Inflows into Australia’s life insurance risk market increased by 6.6% in 2015, although this growth rate is down on the double digit increases the industry has been experiencing in recent years.

Released by Plan For Life as part of its Y/E 2015 Market Overview, the researcher notes all the leading companies experienced increases in their risk business inflows, led by TAL (19.3%), BT/Westpac (13.4%), MetLife (11.7%), OnePath (10.6%) and AIA Australia (10.5%).

The news is not entirely positive, however, as PFL also records that new premium sales fell by 9% year on year in 2015; a year in which MetLife (25.3%), TAL (14.4%) and OnePath (11.5%) nonetheless managed to record double digit percentage increases in their annual risk sales.

In terms of overall risk premium inflows, which take into account individual risk lump sum and income protection business as well as group risk, TAL led the way in 2015, receiving more than $2.6 billion in inflows, followed by AIA Australia ($2+ billion), AMP Group (1.9+ billion), NAB/MLC ($1.8+ billion). Rounding out the top five was CommInsure, which received $1.78 billion in risk premium inflows.

…group risk inflows experienced the highest annual growth

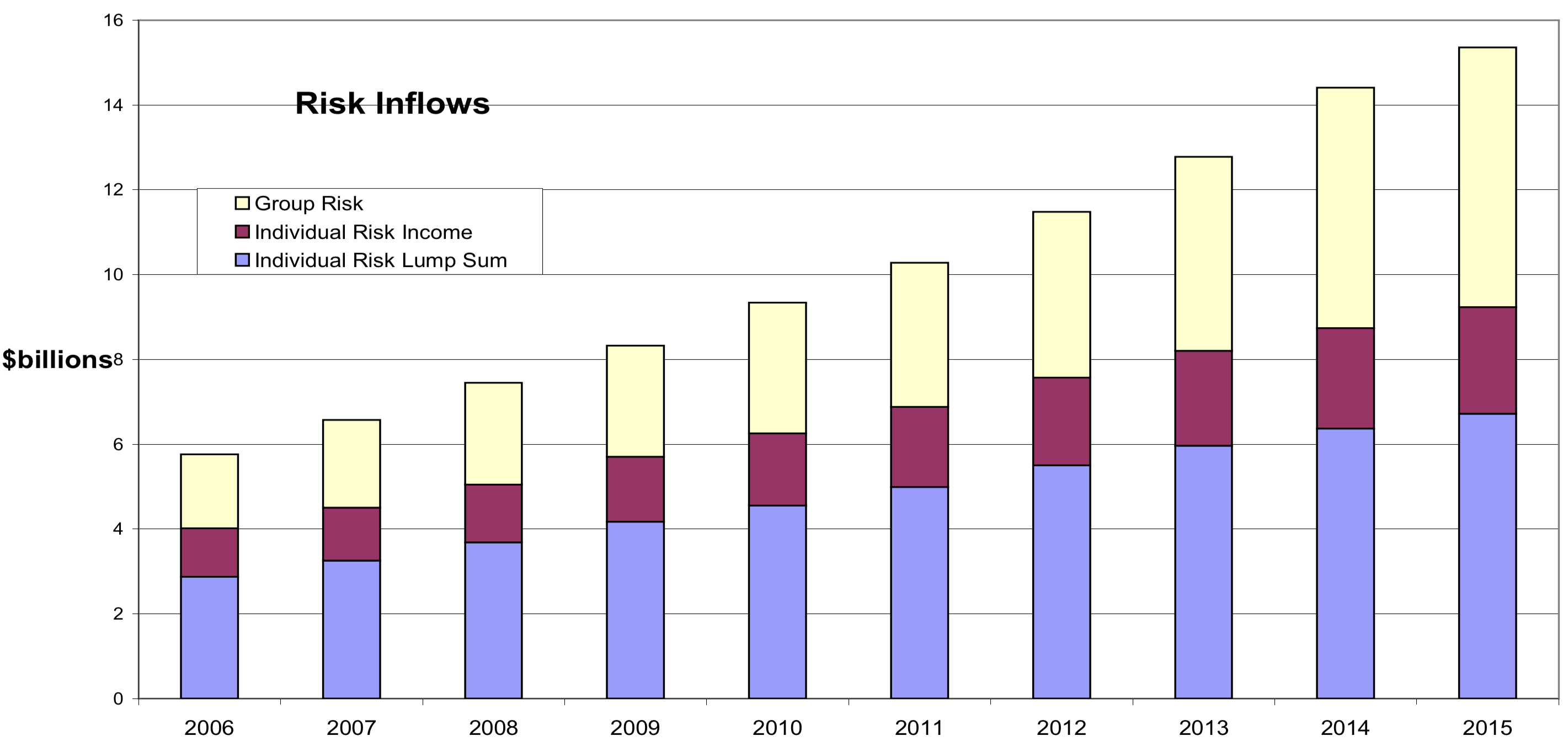

Of the three main sectors, group risk inflows experienced the highest annual growth of just under 8%, followed by individual risk income business growth of 6.2%, with individual risk lump sum inflows up by 5.5%.

PFL also reported a 12.3% decline in overall life insurance premium inflows in the 12 months to December 2015. This category analysis includes all life insurance inflows, where data from retirement income products, individual and group superannuation and ordinary (non-super) investments is combined with the ‘pure’ risk market data reported above.

The following chart published by Plan for Life depicts the consistent growth in life insurance risk market inflows over the last ten years, from just under $6 billion in 2006 to $15.4 billion in 2015:

With premium increases on particularly group policies, but also income protection and trauma in the retail market, this has to help premium inflows?

It is simple, we are all writing more so that we can fund our long term holidays which commence in July 2016, [ if the reforms become law ]. Wake up to yourselves increase to premiums and a mad rush to write business before July 2016 is why risk inflows are heading north, it will be interesting to see if the trend continues after July 2016.

Comments are closed.