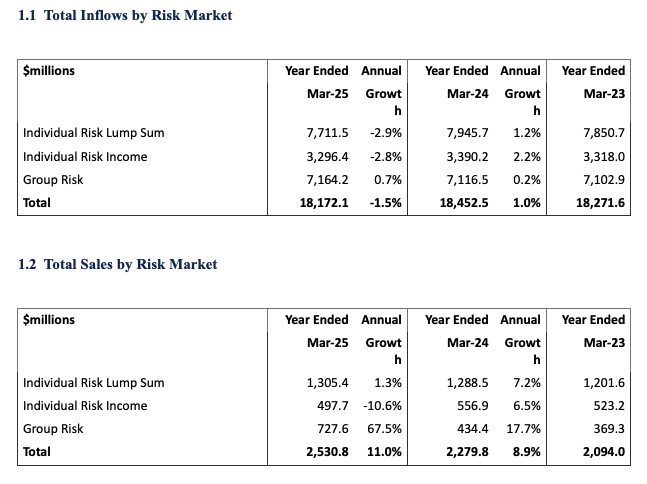

Reported individual risk lump sum sales in the 12 months to 31 March rose slightly by 1.3% according to data published by Plan for Life.

It states that although most insurers, including market leaders TAL (5.1%), Zurich (1.7%) and MLC (5.4%) experienced slightly higher annual sales, these were offset by a couple of significant falls recorded by AIA (-11%) and Resolution (-27.9%).

The actuaries and research firm’s latest Market Overview also shows NobleOak (32.5%), ClearView (9.8%) and MetLife (8.2%) saw the biggest percentage increases.

Meanwhile, annual new premium sales fell 10.6% with in particular TAL (-11.3%), AIA (-45.9%) and Resolution (-27.5%) reporting double digit percentage falls while increases were posted by NobleOak (21.1%) and to a lesser degree both MLC (4.7%) and ClearView (4.6%).

New premium ales increased 11% with TAL (80.9%), MetLife (123.1%) and NobleOak (27.9%) all reporting significantly higher annual sales while those of Zurich (-16.3%), AIA (-43.4%) and Resolution (-26.0%) fell.

Overall, risk market inflows decreased 1.5% over the past year to $18.2bn.