Advisers looking at a list of life insurers in early 2019 will probably spot that a few familiar names have gone as a number of major acquisitions reach their completion. At the same time, a few new names will have entered that list, while others already on it will have marked their return to the retail market. In this article, Riskinfo Senior Journalist, Jason Spits takes a look at the new kids on the retail life insurance block as well as which insurers will be transitioning into other businesses and how that will change the life insurance market.

Each year the regulator of life insurers, APRA, publishes a list of licensed firms operating in Australia and the current list, released in February 2018, reveals there are 29 companies offering risk insurance products.

A closer examination reveals that eight are direct insurance providers, another six are reinsurers, with the remaining 14 insurers offering products through the retail advised channel. Of those 14 insurers, most would be considered major providers, and that number will change in the coming months as a series of acquisitions come to completion (see below: The Changing Face of Retail).

The list on the APRA website also includes a new entrant and a familiar face that is on the verge of returning to the retail advised life insurance market.

The New Kid

The new entrant is Integrity Life, which until February of this year was known as QBE Life and was a small part of general insurer, QBE, where it offered consumer credit insurance (see: Start-Up Insurer Plans Move Into Retail).

Integrity Group Managing Director, Chris Powell told Riskinfo that the life insurance licence of QBE Life was purchased by a group of private investors for $27.1 million.

The new insurer had also continued to attract investors raising more $165 million of capital, comprising equity and debt facilities, from local and overseas investors, including from Japanese life insurer Daido Life which purchased a 14.9 per cent voting equity stake in Integrity Life’s parent company.

Powell is no stranger to life insurance and financial advice having previously held the roles of Chief Financial Officer at Zurich Australia and Chief Operating Officer of Centric Wealth.

While the insurer released its first products into the group life space, Powell said Integrity Life was focused on delivering products through the retail advised channel and adopting new ways to do so.

“We want advisers to feel we listen to their needs and their clients’ and we will act to meet those needs. We have the opportunity to build our products from the ground up,” he said, earlier this year.

“The Top 10 life insurers hold 96% market share – we are about to see their number reduced to a top seven or six. This means there is a place for new operators to disrupt the market with differentiated products and services,” Powell added.

He said the advisers would be given access to a full suite of retail products, and all product design, underwriting and claims management would take place in house.

In July he flagged the launch of those products, which had been designed with risk specialist input, would take place at the start of October (see: Integrity Life Names Retail Product Launch Date).

“We found that advisers and their clients suffered from pain points through the application, underwriting and claims processes and back-office and administration systems of many insurers and so we created purpose-built systems to deal with these issues,” Powell said.

The Other New Kids

Another group that is set to expand its public profile in October is NEOS Life which first announced its arrival in June of this year (see: NEOS Life Opens Its Doors).

NEOS Life will offer advisers a different value proposition by distributing the products of a life insurer but handling all the applications, underwriting and claims related to the product.

NEOS Life Managing Director, Brett Yardley said the agenda of the company was to offer “…a comprehensive suite of retail life insurance products through financial advisers” and had been built to address the poor service, legacy technology and lengthy application processes currently on offer to advisers.

Like Integrity, NEOS Life has not adopted any off-the-shelf systems and processes and Yardley said it has “…reinvented, rather than replicated – by going back to basics and fundamentally challenging every aspect of the traditional life insurance business model”.

The new life insurance business has adopted the UnderwriteMe technology solution created by Pacific Life Re and was aiming to make 80 per cent of its underwriting decisions in three working days.

To date, products have been distributed through a limited group of advisers but last month Yardley told Riskinfo the company was preparing for a full launch into the retail advised life insurance market after the successful pilot phase (see: NEOS Life Full Retail Market Launch).

“When advisers are telling you that dealing with NEOS has been a highlight of their life insurance career, you know you’re hitting the mark,” he said at the time, adding, “Things must change, but with industry consolidation and decreasing competition, existing players have little motivation to make that change happen.”

Adopting a similar business model but with a more nuanced distribution model is PPS Mutual which has been active in the Australia market since early 2016.

The group opted for a mutual model when setting up in Australia, reflecting the model used by one of its founder partners – South Africa based Professional Provident Society SA, which teamed with NobleOak Life and a global reinsurance group to form PPS Mutual (see: South African Insurer Enters Australian Market).

The life insurance business also decided to restrict its offerings to tertiary-educated people from 13 professions, including medicine, accounting, law and engineering and has begun to offer Income Protection, Life, Total and Permanent Disability, and Trauma insurances via advisers.

The business is headed by former chief executive of Centric Wealth and founding Managing Director of Investec Private Advisers, Michael Pillemer who said “…we do not seek to be all things to all people”. He added that PPS Mutual’s structure also meant it was not subject to any from of misalignment between shareholders and customers that characterise ‘incumbent insurers’ in the Australian market

Pillemer said listed life insurers struggled to meet the need of policyholders due to a misalignment of interests between shareholders and customers, which was exacerbated by the short-term pressures that come with being listed on the stock market.

“The Royal Commission has illustrated how these tensions have the potential to drive behaviours which have an adverse impact on policyholders,” he said, adding vertically integrated insurers also faced conflicts, such as limited APLs and the promotion of in-house products, that have not been in the best interests of consumers.

He also said ongoing changes of ownership in the Australian life insurance market showed there was a strong interest in the sector, adding “…that a ‘return to the future’ of mutual insurance might help to restore some much-needed certainty, trust and long-term confidence in the life insurance sector”.

Advisers recommending PPS Mutual products have to be accredited to do so and Pillemer said plans were in place to accredit ‘few hundred advisers’ over the next five years, with that process already taking place with advisers located in Sydney, Melbourne, Brisbane and Perth.

Accreditation includes training on the PPS Mutual model and profit-sharing arrangements as well as product design and, at completion, advisers can charge fees or commissions for their insurance related advice.

A Familiar Face Returns

At the time of writing, MetLife Australia has begun the rollout of its new retail products marking a return to a market channel it was last active in around a decade ago.

The rollout has been proceeded by a number of key appointments (see: MetLife Australia Expands Underwriting and Sales Teams) but MetLife Australia Head of Retail Sales, Matt Lippiatt said the decision to re-enter retail advised insurance was part of a five-year plan to lift the insurer’s profile and market share in Australia.

Lippiatt said the insurer wanted to build viable, long-term scale and entered the group and corporate life insurance sectors, where it now holds top three market positions, before launching retail product.

“It was always our intention to launch into retail but we wanted to understand the gaps in a market that is already well served, and to consider what we can do that is different,” he said.

The result of these decisions has been the launch of modular products (see: MetLife Australia to Re-Enter Retail With Modular Products) which will allow advisers and clients to build a package of life insurance around a base model instead of having to choose between off-the-shelf products.

Lippiatt said the timing of this approach was right as retail advised life insurance had not changed significantly over the past 20 years while advice had moved into a new era of professionalism.

“The current array of solutions are not flexible enough to fill the unmet needs of advisers and their clients. We see the value in financial advice and our expertise is in providing life insurance solutions, so the opportunity and time to move into retail is right for us,” he said.

“We are also a ‘pure’ life insurance provider, which is a trend currently flowing through the value chain in financial advice. We don’t have legacy issues or a vertically integrated model in the background so we are able to look at the market with a fresh perspective,” Lippiatt added.

The Changing Face of Retail

While some may welcome the addition of more life insurance providers, their presence will not change the fact that the number of retail product providers on APRA’s list will become smaller by early 2019, as will the presence of Australian-owned life insurers.

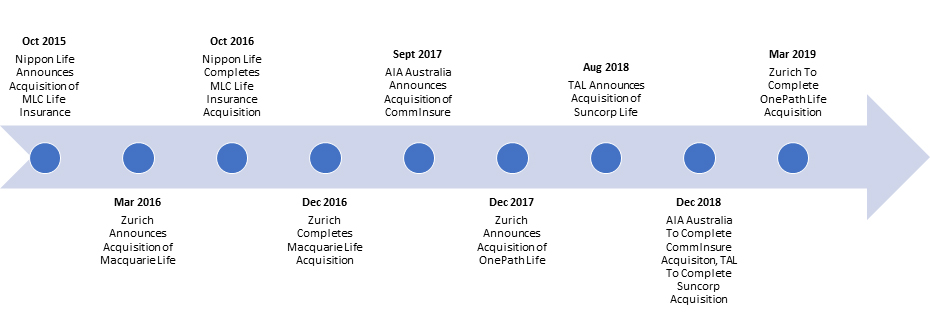

This is due to an ongoing round of acquisitions which began in October 2015 with Nippon Life’s majority acquisition of MLC Life Insurance. At that time there were eight Australian-owned life insurers in a market of 12 life insurers offering products into the retail advised space.

The completion of the Nippon Life acquisition, and the transition of Macquarie Life to Zurich, by late 2016 reduced the Australian contingent to seven and the total number of life insurers to 11.

By the end of 2018, Australian-owned insurers will number five, including Integrity Life, as the acquisition of CommInsure by AIA Australia and Suncorp by TAL will be completed, before the number drops to four following the completion of ANZ’s sale of OnePath to Zurich in March 2019 (Figure 1).

Despite these wide-ranging changes, the number of brands are likely to remain static, but who benefits from them will change.

AIA Australia wrote to advisers in May stating it will keep CommInsure’s brand and products on the market while Zurich Australia stated it would retain the OnePath product and brand and offer them to advisers as a dual proposition alongside Zurich’s own products. TAL will also retain the Asteron brand and product line after it acquires Asteron Life from Suncorp at the end of this year.

An analysis of market share by Riskinfo, however, shows the current spate of transactions will reduce the level of Total Risk Inflows held by Australian-owned life insurers by half, falling from 43.7 per cent to 20.6 per cent, based on March 2018 risk inflow data from Strategic Insight (Table 1).

| Table 1: Market Share of Overseas and Australian Insurers | |||

| Life Insurers | Total Inflows Market Share (%) at March 2018* | Life Insurers | Total Inflows Market Share (%) Projected at March 2019* |

| Overseas Insurers | |||

| TAL | 17.7 | TAL (inc. Suncorp) | 22.7 |

| AIA Australia | 15.2 | AIA Australia (inc. CommInsure) | 23.2 |

| MLC Life Insurance | 12 | MLC Life Insurance | 12 |

| Zurich | 4.2 | Zurich (inc. Suncorp) | 14.3 |

| MetLife Insurance | 4.2 | MetLife Insurance | 4.2 |

| Total | 53.3 | Total | 76.4 |

| Australian Insurers | |||

| AMP | 11.6 | AMP | 11.6 |

| OnePath Australia | 10.1 | – | |

| CommInsure | 8 | – | |

| BT / Westpac | 7.7 | BT / Westpac | 7.7 |

| Suncorp | 5 | – | |

| ClearView | 1.3 | ClearView | 1.3 |

| Integrity Life | – | Integrity Life | -ˆ |

| Total | 43.7 | Total | 20.6 |

| ˆ Projection Not Available | |||

| * Based on Total Risk Inflows Market Share at March 2018. Source: Strategic Insight | |||

The transactions will also cement overseas-owned life insurers in the top three positions for market share, led by AIA Australia with 23.2 per cent, TAL with 22.7 per cent and Zurich with 14.3 per cent of Total Risk Inflows, based on March 2018 data (Table 2).

| Table 2: Total Market Share By Life Insurer | |

| Life Insurers | Total Inflows Market Share (%) Projected as at March 2019* |

| AIA Australia | 23.2 |

| TAL | 22.7 |

| Zurich | 14.3 |

| MLC Life Insurance | 12 |

| AMP | 11.6 |

| BT / Westpac | 7.7 |

| MetLife Insurance | 4.2 |

| ClearView | 1.3 |

| * Based on Total Risk Inflows Market Share at March 2018. Source: Strategic Insight | |

Looking ahead, the ownership issue may not be the most important issue for financial advisers working through the implications of the Life Insurance Framework and the possibility of a return to tertiary study under proposals from FASEA.

If the new entrants to the market are correct, better products, more efficient processes and greater support may be more likely to win the hearts and minds of advisers than incumbency and scale.