While the FAAA has welcomed the cessation of Dixon Advisory’s AFCA membership, the association continues to express ”very deep concerns” regarding the funding model for the CSLR, including the significant increase in exposure for the financial advice profession.

FAAA CEO Sarah Abood, says that now that Dixons’ AFCA membership has finally ceased “…after two false deadlines, and almost 2.5 years after being put into administration – we can see the full potential impact of this matter on our profession and the costs we may need to pay for it, via the CSLR.”

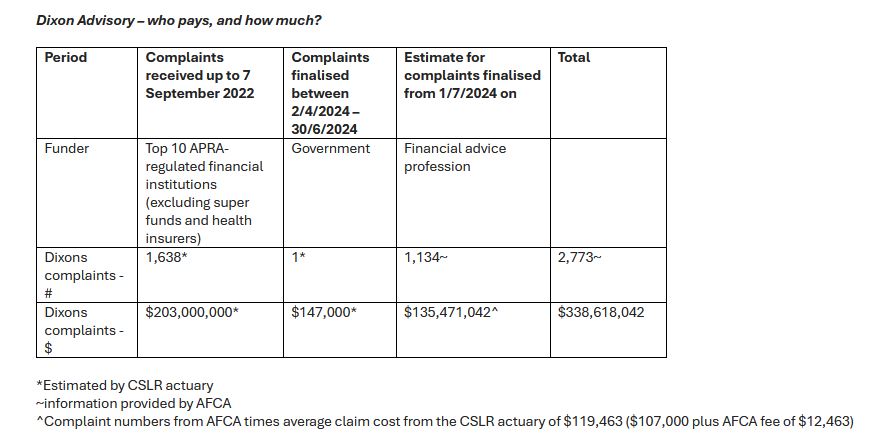

…the total number of cases registered with AFCA now stands at 2,773…

She notes that unsurprisingly, a number of additional complaints were made by Dixons’ clients in the final weeks of AFCA membership, and the total number of cases registered with AFCA now stands at 2,773.

While this is less than the administrator’s estimate of 4,606 investors whose losses … made them potential creditors, this is still a huge number of complaints that will likely take years to process, she says.

Abood says these figures serve to highlight “…once again many serious flaws in the funding model for the CSLR, a model which is both extremely unusual and extremely unfair – and in our view, fundamentally unsustainable.”

…estimates suggest financial advisers could be forced to pick up as much as $135 million of claims related to Dixon Advisory…

She notes that “…estimates suggest financial advisers could be forced to pick up as much as $135 million of claims related to Dixon Advisory, whilst the parent company … has settled its class action for around four cents in the dollar… ”

Abood says this highlights a deep flaw in the CSLR funding model that must be fixed.

“The Dixons scandal is on such a massive scale that it warrants a public inquiry into the circumstances that led to this failure and recommendations to ensure this cannot happen again.”

Urgent Action Needed

The FAAA has identified a number of actions it believes need to be urgently taken in order to fix the CSLR funding flaws:

- The CSLR funding model must be prospective, not retrospective. Advisers should not be paying for matters that occurred well before the scheme came into being

- The government needs to pay the first full year of operation of the scheme as was originally promised, rather than just three months

- The government should re-instate the original sector cap (a maximum of $10 million that could be levied per sector), rather than the $20 million that currently applies

- Our sector should be indemnified against future CSLR claims, where a matter has been reported to ASIC and ASIC has chosen not to act, or has substantially delayed action

- The government must act to ensure that large vertically integrated groups cannot avoid paying fair compensation to consumers by putting a subsidiary into administration

- The government must ensure that all other avenues for client compensation have been exhausted before financial advisers are charged

- A party must be appointed to defend complaints against entities no longer in existence. At present no-one is speaking for the advice provided to the consumer or defending these claims

EVERYTHING the Government does is retrospective and is pushed through in a mad dash to be seen as doing something, which nearly EVERY TIME, turns out to be a disaster that impacts the innocent, while the guilty get off lightly.

The biggest mistake everyone makes is assuming Governments and Public servants have the answers.

This has NEVER been the case, so why do we keep asking them to solve problems they have no answers for and worse still, have no care or responsibility.

Comments are closed.