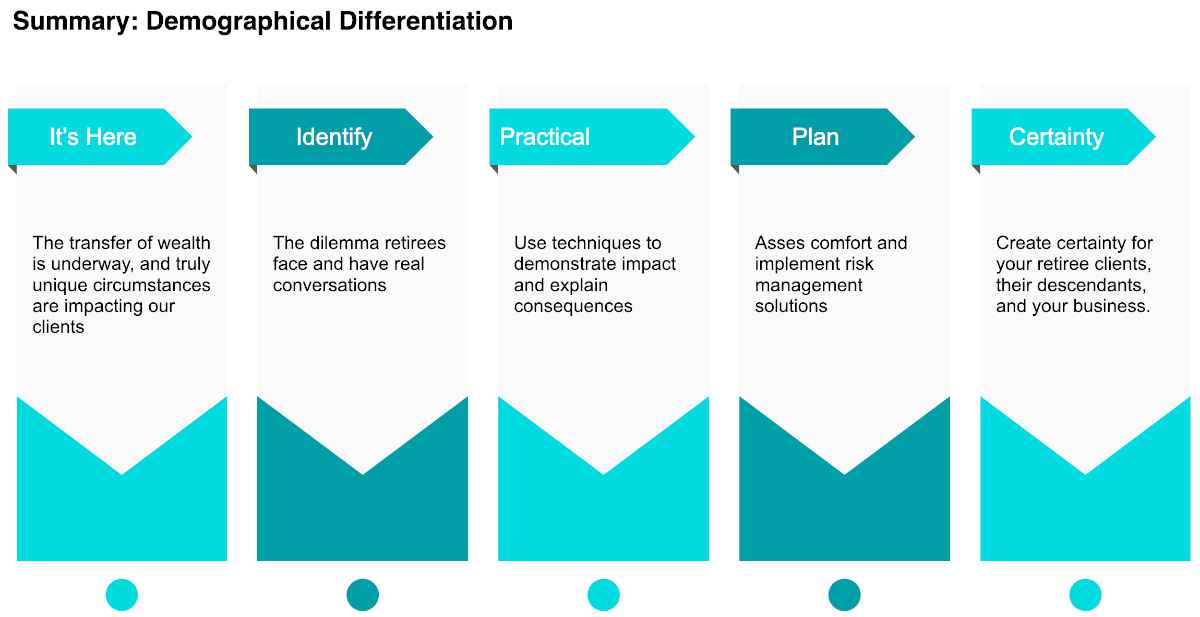

This is one of the key issues addressed by Acenda’s Partner Education Manager, Marshall Ross, at Riskinfocus 25 events across the country last month.

According to Ross, the ‘mums and dads’ of Australia act as the fifth biggest lender in the nation, reflecting the fact that more than 700,000 people – who hold 49% ($35bn) of the country’s wealth – are retiring within the next five years.

“They want to help their children and grandchildren, but not compromise their own financial security,” said Ross. “They face a conflict.”

In the past, he said, the next generation typically fared financially better than their parents. But that has flipped. Parents are looking for ways to help their children.

It’s a confusing picture though, as stats presented by Ross show three-quarters of parents want to support their children and grandchildren financially, 70% don’t want to compromise their lifestyle, and 80% don’t want to downsize to release funds.

“Our objective as advisers is to protect their retirement as well as their kids’ future. That’s what differentiates advice from order taking,” he said.

With regard health insurance he pointed out that with people now regularly living into their nineties, one option to lower their outgoings is to narrow health insurance coverage to reduce premiums.

“Your premier and plus contracts cover about 540,000 conditions, but your standard contract still covers the two that cause 90 percent of claims – cardiac conditions and cancers,” said Ross.

“It’s about allocating budgets to get the most bang for their buck in those critical areas that might impact retirement savings.”

However, he made it clear the future growth of any advisor business is with their clients’ children, and that advisers should consider ways to bring them into the fold.

“If our clients are in de-accumulation mode, your business is in de-accumulation,” said Ross. “The way to arrest that is to engage these people and go into growth mode.”

To do this, he suggests advisers carry out:

- Financial health checks

- Beneficiary meetings

- Mapping the family tree

- Offer basic financial literacy courses

- Help clients understand the likely impacts of the risks they face

However, advising families doesn’t come without risks.

“From an ethics perspective we need to be careful about Standard three and Standard two around conflicts and acting in the interests of all clients,” said Ross.

“When we are delving into insurance benefits and estates, they are a zero sum game. If one person gets more money than the other you risk conflict.

“We need to be careful when advising members of the same family as there is an inherent conflict that needs to be managed.”

In addition Ross touched on the transition from commission to a mixture of commission and advice fees illustrating how a single client could generate around $18,000 in income over a 10 year relationship. Crucial for business succession plans.