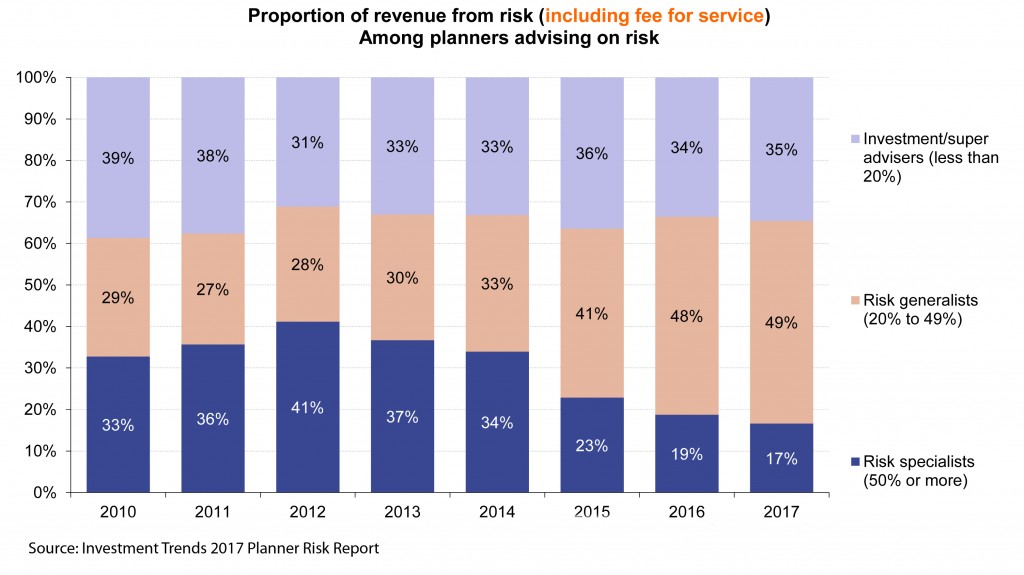

The proportion of risk specialists among advisers who write risk business has continued to decline to its lowest point in five years, according to Investment Trends.

Outcomes from the researcher’s ninth annual Planner Risk Report reveal only 17% of financial advisers who provide advice on life insurance could be considered risk specialists.

In defining a risk specialist as one who derives 50% or more of their practice revenue from risk advice, the report found that many advisers were ‘risk generalists’, with 49% deriving 20% to 49% of practice revenue from risk advice, while a further 35% were more focused on investments and superannuation, receiving only 20% of revenue from risk advice activities.

The low number of risk specialists indicates an ongoing long-term contraction with their numbers falling steadily from 41% in 2012 to the current levels of 17% in 2017, among advisers who write risk business.

“…only 17% of financial advisers who provide advice on life insurance could be considered risk specialists…”

At the same time the number of risk generalists has increased from 28% of advisers in 2012 to 49% in 2017, while the number of investment/superannuation focused advisers has remained steady around 33-35%.

Investment Trends Senior Analyst, King Loong Choi said the drift in numbers from risk specialists to risk generalists was partly due to the incoming Life Insurance Framework (LIF) reforms but also because of the broader evolution of advisers’ practices following the Future of Financial Advice (FoFA) reforms.

Choi said LIF and FoFA were also impacting insurance revenues, which had continued to decline as a share of an adviser’s practice revenue among all advisers providing risk advice, and had fallen from a high of 32% in 2015, to 28% in 2016 and 26% in 2017.

Generally, however, fewer advisers reported year-on-year growth in practice profitability, according to Investment Trends, with 59% of advisers stating their practice was more profitable, down from 61% in 2016, 66% in 2015 and 72% in 2014. Conversely, the level of advisers stating their practice was less profitable has grown from 7% in 2014 to 15% in 2017.

Does this mean that we will be like the dinosaurs and become extinct or the rarer we become the more Valued we will be?

Risk generalists ?? That’s a new one !! How about an old fellas description of this

These are people who once had a view that they were in this business to assist people but have now been kicked from pillar to post by the regulators banks and out of touch politicians so much that they are seeking refuge in the investment areas just to stay in business

Wait until this legislation really kicks in next year

The specialist risk adviser won’t be valuable they simply will be hard to find as they will be heading for extinction ( more chance of finding a Tasmanian Tiger) and the on line sales institutions will finally have their day along with their owners the banks and insurers. This is an agenda they have been pushing for for years

Ask the wrong questions of the wrong people you are bound to get misleading answers

I suspect many pure risk advisers couldn’t be bothered. Some are under pressure from institutional AFSLs to call themselves “holistic” advisers.

I am absolutely gobsmacked this would be the case.

Lets see they decrease the pay by up to half, increase the workload and then say oh by the way you cannot spend your revenue until the 2 year clawback period passes.

Truly surprising.

Comments are closed.