A comprehensive analysis compiled by Adviser Ratings has confirmed the number of authorised representatives in Australia is shrinking.

The financial advice data and rating agency has utilised data from ASIC’s Financial Advisers Register to report some key trends taking place in the advice sector, giving a statistical confirmation to other anecdotal signs of reduced adviser numbers.

Among a raft of its key findings, Adviser Ratings reports:

- Total adviser numbers reduced by 6.4% in the second quarter of 2019

- The number of ‘ceased’ advisers increased by 40% during the second quarter, rising to more than 1,750 for the quarter

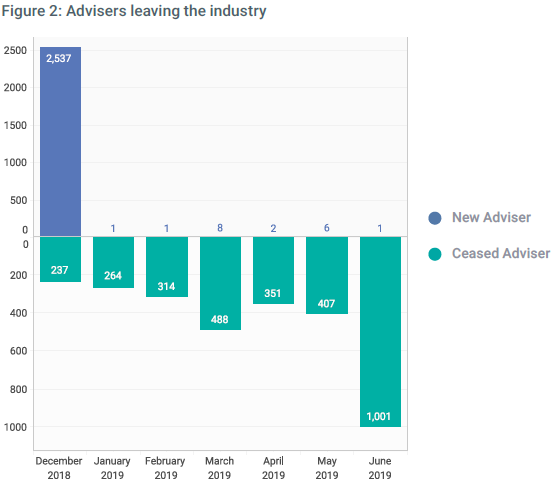

Focussing on advisers departing the industry in 2019, the agency gave some context to this trend by balancing 2019 departures with a significant spike in advisers either returning to or entering the industry for the first time in the lead up to 31 December 2018. Its report includes this table:

…2,825 advisers ceased practising in the first half of 2019, representing a decline of nearly 11 percent

The firm’s commentary around this chart included the point that the first six months of 2019 witnessed a large decrease in total adviser numbers, where 2,825 advisers ceased practising in the first half of 2019, representing a decline of nearly 11 percent from the peak at the beginning of this year.

The agency expects this trend to continue: “We anticipate a higher than average number of ceased advisers over the next few years as more and more advisers “bite the bullet” and call time on their advising careers leading up to 2024, which is when all licensed advisers must have achieved the bachelor’s degree (or equivalent) educational requirement.”

Riskinfo will report other findings from this research in the coming weeks.

These figures do not tell the real truth.

The only reason why there was a spike in numbers to the end of December, was the sledgehammer effect of not registering.

It was a false positive.

The real truth is only a handful of new advisers entered the industry since January and well over 3000 have left.

That is the tip of the ice berg.

There are thousands of advisers who will stay till the end of 2023, though will not be active, which will exacerbate the decline in New Business revenue for Life Companies.

We repeatedly told the Life Companies, the regulators, politicians etc, what will happen if it becomes too restrictive for Advice practices and as usual, they refused to listen and act in the correct manner.

Instead, they listened to the bleeding hearts club of clueless idealists who live in a fantasy world and the greedy big end of town, who thought they could manipulate the system to maximise their profits at everyone else’s expense.

There is only one solution.

Reverse this insane set of regulations and reset the path, or watch the decline continue.

A suggested poll for Risk Info to run – “As an existing adviser, do you intend to remain an adviser after 1 January 2024?” As we know, Risk Info show the results of its surveys as percentages, so may I suggest that after such a poll, Risk Info report on how many took part (I assume they can do that). The percentage results and the number participating, may be an eye opener!

Jeremy you are so correct.

This is a ticking time bomb and the fuse is getting shorter. Ongoing Adviser exits will lead to reduced profit levels for Life Companies due to reduced new business, therefore increased premiums for existing policy holders, therefore increased policy cancellations therefore a strain on the current economy and NDIS when Insurances are no longer in force to fund claims. It’s not that difficult to understand or to correct so everyday Australians have access to affordable appropriate advice.

Its like watching a train wreck ! horrendous but you cannot look away.

We have seen nothing yet wait until December 2023 the exodose will be mind blowing. Good bye retail insurance industry . No advisers no income to Insurers no way to keep paying claims clients getting out and “taking the chance” as its all too expensive. Collapse of the heath system and it goes on and on like unwinding a ball of cotton. We did try to tell you but arrogance is the “pointy” end of stupidity.

ASIC’s work is almost done – destroy the IFA market leaving the spoils to their union fund masters.

Comments are closed.